комментарии QCAP на форуме

-

Чё там Вася? В лонгах? Так и знал что его просто так не выпустят))

Тимофей Мартынов, А на такие коментарии в форуме торговли фьючерса, не думаю что будет интересно отвечать людям которые торгуют, а не обсуждают Васю.

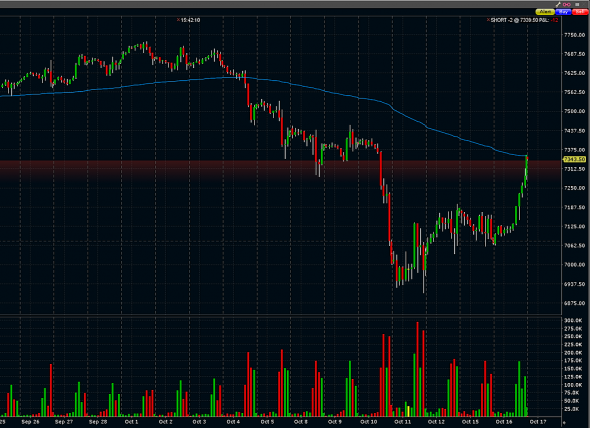

Валимся солидно, а форум спит

Тимофей Мартынов,

У вас сайт не для трейдеров S&P500 фьючерс, видимо никто не торгует ES или не пишет об этом. Одни аналитики и предполагатели. Что бы ветка форума стала интересной нужно пригласить в нее трейдеров которые торгуют ES NQ YM RTY. Что бы была возможность обсуждать движение цены, коментарии к трейдам.

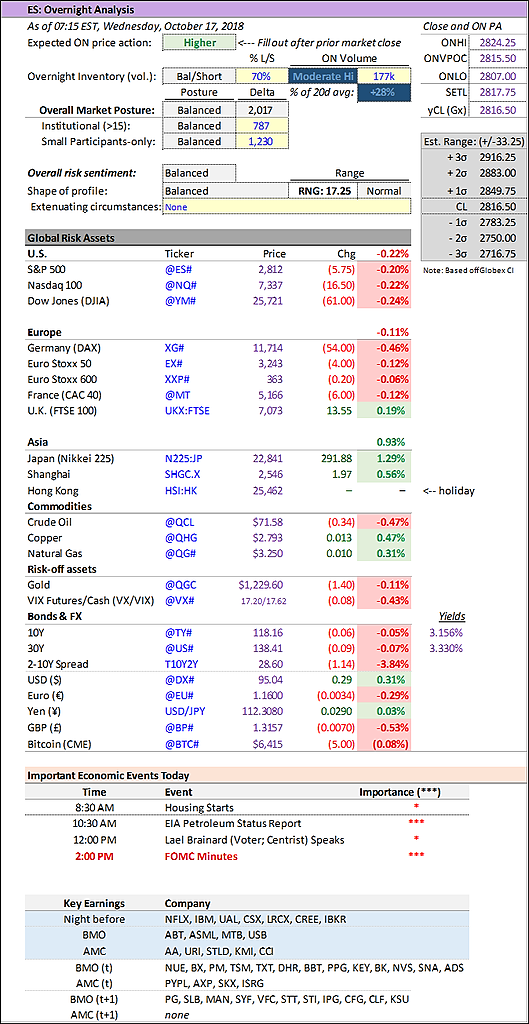

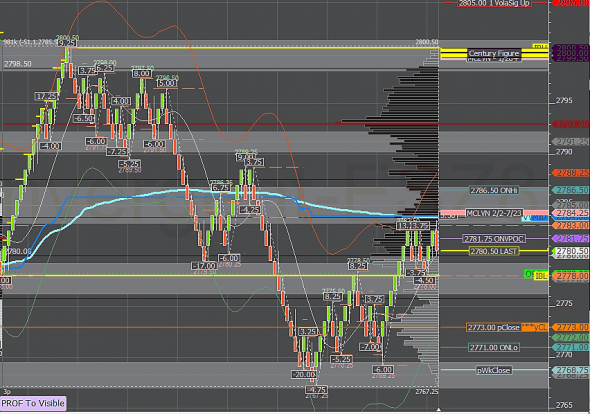

(US) FOMC MINUTES FROM SEPT 26TH MEETING: GENERALLY ANTICIPATE FURTHER GRADUAL RATE INCREASES; ESTAIMTES OF NEUTRAL RATE WILL BE ONLY ONE OF MANY FACTORS TO CONSIDER IN FUTURE POLICY — Almost all policymakers considered it appropriate to remove reference in statement to monetary policy being accommodative- Some officials noted financial stress in emerging markets as risk to econom- A few officials saw rates becoming modestly restrictive for a time — Some officials saw possible risks to financial stability — Few officials saw higher interest rates behind the weak residential investment.

