17 апреля 2014, 19:04

EURUSD: time to go short?

EURUSD: time to go short?

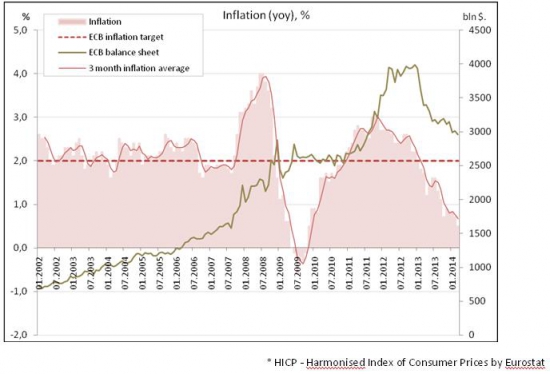

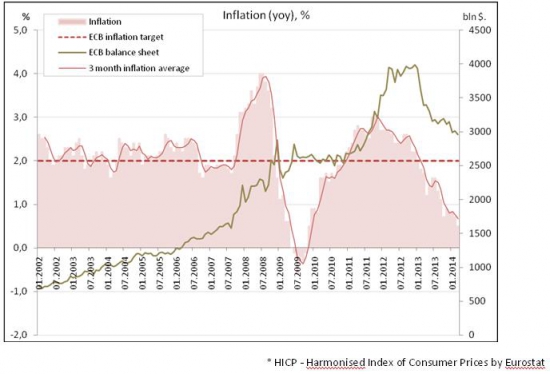

Eurozone is probably facing risk of deflation.

It seems like disinflation trend is not going to stop.Europehas a lot of spare capacity (according to Mr. Draghi), output gap is about 2.1% (according to Goldman Sachs) and about 4% (according to OECD). Sudden inflation print below 0% can cause broad sell-off.

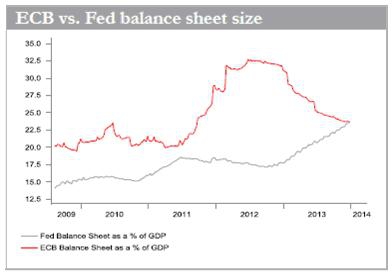

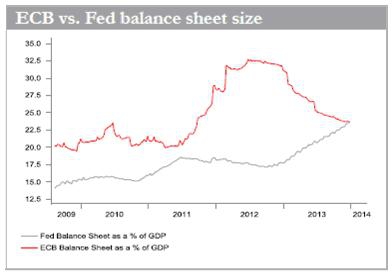

Another look at balance sheets…

ECB balance continues shrinking while FED balance continues expanding. Are we at the turning point?

However, many banks state that inflation is bottoming. UBS: “…the HICP rate of 0.5% in March marks the bottom of the inflation cycle; we expect the rate to jumpup again in April (to 0.9% y/y), then move sideways until late Q3, before risingtowards 1.3% y/y by end-2014).

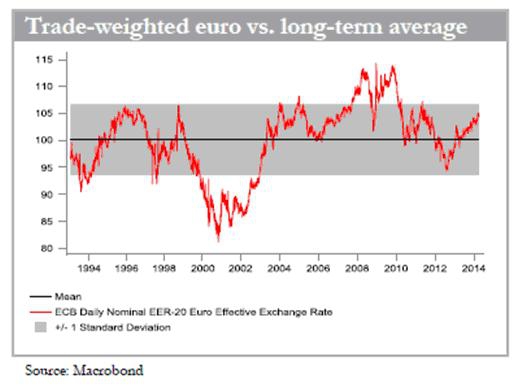

But, the point is that EURUSD will probably be lower in the end of 2014-2015, even if inflation starts rising, because these levels are considered as too high.

