комментарии Den на форуме

-

Какой прогноз по дивидендам за 2019 год?

Antonio Z,

Ближайшие дивиденды: 0.02 руб. (8.93%) 14.05.2020 (прогноз)

www.dohod.ru/ik/analytics/dividend/ttlk

Александр Тихонов, думаю будет больше чем 2 коп

Бумага в флете с августа, по ТА известно чем обычно это заканчивается. Негатив корпоративный и рыночный уже в цене. Из года в год дилемма в 1 кв о дивидендах сохраняется. Имхо на среднесрок риск более чем обоснован при потенциале дивидендов 15-20 руб на преф — 20-25% ДД… Без дивов по уставу уронят цену, и, как следствие, пробьют еще больше ковенант. Это никому не интересно. Посмотрим.

Бумага в флете с августа, по ТА известно чем обычно это заканчивается. Негатив корпоративный и рыночный уже в цене. Из года в год дилемма в 1 кв о дивидендах сохраняется. Имхо на среднесрок риск более чем обоснован при потенциале дивидендов 15-20 руб на преф — 20-25% ДД… Без дивов по уставу уронят цену, и, как следствие, пробьют еще больше ковенант. Это никому не интересно. Посмотрим.

закрыл по 104.9. 4.5% за месяц достаточно. Ситуация выглядит как очевидное кидалово миноров. В рынке есть более интересные истории с точки зрения ДД и value

закрыл по 104.9. 4.5% за месяц достаточно. Ситуация выглядит как очевидное кидалово миноров. В рынке есть более интересные истории с точки зрения ДД и value

Странно, почему «не интересны для долгосрочного инвестирования»? Котировки на исторических минимумах. Костин говорит: «Мы позитивно смотрим на Мечел. Нам кажется, что по новому графику реструктуризации Мечел вполне в состоянии выплачивать долг. Новый график пока согласовывается, это предмет довольно обширных переговоров. Как-нибудь договоримся, думаю». «Все считают, что мы всем хотим управлять – это совсем не так. Мы сразу сказали, что управлять Мечелом мы не хотим. Если смотреть вдолгую, то Мечел – вполне эффективная компания».

MAVr, ну лично мне не охота усредняться, а выходить с убытком в 15% не хочется

Энди Д, за 3 года дивами половину вернул, ещё через 3 100% верну. А там, глядишь, и вверх двинемся)

Виталий, поделитесь плз, откуда уверенность что мечел заплатит дивидендов на 100% за 3 года?

Den, если не заплатит, то в соответствии с Уставом префы становятся голосующими. А этого никто не хочет)

Виталий, то что заплатит понятно, меня больше смущает размер дивидендов. Откуда уверенность что дадут хотя бы 20% в год?

Странно, почему «не интересны для долгосрочного инвестирования»? Котировки на исторических минимумах. Костин говорит: «Мы позитивно смотрим на Мечел. Нам кажется, что по новому графику реструктуризации Мечел вполне в состоянии выплачивать долг. Новый график пока согласовывается, это предмет довольно обширных переговоров. Как-нибудь договоримся, думаю». «Все считают, что мы всем хотим управлять – это совсем не так. Мы сразу сказали, что управлять Мечелом мы не хотим. Если смотреть вдолгую, то Мечел – вполне эффективная компания».

MAVr, ну лично мне не охота усредняться, а выходить с убытком в 15% не хочется

Энди Д, за 3 года дивами половину вернул, ещё через 3 100% верну. А там, глядишь, и вверх двинемся)

Виталий, поделитесь плз, откуда уверенность что мечел заплатит дивидендов на 100% за 3 года?

Что у распадской с чистый долг к EBITDA?

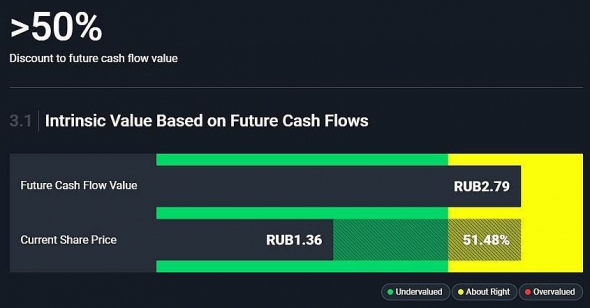

Den, отрицательный NetDebt/Ebitda = -0,9

Ev/Ebitda= 0,99

Алексей, компания стоит годовую ebitda?! Это очень дёшево. А дивы будут… в дивы Системы год назад тоже никто не верил. Сейчас проблема в другом — найти хорошую бумагу с потенциалом роста на рынке тяжело. Полгода назад хотел брать распадскую по 130, тогда она улетела вверх, сейчас затарил по 101. Подождем.

— бюджету нужны бабки

Den, вроде везде пишут, что бюджету деньги не нужны. Чудовищный профицит, размер ФНБ превысил 7% ВВП.

Sergey, Не слышал о кеш алергии у власти. Страна живет нац проектами, ОПК, мостами, стадионами и другими вечными капексами. Кеш минфину точно нужен.

1) есть потенциал роста — оценка sum of parts существенно выше текущих цен

2) новая див политика осенью скорее порадует чем разочарует:

— ЧП 1П 2019 123.1 млрд против 42.3 в 1П 2018

— на счетах RSTI много кеша

— до дивов 50% от ЧП есть хороший запас

— бюджету нужны бабки

Den, у них уже есть див. политика, которая была принята при всё том же Ливинском несколько лет назад. Что там особо нового и положительного будет — я не знаю

Совет директоров «Россетей» утвердил новую дивидендную политику. Компания будет отдавать акционерам большую из двух величин — 50% чистой прибыли по МСФО или РСБУ, говорится в материалах компании, с которыми ознакомились «Ведомости». Представитель «Россетей» это подтвердил.

При этом для расчета дивидендной базы чистая прибыль по РСБУ будет скорректирована на сальдо доходов и расходов от переоценки финансовых вложений, инвестиций, осуществляемых за счет чистой прибыли от передачи электроэнергии, доли чистой прибыли от техприсоединения за исключением фактически поступивших денежных средств, доли чистой прибыли, направляемой на оказание финансовой поддержки планов развития и доли прибыли на инвестиции и развитие, в соответствии с бюджетом «Россетей».

Чистая прибыль по МСФО для расчета дивидендов будет скорректирована на инвестиции, осуществляемые за счет чистой прибыли от передачи электроэнергии, обесценения или восстановления стоимости основных средств, доходов и расходов от восстановления или утраты контроля над дочерними компаниями, долю чистой прибыли от техприсоединения за исключением фактически поступивших денежных средств, долю чистой прибыли, направляемой на оказание финансовой поддержки планов развития, долю чистой прибыли на инвестиции и развитие.

Дивиденды по МСФО не должны будут превышать чистую прибыль по РСБУ без учета доходов и расходов от переоценки финансовых вложений, прибыли, направляемой на оказание финансовой поддержки дочерним компаниям, прибыли, направляемой на инвестиции и развитие компании и обязательных отчислений в резервный и другие фонды.

ZaPutinNet, C 2017 года, когда вышла эта новость, утекло очень много воды. По факту платят 3-5%, а не 50% от ЧП. При этом ebitda растет на 20% в этом году. Debt to Equity снижается последние 5 лет. И префы и обычка сильно неодоценены (P/B 0.2, P/E 2.2, PEG 0.6). Факторов роста много. Тренд на рост выплат госкомпаниями в бюджет только усилится. Еще раз, посмотрим, все останутся при своем мнении.