15 мая 2013, 16:48

Аналитика на 15 мая

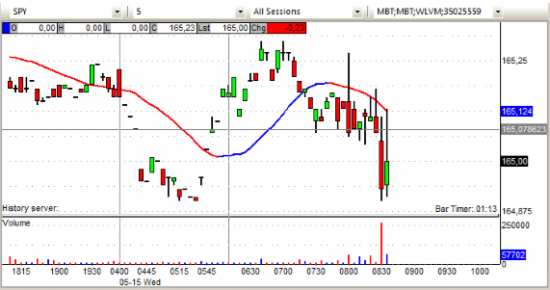

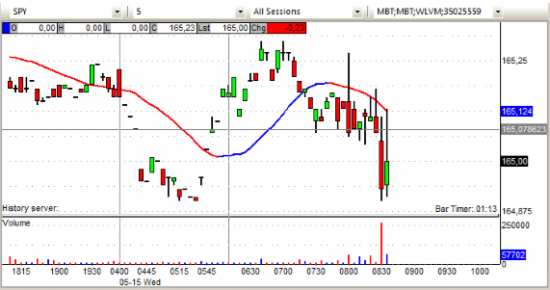

Спайдер незначительно изменяется открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: CHCI +41.4%, VIPS +10.4%, VOXX +8.1%, FENG +7.1% (light volume), SPWR +5.6%, EJ +4.9% (thinly traded), ALXA +4.8% (light volume), CHLN +4.7% (light volume), PRMW +4.6% (light volume), MIL +2.8% (ticking higher), CSC +2.4%, M +1.3%, TPH +1.3%, PF +0.9% (also announces commencement of quarterly dividend program; declares initial dividend of $0.18 per share), A +0.8%.

M&A news: MFLR +48.6% (Independent Bank and Mayflower Bancorp, Inc. Sign Definitive Merger Agreement for Acquisition of Mayflower Bancorp), .

Other news:

TXCC +10% (hires Needham & Company to evaluate strategic alternatives), NEPT +6.1% (ticking higher, reports that the Class Action Lawsuit Against the co was Dismissed), RYAAY +2.6% (move attributed to comments from CEO that passenger growth rate may double by 2018), AFFY +2.1% (discloses CEO to step down on May 15), HA +1.9% (prices $444.54 mln offering of Class A and Class B enhanced equipment trust certificates), TTM +1.7% (India's Sensex closed higher by 2.5% as India's broad wholesale measure was cooler than expected at 4.89%), DSS +1.6% (Lexington Technology Group reaches settlement with a second defendant in Bascom patent case), WAB +0.1% (announces 2-For-1 stock split, 60% dividend increase).

Analyst comments: INSM +9.4% (initiated with Buy at Lazard), ARO +3.1% (upgraded to Outperform from Market Perform at BMO), SODA +2.2% (Hearing tgt raised to $75 at ROTH Capital), GPS +1.5% (upgraded to Buy from Neutral at Citigroup), HALO +1.3% (initiated with an Overweight at Piper Jaffray), UN +0.7% (upgraded to Buy from Reduce at Nomura), AZN +0.6% (Hearing estimates raised at Berenberg)

Gapping down:

In reaction to disappointing earnings/guidance: XONE -8.6%, PLAB -5.5%, ROG -4.6% (provides update on cost improvement initiatives; reaffirms non-GAAP Q2 guidance, lowers GAAP Q2 guidance), DE -4%, WMC -3.1% (light volume), AG -2.2% (light volume), TMHC -0.5% (light volume).

Metals/mining stocks trading lower: SLV -2.1%, HMY -2.1%, GFI -2.1%, AUY -1.8%, RIO -1.8%, SLW -1.7%, FCX -1.5%, GDX -1.4%, IAG -1.1%, GOLD -0.9%, BBL -0.3%.

Select oil/gas related names showing early weakness: STO -2.2%, RDS.A -2.1%, BP -0.4% (BP, Statoil and Shell are subject of price fixing probe by EU commission, according to reports ), SDRL -1.3%, RIG -1.0% .

A few telcom names are lower: PT -2.5%, FTE -1.7%, VOD -0.5%

Other news: RMTI -10.9% (announces proposed public offering of common stock; size not disclosed), AINV -5.3% (announces public offering of 18 mln shares of common stock), P -4.5% (GOOG to launch streaming music service ), AIXG -2.5% (still checking), THC -2.5% (still checking, presented yesterday afternoon at BofA conference), RH -2.2% (Restoration Hardware priced its public follow-on offering of common stock by existing stockholders; size of the offering has been increased to ~8.674 mln shares of common stock at a public offering price of $50.00/share), SNE -1.7% (Sony plans to withdraw ODM orders for 2014 du

Отчеты компаний:

Сегодня перед открытием:

ACAT BASI BDR CGX CHLN CSC DE DLHC EJ GLOG JST M MIL NSLP OXF PFSW SORL VIP VSCP WMC

Вчера после закрытия:

A ATHX CCSC COVR DCIN DGSE EXP FENG GSB GVP KOOL NLST PRMW QBAK TXCC VIPS VOXX XONE

Торговые идеи NYSEи NASDAQ:

SPWR– смотрим акцию в течении дня, возможна хорошая волатильность.