The rate is approaching 1.4000. Proximity to this level caused European leaders to express discomfort with the currency rate

Date: 12.04.14. EUR: 1.3900

Draghi (IMF Washington):

“The strengthening of the exchange rate would require further monetary policy accommodation”

“Euro appreciation over the last year was an important factor in bringing euro zone inflation down to its current levels, accounting for a 0.4-0.5 percentage point of decline”

“The rise of the single currency’s exchange rate is one of the main reasons Eurozone iflation is at dangerously low 0.5”

Date 03.04.14. EUR: 1.3770

Draghi (press-conference):

«The Governing Council is unanimous in its commitment to using also unconventional instruments within its mandate in order to cope effectively with risks of a too prolonged periodof low inflation.» (by the way, the ECB stressed its determination to act quickly not just in the event of the Eurozone sliding into deflation but also ifinflation stays low for an unacceptable long period)

Is EUR indeed so high?

Just for reference, main euro area trading partners are (share in export):

What can ECB do? There are many options…

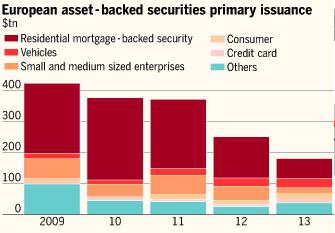

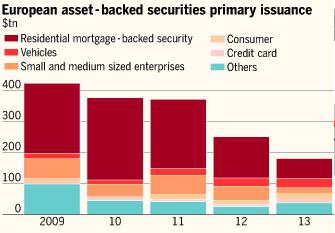

a) ABS

M. Draghi hinted that were there sufficient liquidity in the market of ABS, the central bank would be prepared to buy them to counter the rising inflation.

ABS were blamed as one of the catalysts of crisis and European market for securitization was almost closed for business.Looking at data on outstandingAsset-Backed-Securities according to AFME data in Europe, the total stood at EUR203bn as of the end of 2013.The comparable figure in the US is six times larger.

Today, ECB startedlobbying Basel Committee to be more flexible with the way they treat ABS. Joint paper about ABS was also prepared by ECB and BoE.

In case of QE EURUSD can drop significantly. That wasn’t the case when LTRO was launched (then, EURUSD surged) because LTRO was largely sterilized.

b) Government debt

QE with government bonds is politically difficult (previously, theGerman Constitutional Court’s ruling on OMT stated that therewere important reasons to assume that OMT “exceeds the ECB’s monetary policymandate” and that it “violates the prohibition of monetary financing of the budget”)

c) Corporate debt

Why EUR hasn’t fallen already?

Reasons by Bank of Tokyo-Mitsubishi:

1. Flows for euro in Q1 have been supportive (both equities and bonds)

2. Russian capital

“… the uncertainty created by the Russian annexation of Crimea and the capital flight fromRussiamay be playing a supportive role for the euro. The Russian government has stated that around USD 70bn of capital has leftRussiasince the start of the year, more than the USD 63bn total for all of 2013. Given the perception that the US has a freer hand in implementing more aggressive sanctions than the euro-zone where trade and energy linkages are much more significant, Russian capital may well be ending up in euros rather than dollars. However, If Russian crisis escalates further, it may be actually EUR-negative. A broader set of sanctions and the increased risk of retaliation byRussiawould have potential severe macro-economic repercussions for the euro-zone”

3. Huge reserve accumulation by PBOC.

“…We have had an unprecedented move in USD/CNY since the middle of February and our view on this is that it has been engineered by the Chinese authorities (as highlighted in Topic 1 above by my colleague Cliff Tan) and hence the PBOC has likely been an active buyer of dollars. However, as mentioned above the scale of intervention is inconclusive and hence we can’t draw any definitive conclusions in regard to potential recycling flows into the euro. But more importantly if the Chinese authorities do have some success in increasing two way flows in USD/CNY that should mean a slower pace of reserve accumulation which would mean less reserve recycling flows supporting the euro as we move forward. We willwatchChinareserve data closely as we advance through this year to see if the pace of reserve accumulation slows.“

Chinareserve accumulation Q1 was dramatic. It increased almost 130bln $ to 3950 bln $!

If these factors reverse, impact on EUR can be huge!

