комментарии QCAP на форуме

-

Remember quarter-end and month-end is taking place today. Might get a bit erratic as large players position!

Remember quarter-end and month-end is taking place today. Might get a bit erratic as large players position! (US) Market Trading Hours Summary: Stocks attempt to lift, helped by positive retail earnings

(US) Market Trading Hours Summary: Stocks attempt to lift, helped by positive retail earnings

Thu, 28 Mar 2019

Summary:

US indices initially moved up marginally, along with interest rates, but the global growth discussion remains front and center. Reports on the China/US trade talks were somewhat constructive, while Brexit concerns lingered as MPs waffle on whether or not they can ultimately support PM May's plan. Crude prices slipped after President Trump once again called on OPEC to keep prices from rising. The dollar moved up, with particular weakness in pockets of emerging market currencies as they extended declines.

Overnight

-(CN) Trump Administration Official: China tariffs will be key sticking point and will be resolved as part of the deal; no specific time frame set for trade deal, talks could conclude anytime from April to June; US and China have made progress in all areas of trade talks

— European Mar inflation data (German States and Spain) coming in below expectations and moving farther away from ECB target

— Brexit stalemate deepens as UK Parliament failed to agree on a way forward via 8 options

— UK PM May announced to backbench Conservative MPs that she would step down as PM after her Brexit deal was delivered and would not lead the next stage of negotiations

— Turkey’s deepening market turmoil fuels concern about contagion to other developing market

US Session

-(CN) China said to plan allowing foreign tech firms to own cloud operations as a part of trade talks — press

-(US) Q4 FINAL GDP PRICE INDEX: 1.7% V 1.8%E; CORE PCE Q/Q: 1.8% V 1.7%E

-(US) Q4 FINAL GDP ANNUALIZED Q/Q: 2.2% V 2.3%E; PERSONAL CONSUMPTION: 2.5% V 2.6%E

-(US) INITIAL JOBLESS CLAIMS: 211K V 220KE; CONTINUING CLAIMS: 1.76M V 1.78ME

-(US) Pres Trump calls on OPEC to increase oil flow; says oil prices getting too high

-(RU) Russia and OPEC might agree to three-month extension of oil supply reductions at June meeting; Energy Min Novak said to tell Saudis he can't promise extension until end of 2019 — press

-(US) Nevada reports Feb casino gaming Rev $1.01B, -0.6% y/y; Las Vegas strip Rev $591.7M, -2.0% y/y

-(US) Fed's Clarida (moderate, voter): Fed can be patient amid global risks and muted inflation; Fed must pay ever closer attention to global growth risks

-(US) FEB PENDING HOME SALES M/M -1.0% V -0.5%E; Y/Y: -5.0% V -3.0%E

Europe

-(EU) EURO ZONE MAR BUSINESS CLIMATE INDICATOR: 0.53 V 0.68E

-(IT) ITALY DEBT AGENCY (TESORO) SELLS TOTAL €6.25B VS. €5.5-6.25B INDICATED RANGE IN 5-YEAR AND 10-YEAR BTP BONDS

-(BE) Belgium Mar CPI M/M: 0.3% v 0.3% prior; Y/Y: 2.3% v 2.2% prior

-(TR) Turkey President Erdogan: Reiterates stance that as interest rates fall so will inflation

-(IE) Ireland Feb Retail Sales Volume M/M: +2.1% v -1.2% prior; Y/Y: +5.1% v -0.5% prior

-(UK) Former UK Foreign Min Johnson: PM May's Brexit deal is dead

-(CZ) CZECH CENTRAL BANK (CNB) LEAVES 2-WEEK REPURCHASE RATE UNCHANGED AT 1.75%; AS EXPECTED

-(DE) GERMANY MAR PRELIMINARY CPI M/M: 0.4% V 0.6%E; Y/Y: 1.3% V 1.5%E

-(ZA) SOUTH AFRICA CENTRAL BANK (SARB) LEAVES INTEREST RATES UNCHANGED AT 6.75%; AS EXPECTED

Corporate Headlines:

-LULU valuation stretches further following earnings beat on 6% SSS growth

-PVH rises as guidance impresses

-NLSN slips on report Blackstone exits auction process

-WBC confirms ZF deal below yesterday's closing price

-DB reportedly mulls raising up to €10B in equity for Commerzbank merger deal — FT