(US) FOMC MINUTES FROM SEPT 26TH MEETING: GENERALLY ANTICIPATE FURTHER GRADUAL RATE INCREASES; ESTAIMTES OF NEUTRAL RATE WILL BE ONLY ONE OF MANY FACTORS TO CONSIDER IN FUTURE POLICY — Almost all policymakers considered it appropriate to remove reference in statement to monetary policy being accommodative- Some officials noted financial stress in emerging markets as risk to econom- A few officials saw rates becoming modestly restrictive for a time — Some officials saw possible risks to financial stability — Few officials saw higher interest rates behind the weak residential investment.

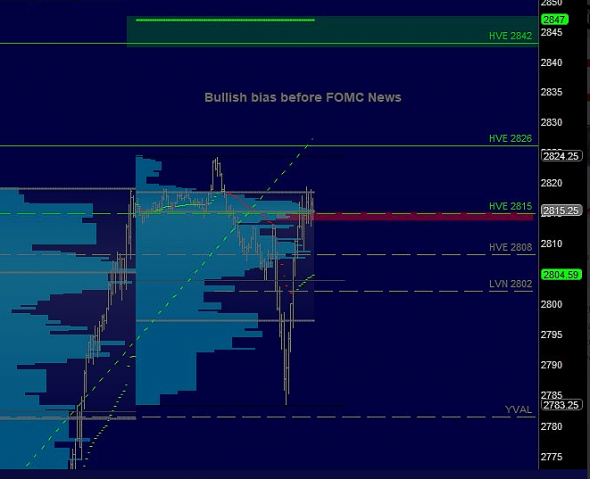

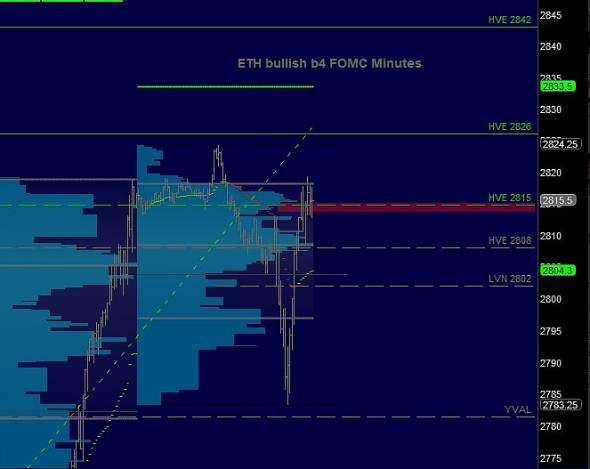

(US) Preview: FOMC Meeting Minutes expected at 14:00 ET (18:00 GMT) At the Sept 26 FOMC meeting the committee raised rates another 25 bps, as expected, taking the target range up to 2.00-2.25%. The vote was unanimous and the «dot plot» indicated that the Fed was forecasting another rate hike in Dec, followed by three more in 2019 and capped by one last hike in 2020. The other big move in the Sept FOMC statement was the deletion of the phrase «the stance of monetary policy remains accommodative.» In his press conference Chair Powell explained that it was the right time to remove this language, but that Fed policy is still accommodative, as rates are still below the 'neutral' rate. An area of contention at the Fed is determining where 'neutral' is and whether the Fed should pause at neutral or continue raising rates modestly above neutral (to slightly 'restrictive'). The recent equity market selloff was at least partially attributed to Powell saying in early Oct that «We are a long way from neutral at this point, probably,» which chipped away at the idea that the neutral rate is relatively low. The minutes may shed some light on the Fed's deliberations on this point and what factors could take rate policy off its track of gradual hikes (e.g. higher inflation, trade war heating up, greater market volatility).