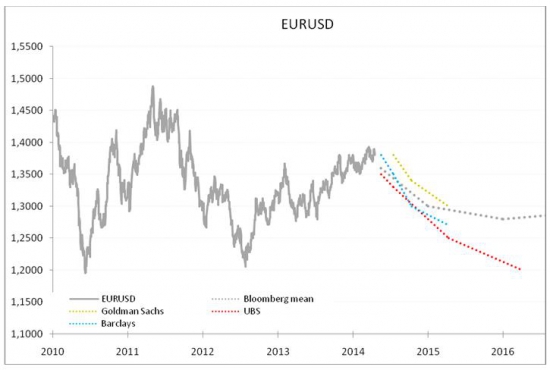

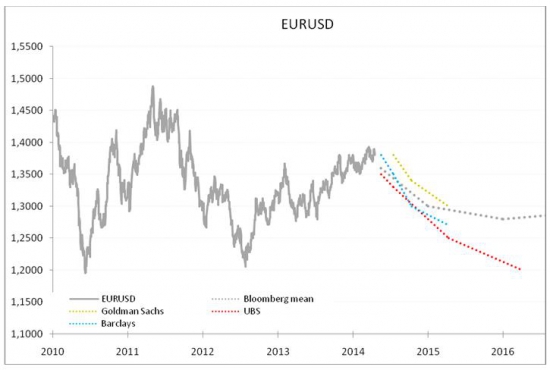

Banks’ forecasts are skewed to lower EURUSD

In April Goldman Sachs changed itsofficial forecast was changed from 1.4000 to 1.3400 (6 month period) and from 1.4000 to 1.3000 (1 year period)

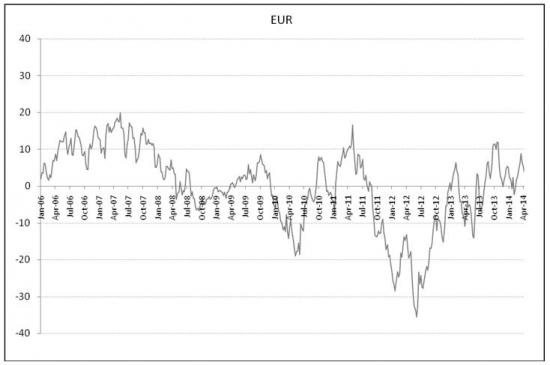

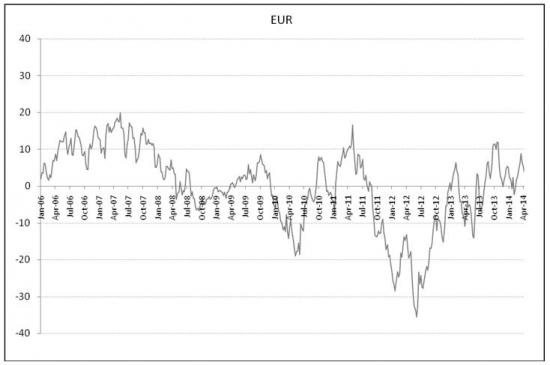

The market is currently long EURUSD which adds to downside potential:

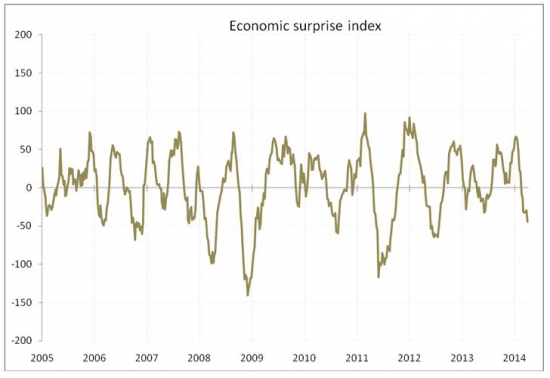

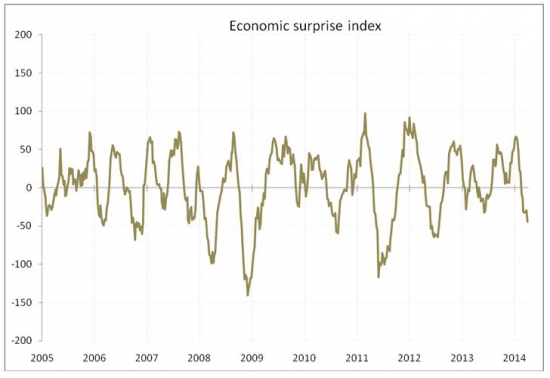

Another reason why EURUSD may fall is USD side:

After winter data disappointment market is expecting US economy to surprise on the upside again.

