09 апреля 2013, 16:55

Аналитика на 9 апреля

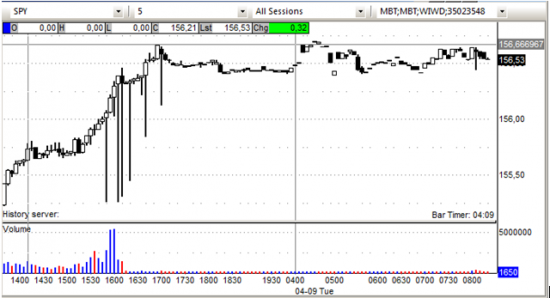

Спайдер торгуется на премаркете около уровня вчерашнего закрытия.

SPY (внутридневной график) боковое движение на премаркете. Сопротивление 156.70-157.00 Поддержка: 156.50-155.75

Ожидаемая макроэкономическая статистика:

Gapping up:

In reaction to strong earnings/guidance: STAA +19.8%, FOE +1.2%.

M&A news: KKR +2.6% (KKR has joined BX and other PE firms to bid more than $12 bln for LIFE, according to reports).

Financial related names showing strength: RBS +2.3%, CS +1.9%, BCS +1.5%, BBVA +1.4%.

Metals/mining stocks trading higher: RIO +3.3%, MT +1.8%, VALE +1.7%, BBL +1.6%, BHP +1.4%, HL +1.4%, AU +1.3%, GOLD +0.7%.

Other news: STP +12.5% (receives continued listing standards notice from the New York Stock Exchange), CXW +4.6% (Board of Directors authorizes special dividend of $675 mln or ~$6.63 per share), TI +4.6% ( Hutchison Whampoa may be targeting a 29.9% stake in TI, according to reports), ALU +3.7% (LGS Innovations Appoints Rich Martin as New CIO), SSRX +2% (OrbiMed Advisors disclosed 9.44% stake in 13D; not believe Merger is in the best interests of the shareholders), GILD +1.9% (submits NDA for sofosbuvir for the treatment of hepatitis C virus infection, RDN +1.9% (reports Primary New Insurance Written of $3.63 bln; ending primary delinquent inventory of ~85.1K loans)

Analyst comments: HILL +6% (upgraded to Buy from Hold at Needham), BCRX +2.6% (upgraded to Buy from Hold at MLV & Co; tgt $3), AMTG +1.1% (upgraded to Overweight from Neutral at JP Morgan), GPS +0.4% (tgt to $56 from $51 at Jefferies)

Gapping down:

In reaction to disappointing earnings/guidance: SHLM -5.9%, TTEK -3.4% (also anticipates eastern Canadian weakness in second half; expects reduction in revenue of $20-30 mln to operating income over the second half of fiscal 2013; reaffirms Q2 guidance) MG -2.8%, AA -1.3%.

Select Japan related names showing weakness: MTU -3.7% (ticking lower), NMR 3.2%, TSM -3.1%, HMC -2.3%.

Other news: OCZ -11.1% (provides update on restatement process and NASDAQ status: will not meet April 8, 2013 NASDAQ extension date to become current in its periodic filings with the SEC), JCP -9.9% (appoints Myron Ullman, III CEO, succeeding Ron Johnson ), IX -5.8% (still checking), CUZ -3.5% (announces offering of 14 mln shares of common stock), STWD -3.3% (is offering 26,500,000 shares of its common stock in an underwritten public offering), KRG -2.8% (commenced an underwritten public offering of 12,500,000 common shares of beneficial interest), MCC -2.5% (announces offering of 4 mln shares of common stock), DEO -2.2% (reports suggesting India Competition Commission request for additional info related to United Spirits deal), DEO -2.1% (still checking), DCTH -1.2% (expands program to increase efficiencies and reduce cash utilization), MRVL -1.1% (10% owner Greenlight Capital discloses selling shares), ECL -0.7% ( DoJ confirms it requires divestiture in merger of Ecolab and Permian Mud Service)

Analyst comments: PL -2.1% (ticking lower, downgraded at Raymond James and BofA/Merrill).

Отчеты компаний:

Вчера после закрытия: AA ANGO MG SHLM VISN

Сегодня перед открытием: ADGE SYRG ZEP

Торговые идеи NYSEи NASDAQ:

CXW– совет директоров компании одобрил специальный дивиденд в размере примерно 6,63 USD на акцию. Торгуем акцию исходя из максимумов премаркета и постмаркета.

JCP– уход CEO. Смотрим акцию в шорт ниже уровней 15.00 и 14.00

STWD– дополнительное размещение 26,5 миллионов акций. Лонг выше 27.50, ниже этого уровня возможен шорт с потенциалом до минимума постмаркета.

GILD– предоставила в FDA новый NDA по испытаниям препарата Sofosbuvir. Выше 48.25 смотрим акцию в лонг. Ниже 48.00 – шорт.

YUM– возможно продолжение движения на новостях из Китая о вспышке птичьего гриппа.

LIFE – новые новости о поглощении. В тендере участвует еще одна компания (KKR). Смотрим на лонг выше 67.50.

Ежедневная аналитика.

- Европейские индексы на положительной территории.