(US) Preview: FOMC Meeting Minutes expected at 14:00 ET (18:00 GMT) At the Sept 26 FOMC meeting the committee raised rates another 25 bps, as expected, taking the target range up to 2.00-2.25%. The vote was unanimous and the «dot plot» indicated that the Fed was forecasting another rate hike in Dec, followed by three more in 2019 and capped by one last hike in 2020. The other big move in the Sept FOMC statement was the deletion of the phrase «the stance of monetary policy remains accommodative.» In his press conference Chair Powell explained that it was the right time to remove this language, but that Fed policy is still accommodative, as rates are still below the 'neutral' rate. An area of contention at the Fed is determining where 'neutral' is and whether the Fed should pause at neutral or continue raising rates modestly above neutral (to slightly 'restrictive'). The recent equity market selloff was at least partially attributed to Powell saying in early Oct that «We are a long way from neutral at this point, probably,» which chipped away at the idea that the neutral rate is relatively low. The minutes may shed some light on the Fed's deliberations on this point and what factors could take rate policy off its track of gradual hikes (e.g. higher inflation, trade war heating up, greater market volatility).

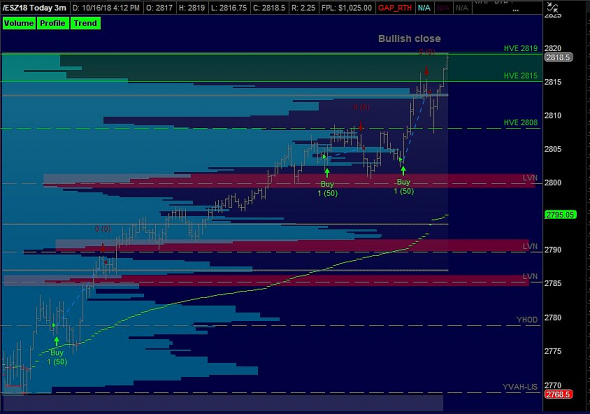

(US) Market Trading Hours Summary: Indices retreat despite Netflix blowout

(US) Market Trading Hours Summary: Indices retreat despite Netflix blowout

Summary:

Stocks moved lower as volatility resumed after yesterday's market surge. Housing data stayed soft, suggesting at least one portion of the US economy is muted despite the strong labor market and robust overall economic growth. Netflix subscribers surged once again, but gains have backed well off of post-market highs from last evening. Treasury prices drifted higher as risk-off flows are likely being aided once again by uncertainty surrounding Brexit and US/China trade relations. Crude futures dipped towards $70 in the WTI contract following weekly inventory data. The Greenback found a modest bid ahead of the release of the US Treasury's global currency report.

Overnight

— (CN) China Premier Li: Confident to reach economic goals this year; Q3 GDP will be at reasonable range

— (CN) China local govt Guangdong said to be considering offering support to local listed companies — Chinese press

— EU leaders gather for 'moment of truth' Brexit summit; waning optimism on any agreement this week

— UK Sept CPI comes in below expectations and edging closer to BOE target

— Euro Zone Sept Final CPI unrevised and remaining above ECB target for the 4th straight month

US Session

-(US) MBA Mortgage Applications w/e Oct 12th: -7.1% v -1.7% prior

-(US) SEPT HOUSING STARTS: 1.201M V 1.21ME; BUILDING PERMITS: 1.24M V 1.28ME

-(US) US reportedly to withdraw from United Nations’ Universal Postal Union — press

-(US) Atlanta Fed cuts Q3 GDP forecast to 3.9% from 4.0% prior

— (TR) US Sec State Pompeo: will have a decision shortly regarding US sanctions on Turkey after the release of Pastor Brunson

-(US) DOE CRUDE: +6.5M V +1.5ME; GASOLINE: -2.0M V -0.5ME; DISTILLATE: -0.8M V -1ME

-President Trump: Reiterates China is not ready for trade talks yet

Europe

-(EU) EU Official: Could have a 'no-deal' Brexit Summit in November if no progress is made — financial press

-(UK) PM May reiterates view that Britain will honor its financial obligations to EU but nothing is agreed upon until everything is agreed upon — comments ahead of EU Leader Summit

-(UK) BOE Cunliffe: absent of action by EU authorities there would be legal uncertainty around counterparties

-(IT) EU Budget Commissioner Oettinger: Italy's 2019 draft budget is not in line with EU guidelines — press

-(UK) Ireland PM Varadkar: fresh thinking on Brexit is welcome but time is running out

Corporate Headlines:

-Netflix rises as subscriptions jump

-IBM disappoints again

-United soars after strong results

-Adtran declines along with results

-Teva falls after ESRX denies coverage of Ajovy

-US financial regulators remove SIFI designation from Prudential Financial

-Casino magnate Tilman Fertitta reportedly has approached Caesars about potential merger deal — press

This morning's Trader Bite at *9:00 AM* Eastern US:

This morning's Trader Bite at *9:00 AM* Eastern US:

www.youtube.com/watch?v=AdIDGAu7K6w