Eurozone is probably facing risk of deflation.

It seems like disinflation trend is not going to stop.Europehas a lot of spare capacity (according to Mr. Draghi), output gap is about 2.1% (according to Goldman Sachs) and about 4% (according to OECD). Sudden inflation print below 0% can cause broad sell-off.

Another look at balance sheets…

ECB balance continues shrinking while FED balance continues expanding. Are we at the turning point?

However, many banks state that inflation is bottoming. UBS: “…the HICP rate of 0.5% in March marks the bottom of the inflation cycle; we expect the rate to jumpup again in April (to 0.9% y/y), then move sideways until late Q3, before risingtowards 1.3% y/y by end-2014).

But, the point is that EURUSD will probably be lower in the end of 2014-2015, even if inflation starts rising, because these levels are considered as too high.

The rate is approaching 1.4000. Proximity to this level caused European leaders to express discomfort with the currency rate

Date: 12.04.14. EUR: 1.3900

Draghi (IMF Washington):

“The strengthening of the exchange rate would require further monetary policy accommodation”

“Euro appreciation over the last year was an important factor in bringing euro zone inflation down to its current levels, accounting for a 0.4-0.5 percentage point of decline”

“The rise of the single currency’s exchange rate is one of the main reasons Eurozone iflation is at dangerously low 0.5”

Date 03.04.14. EUR: 1.3770

Draghi (press-conference):

«The Governing Council is unanimous in its commitment to using also unconventional instruments within its mandate in order to cope effectively with risks of a too prolonged periodof low inflation.» (by the way, the ECB stressed its determination to act quickly not just in the event of the Eurozone sliding into deflation but also ifinflation stays low for an unacceptable long period)

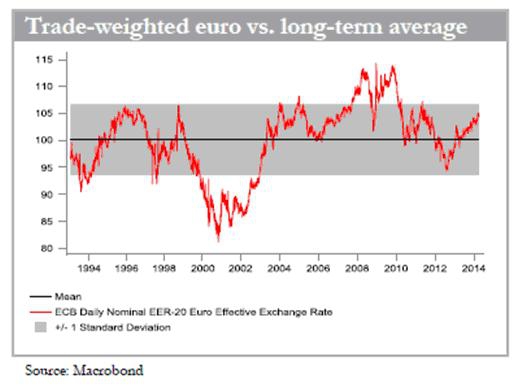

Is EUR indeed so high?

Just for reference, main euro area trading partners are (share in export):

- UK–13%

- US – 12%

- Switzerland– 6%

- China– 6%

- Poland– 5%

- Russia– 4.5%

- Index is not at extreme levels (the higher the index, the less competitive European products)

- However, given that export growth has been the key driver that supported Eurozone economy during the crisis and it is more now important, this level can be considered as high

What can ECB do? There are many options…

- QE

a) ABS

M. Draghi hinted that were there sufficient liquidity in the market of ABS, the central bank would be prepared to buy them to counter the rising inflation.

ABS were blamed as one of the catalysts of crisis and European market for securitization was almost closed for business.Looking at data on outstandingAsset-Backed-Securities according to AFME data in Europe, the total stood at EUR203bn as of the end of 2013.The comparable figure in the US is six times larger.

Today, ECB startedlobbying Basel Committee to be more flexible with the way they treat ABS. Joint paper about ABS was also prepared by ECB and BoE.

In case of QE EURUSD can drop significantly. That wasn’t the case when LTRO was launched (then, EURUSD surged) because LTRO was largely sterilized.

b) Government debt

QE with government bonds is politically difficult (previously, theGerman Constitutional Court’s ruling on OMT stated that therewere important reasons to assume that OMT “exceeds the ECB’s monetary policymandate” and that it “violates the prohibition of monetary financing of the budget”)

c) Corporate debt

- Negative deposit rate

- Stop sterilizing SMP portfolio (currently, ECB sterilizes bonds by offering one-week deposits to the banking system. Banks bid competitively for the deposits, and the rate bid has tracked the ECB’s own overnight deposit rate very closely. It has been only fractionally above zero since the ECB last cut its deposit rate in July).

