⚡️ Let's measure the market situation after this volatile week.

Good Sunday, traders!

Let's measure the market situation after this volatile week.

▪️ Last time we expected falling in Euro. This occurred not on Monday-Tuesday, but on Wednesday we had a downside reaction on 400 futures points. But then the market again returned to balance and returned almost all weekly losses. (Watch)

I think that it will continue falling, but of course Till FED by the 22 of March the market will be in a state of uncertainty and low liquidity.

▪️ Opinion about the grain market, particularly Corn (ZC) (Watch)

was also realized. After some coiling, from the start of the week, we got 30 dollars upside movement till Friday, and I think this upside movement will also continue the following week (Watch) .

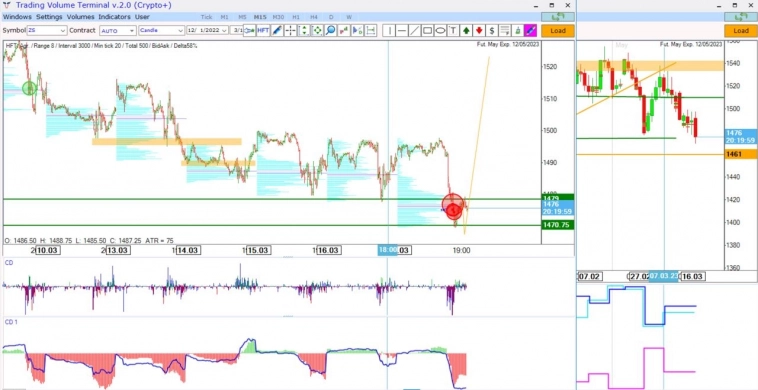

▪️ I see the potential in Soybeans (ZS) after the tick imbalance which occurred, while support was broken on both timeframes (Watch)

From the March 7 report, hedge funds increased their purchases by 18% and OI rose again. Believe that here we see weak passengers' liquidation and involvement in shorts, which gives the opportunity to make a swing against this imbalance.

Unfortunately, CFTC data on March 17 was not released. And the return of the standard publishing mode is delayed again. I really feel a lack of information for decision-making from the beginning of February after the cyber-related incident on Data servers. They promised to restore the date to mid-March, but on Friday we did not receive data for March 14. As is informed on the CFTC web page, new data still need to be reviewed and validated.

I wish you a smashing week and positive Sunday!

Is the banking crisis over yet?