- Nikkei 0.0 %

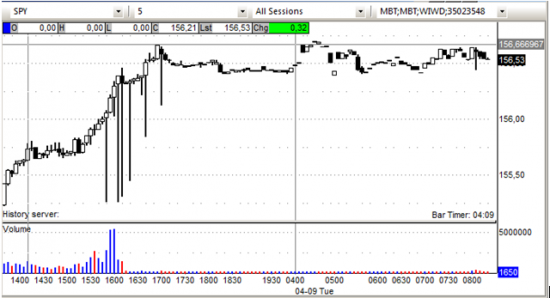

SPY (внутридневной график) боковое движение на премаркете. Сопротивление 156.70-157.00 Поддержка: 156.50-155.75

Ожидаемая макроэкономическая статистика:

- February Wholesale Inventories (10am)- Briefing.com consensus +0.5%

Gapping up:

In reaction to strong earnings/guidance: STAA +19.8%, FOE +1.2%.

M&A news: KKR +2.6% (KKR has joined BX and other PE firms to bid more than $12 bln for LIFE, according to reports).

Financial related names showing strength: RBS +2.3%, CS +1.9%, BCS +1.5%, BBVA +1.4%.

Metals/mining stocks trading higher: RIO +3.3%, MT +1.8%, VALE +1.7%, BBL +1.6%, BHP +1.4%, HL +1.4%, AU +1.3%, GOLD +0.7%.

Other news: STP +12.5% (receives continued listing standards notice from the New York Stock Exchange), CXW +4.6% (Board of Directors authorizes special dividend of $675 mln or ~$6.63 per share), TI +4.6% ( Hutchison Whampoa may be targeting a 29.9% stake in TI, according to reports), ALU +3.7% (LGS Innovations Appoints Rich Martin as New CIO), SSRX +2% (OrbiMed Advisors disclosed 9.44% stake in 13D; not believe Merger is in the best interests of the shareholders), GILD +1.9% (submits NDA for sofosbuvir for the treatment of hepatitis C virus infection, RDN +1.9% (reports Primary New Insurance Written of $3.63 bln; ending primary delinquent inventory of ~85.1K loans)

Analyst comments: HILL +6% (upgraded to Buy from Hold at Needham), BCRX +2.6% (upgraded to Buy from Hold at MLV & Co; tgt $3), AMTG +1.1% (upgraded to Overweight from Neutral at JP Morgan), GPS +0.4% (tgt to $56 from $51 at Jefferies)

Gapping down:

In reaction to disappointing earnings/guidance: SHLM -5.9%, TTEK -3.4% (also anticipates eastern Canadian weakness in second half; expects reduction in revenue of $20-30 mln to operating income over the second half of fiscal 2013; reaffirms Q2 guidance) MG -2.8%, AA -1.3%.

Select Japan related names showing weakness: MTU -3.7% (ticking lower), NMR 3.2%, TSM -3.1%, HMC -2.3%.

Other news: OCZ -11.1% (provides update on restatement process and NASDAQ status: will not meet April 8, 2013 NASDAQ extension date to become current in its periodic filings with the SEC), JCP -9.9% (appoints Myron Ullman, III CEO, succeeding Ron Johnson ), IX -5.8% (still checking), CUZ -3.5% (announces offering of 14 mln shares of common stock), STWD -3.3% (is offering 26,500,000 shares of its common stock in an underwritten public offering), KRG -2.8% (commenced an underwritten public offering of 12,500,000 common shares of beneficial interest), MCC -2.5% (announces offering of 4 mln shares of common stock), DEO -2.2% (reports suggesting India Competition Commission request for additional info related to United Spirits deal), DEO -2.1% (still checking), DCTH -1.2% (expands program to increase efficiencies and reduce cash utilization), MRVL -1.1% (10% owner Greenlight Capital discloses selling shares), ECL -0.7% ( DoJ confirms it requires divestiture in merger of Ecolab and Permian Mud Service)

Analyst comments: PL -2.1% (ticking lower, downgraded at Raymond James and BofA/Merrill).

Отчеты компаний:

Вчера после закрытия: AA ANGO MG SHLM VISN

Сегодня перед открытием: ADGE SYRG ZEP

Торговые идеи NYSEи NASDAQ:

CXW– совет директоров компании одобрил специальный дивиденд в размере примерно 6,63 USD на акцию. Торгуем акцию исходя из максимумов премаркета и постмаркета.

JCP– уход CEO. Смотрим акцию в шорт ниже уровней 15.00 и 14.00

STWD– дополнительное размещение 26,5 миллионов акций. Лонг выше 27.50, ниже этого уровня возможен шорт с потенциалом до минимума постмаркета.

GILD– предоставила в FDA новый NDA по испытаниям препарата Sofosbuvir. Выше 48.25 смотрим акцию в лонг. Ниже 48.00 – шорт.

YUM– возможно продолжение движения на новостях из Китая о вспышке птичьего гриппа.

LIFE – новые новости о поглощении. В тендере участвует еще одна компания (KKR). Смотрим на лонг выше 67.50.

Ежедневная аналитика.

0 Комментариев

Читайте на SMART-LAB:

⚡️ Развиваем синергию внутри Группы Займер

Важнейшим эффектом сделок по покупке «Таксиагрегатор» и IntellectMoney будет развитие синергических связей между компаниями Группы. 🟢 Займер будет предоставлять займы водителям, подключенным к...

13.02.2026

⛽️ Новатэк: не так плохо, как кажется

Король СПГ представил отчет по МСФО за 2025 год Новатэк (NVTK) ➡️Инфо и показатели Результаты — выручка: ₽1,4 трлн (-6%); — EBITDA: ₽859,3 млрд (-15%); — чистая прибыль:...

12.02.2026