- Cut reserve requirement ratio – RRR

- Another LTRO

- Rate cut buy 15 bps

Why EUR hasn’t fallen already?

Reasons by Bank of Tokyo-Mitsubishi:

1. Flows for euro in Q1 have been supportive (both equities and bonds)

2. Russian capital

“… the uncertainty created by the Russian annexation of Crimea and the capital flight fromRussiamay be playing a supportive role for the euro. The Russian government has stated that around USD 70bn of capital has leftRussiasince the start of the year, more than the USD 63bn total for all of 2013. Given the perception that the US has a freer hand in implementing more aggressive sanctions than the euro-zone where trade and energy linkages are much more significant, Russian capital may well be ending up in euros rather than dollars. However, If Russian crisis escalates further, it may be actually EUR-negative. A broader set of sanctions and the increased risk of retaliation byRussiawould have potential severe macro-economic repercussions for the euro-zone”

3. Huge reserve accumulation by PBOC.

“…We have had an unprecedented move in USD/CNY since the middle of February and our view on this is that it has been engineered by the Chinese authorities (as highlighted in Topic 1 above by my colleague Cliff Tan) and hence the PBOC has likely been an active buyer of dollars. However, as mentioned above the scale of intervention is inconclusive and hence we can’t draw any definitive conclusions in regard to potential recycling flows into the euro. But more importantly if the Chinese authorities do have some success in increasing two way flows in USD/CNY that should mean a slower pace of reserve accumulation which would mean less reserve recycling flows supporting the euro as we move forward. We willwatchChinareserve data closely as we advance through this year to see if the pace of reserve accumulation slows.“

Chinareserve accumulation Q1 was dramatic. It increased almost 130bln $ to 3950 bln $!

If these factors reverse, impact on EUR can be huge!

Banks’ forecasts are skewed to lower EURUSD

In April Goldman Sachs changed itsofficial forecast was changed from 1.4000 to 1.3400 (6 month period) and from 1.4000 to 1.3000 (1 year period)

The market is currently long EURUSD which adds to downside potential:

Another reason why EURUSD may fall is USD side:

After winter data disappointment market is expecting US economy to surprise on the upside again.

8 Комментариев

Тимофей Мартынов17 апреля 2014, 19:04Сам написал?+3

Тимофей Мартынов17 апреля 2014, 19:04Сам написал?+3 966895517 апреля 2014, 19:07На испанском нет случайно?+3

966895517 апреля 2014, 19:07На испанском нет случайно?+3 Neiron17 апреля 2014, 19:10Ну если голдманы поменяли свой прогноз, то тогда да дело шортами наконец запахло… А по теме топика, Драги на последней пресс конференции сказал, что QE и прочие программы, технически сложно исполнимы, типа нам легче ставки порезать… К июлю надеюсь увидеть 1,28.0

Neiron17 апреля 2014, 19:10Ну если голдманы поменяли свой прогноз, то тогда да дело шортами наконец запахло… А по теме топика, Драги на последней пресс конференции сказал, что QE и прочие программы, технически сложно исполнимы, типа нам легче ставки порезать… К июлю надеюсь увидеть 1,28.0 NEMESIS17 апреля 2014, 19:20ой, столько букв, а можно и проще lasttrade.ru/signals/8-46-17-04-14/+1

NEMESIS17 апреля 2014, 19:20ой, столько букв, а можно и проще lasttrade.ru/signals/8-46-17-04-14/+1 Дмитрий17 апреля 2014, 20:19Без перевода «не очень». :)0

Дмитрий17 апреля 2014, 20:19Без перевода «не очень». :)0 Vlаdimi®17 апреля 2014, 22:29Можно было вполне ограничиться одним заголовком.+1

Vlаdimi®17 апреля 2014, 22:29Можно было вполне ограничиться одним заголовком.+1