19 мая 2014, 18:30

Volumes after the news E6

All who read the previous article (Volumes after the news.) already have an idea how to interpret the futures volume after the news. So, I will not repeat and will write directly on the current subject.

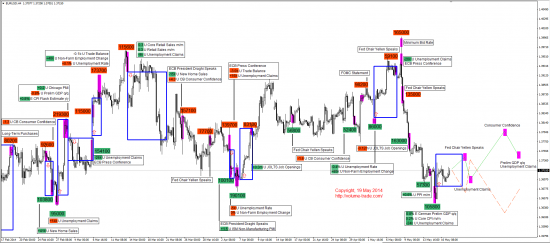

As the this theme was interesting to our readers, I decided to review the key events in futures 6E before June 1. So first, I select important days and news which are worth paying attention:

Wed May 21: USD Fed Chair Yellen Speaks, USD FOMC Meeting Minutes;

Thu May 22: USD Unemployment Claims, USD Existing Home Sales;

Tue May 27: USD CB Consumer Confidence;

Thu May 29: Prelim GDP q/q, Unemployment Claims, Pending Home Sales m/m.

I'll wait for the accumulation of volume after the news. And I will select the key points that will be at the maximum or minimum of the market at the time of accumulation of volumes.

Example: Today is May 19, I am guided by the correction or growth to key news on May 21. If the price will go up to this time and large volumes will be at the highs of the market, we should expect the price will go down, at least until the next news May 22.

Of course do not forget about numbers of volumes. It is necessary to know, as prices can update the level of previous large volumes or not. I did a graphical view of an exemplary price movement E6 before June 1. And I suppose but I do not say that, if the each accumulation of volumes after the news will be on extremes of the market, the movement of the futures will look like as shown in the figure. Red line — alternative scenario. Of course the accumulation of volumes may be located in any other way. So watch out for the amount of volumes, for their zones of accumulation and market extremums!

Source: http://volume-trade.com/education/articles/724-futures-volume-after-the-news-e6-part-1.html

2 Комментария

Joker201219 мая 2014, 18:37ну все теперь на 1.38300

Joker201219 мая 2014, 18:37ну все теперь на 1.38300 Joker201219 мая 2014, 18:38+++++0

Joker201219 мая 2014, 18:38+++++0

Читайте на SMART-LAB:

USD/CHF: Роковая встреча у линии тренда — быкам здесь не место?

Швейцарский франк продолжает накапливать потенциал для возобновления нисходящего движения — «медведи» уверенно удерживают стратегическое преимущество. В настоящий момент цена формирует...

25.02.2026

Дивидендная доходность «голубых фишек». Какой она будет

На российском рынке в разгаре сезон отчётности: компании подводят результаты 2025 года, а значит, можно оценить и потенциальные дивиденды. Традиционно «голубые фишки» ассоциируются у инвесторов...

25.02.2026