COT reports

Hello, traders!

That week was crazy for movements. Priorities were not as helpful as the previous one. But I remember the words of Brent Donnelly:

«Good traders have a plan. They may not always stick to the plan but they always have one.»

By the way, if you want to read more quotes in English, you can simply put EN language on TVT and put the tick chart of ES, and upload 5 years of history))

Lets Start.

🔺 Gold (GC) despite my hopeful expectations made one more strong wave down and created a similar imbalance near the 1850 price level. Anyway I see a further continuation of the uprising, imbalances of market sellers were very strong for bigger potential.

🔺 In British pound (6B) our goal of 1.2650 -12pips was achieved, and now we see a very beautiful situation for buyers. We have a strong divergence with HFT volumes on 15 minutes chart. Moreover, there is buying opportunity here on D1, after Put block trades were created.

🔺 Crude Oil (CL), as we expected, crashed the uptrend line, fell to 100.28, but then was bought by bulls sharply. And now I see the selling opportunity again, but we need one more impulse upside desirably with HFTs’ and buyers' involvement, and then up trendline breakdown is also expected. Call Blocks, which you can see on the daily chart, are also in the game now.

🔺 Copper (HG) made a significant rebound according to our estimated direction after Put Blocks and stopping HFTs’. Of course, it is not 4.7 as we expected but for sure it is enough for swing traders. Now we see that hedge funds continue to accumulate shorts in this asset for the second week in a row and I can't say that hedgers are so strong and the 4.7 average term target will be really achieved, but some swing longing opportunities I can see even now.

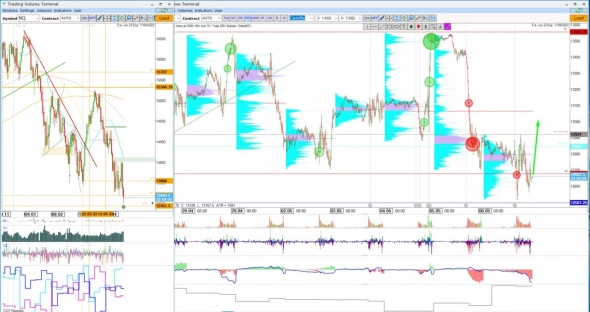

🔺 For now, I see the great imbalance in Nasdaq (NQ) after the breakdown of the support, and it seems to me there will be some pullback afterward.

As a result:

Gold (GC) — hold buys

British pound (6B) — buy

Crude Oil (CL) — sell

Copper (HG) — buy

Nasdaq (NQ) — buy

Sincerely, Taras Sviatun

Константин Платонов09 мая 2022, 00:08Thank you for all the hard work you have put in on this topic!0

Константин Платонов09 мая 2022, 00:08Thank you for all the hard work you have put in on this topic!0