M– смотрим акцию в лонг выше цены открытия, ниже 48.00 – шорт.

SODA– лонг выше 66.00

GPS– лонг выше 41.50

WMC– шорт ниже 20.00

P– лонг выше 16.50

THC– шорт ниже цены открытия.

Оригинал статьи:http://shark-traders.com/blog/analitika-na-15-maya/

- Европейские индексы на положительной территориии.

Премаркет NYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: CHCI +41.4%, VIPS +10.4%, VOXX +8.1%, FENG +7.1% (light volume), SPWR +5.6%, EJ +4.9% (thinly traded), ALXA +4.8% (light volume), CHLN +4.7% (light volume), PRMW +4.6% (light volume), MIL +2.8% (ticking higher), CSC +2.4%, M +1.3%, TPH +1.3%, PF +0.9% (also announces commencement of quarterly dividend program; declares initial dividend of $0.18 per share), A +0.8%.

M&A news: MFLR +48.6% (Independent Bank and Mayflower Bancorp, Inc. Sign Definitive Merger Agreement for Acquisition of Mayflower Bancorp), .

Other news:

TXCC +10% (hires Needham & Company to evaluate strategic alternatives), NEPT +6.1% (ticking higher, reports that the Class Action Lawsuit Against the co was Dismissed), RYAAY +2.6% (move attributed to comments from CEO that passenger growth rate may double by 2018), AFFY +2.1% (discloses CEO to step down on May 15), HA +1.9% (prices $444.54 mln offering of Class A and Class B enhanced equipment trust certificates), TTM +1.7% (India's Sensex closed higher by 2.5% as India's broad wholesale measure was cooler than expected at 4.89%), DSS +1.6% (Lexington Technology Group reaches settlement with a second defendant in Bascom patent case), WAB +0.1% (announces 2-For-1 stock split, 60% dividend increase).

Analyst comments: INSM +9.4% (initiated with Buy at Lazard), ARO +3.1% (upgraded to Outperform from Market Perform at BMO), SODA +2.2% (Hearing tgt raised to $75 at ROTH Capital), GPS +1.5% (upgraded to Buy from Neutral at Citigroup), HALO +1.3% (initiated with an Overweight at Piper Jaffray), UN +0.7% (upgraded to Buy from Reduce at Nomura), AZN +0.6% (Hearing estimates raised at Berenberg)

Gapping down:

In reaction to disappointing earnings/guidance: XONE -8.6%, PLAB -5.5%, ROG -4.6% (provides update on cost improvement initiatives; reaffirms non-GAAP Q2 guidance, lowers GAAP Q2 guidance), DE -4%, WMC -3.1% (light volume), AG -2.2% (light volume), TMHC -0.5% (light volume).

Metals/mining stocks trading lower: SLV -2.1%, HMY -2.1%, GFI -2.1%, AUY -1.8%, RIO -1.8%, SLW -1.7%, FCX -1.5%, GDX -1.4%, IAG -1.1%, GOLD -0.9%, BBL -0.3%.

Select oil/gas related names showing early weakness: STO -2.2%, RDS.A -2.1%, BP -0.4% (BP, Statoil and Shell are subject of price fixing probe by EU commission, according to reports ), SDRL -1.3%, RIG -1.0% .

A few telcom names are lower: PT -2.5%, FTE -1.7%, VOD -0.5%

Other news: RMTI -10.9% (announces proposed public offering of common stock; size not disclosed), AINV -5.3% (announces public offering of 18 mln shares of common stock), P -4.5% (GOOG to launch streaming music service ), AIXG -2.5% (still checking), THC -2.5% (still checking, presented yesterday afternoon at BofA conference), RH -2.2% (Restoration Hardware priced its public follow-on offering of common stock by existing stockholders; size of the offering has been increased to ~8.674 mln shares of common stock at a public offering price of $50.00/share), SNE -1.7% (Sony plans to withdraw ODM orders for 2014 du

Отчеты компаний:

Сегодня перед открытием:

ACAT BASI BDR CGX CHLN CSC DE DLHC EJ GLOG JST M MIL NSLP OXF PFSW SORL VIP VSCP WMC

Вчера после закрытия:

A ATHX CCSC COVR DCIN DGSE EXP FENG GSB GVP KOOL NLST PRMW QBAK TXCC VIPS VOXX XONE

Торговые идеи NYSEи NASDAQ:

SPWR– смотрим акцию в течении дня, возможна хорошая волатильность.

M– смотрим акцию в лонг выше цены открытия, ниже 48.00 – шорт.

SODA– лонг выше 66.00

GPS– лонг выше 41.50

WMC– шорт ниже 20.00

P– лонг выше 16.50

THC– шорт ниже цены открытия.

Оригинал статьи:http://shark-traders.com/blog/analitika-na-15-maya/

0 Комментариев