-OSR.DE cuts outlook

— Dow Jones -0.1%

— S&P 500 -0.2%

— Nasdaq -0.3%

— Russell 2000 -0.1%

Treasuries:

— US 2-yr: +1bps at 2.222%

— 10-yr: +1bps at 2.388%

— 30-yr: -1bps at 2.816%

— 2-10 spread: flat at 0.17%

Commodities:

— May crude oil $58.80, -1.0%

— Apr Gold $1,292/oz, -1.4%

— May Silver $15.07/oz, -1.5%

— May Copper $2.873/oz, +0.3%

(US) Market Close Summary: Stocks fall, pound gains as PM May vows to quit if Brexit deal gets through Parliament

(US) Market Close Summary: Stocks fall, pound gains as PM May vows to quit if Brexit deal gets through Parliament

US Session

-(US) MBA Mortgage Applications w/e Mar 22nd: 8.9% v 1.6% prior

-(CA) CANADA JAN INT'L MERCHANDISE TRADE (CAD): -4.3B V -3.6BE

-(US) JAN TRADE BALANCE: -$51.1B V -$57.0BE; China: -$33.2B v -$38.7B prior

-(US) Q4 CURRENT ACCOUNT: -$134.4B V -$130.0BE

-(MX) Mexico Feb Trade Balance: $1.22B v $0.3Be

-(US) Atlanta Fed raises Q1 GDP forecast to 1.5% v 1.3% prior

-(US) DOE CRUDE: +2.8M V -0.5ME; GASOLINE: -2.9M V -2.5ME; DISTILLATE: -2.1M V -1ME

-(US) White House Economic Adviser Hassett: 10-year is clearly responding to news from Europe — CNBC interview

-*(US) TREASURY'S $41B 5-YEAR NOTE AUCTION DRAWS: 2.172%; BID-TO-COVER RATIO: 2.35 V 2.40 PRIOR AND 2.44 OVER THE LAST 12 AUCTIONS

-(US) Pres Trump asks agencies to end conservatorship of Fannie and Freddie; will sign Trump reform memo

Europe

-(UK) EU's Barnier: In all Brexit scenarios, the Good Friday agreement will continue to apply

-Swedish Economic Crime Authority initiates a preliminary investigation regarding suspected insider crimes

-(DE) GERMANY SELLS €2.433B VS. €3.0B INDICATED IN 0.25% FEB 2029 BUNDS; AVG YIELD: -0.05% (1st negative rate since 2016) V +0.12% PRIOR; BID-TO-COVER: 2.59X V 2.48X PRIOR

-(DE) ECB's Lautenschlaeger (Germany, SSM member): Fit and proper rules not harmonized at all — panel comments

-(ES) ECB’s de Guindos (Spain): ECB has the tools to shield the economy from spillovers

-(UK) Mar CBI Retailing Reported Sales: -18 v +4e

-(UK) Northern Irish DUP Dep Party official Dodds: To support proposal for the Malthouse compromise plan A in the indicative votes

-(EU) ECB said to be working on models for tiered Deposit Rate — press

-(UK) UK PM May Spokesperson: Will only bring back Brexit vote when we have a realistic prospect of success

-(EU) ECB's Mersch (Luxembourg): ECB will not rush to return to the pre-crisis balance sheet

-(UK) UK Lawmakers approve procedure for 8 indicative votes on Brexit options on Wednesday (vote 331 to 287)

-(UK) Reportedly UK PM May planning motion for potential 'meaningful vote' on Brexit deal on Friday

-(UK) PM May told Tory MPs that she'll hand over leadership once Brexit is delivered; does not offer a specific timetable for stepping down — press

-(UK) Brexiteer MP Rees Moog: if Northern Ireland's DUP abstain in Brexit deal vote, I will back the deal

Corporate Headlines

-KBH and LEN reports housing market picked up as rates fell

-Centene to acquire Wellcare in ~$17B deal

-LUV cuts Q1 outlook due to flight cancellations

-PAYX reports inline results

-At Home falls 20% on poor guidance

-IFX.DE cuts outlook

-Boeing exec: Announces three software changes for 737 MAX; sees 737 MAX upgrade installed within days of software approval; working with regulators on a 737 MAX patch and training

Summary:

US stock indices bounced off the lows of the day but still ended in negative territory amid continued flashing signs indicating growth worries persists. Ahead of the NY opening bell, futures slid along with bond yields after central bank officials on both sides of the Atlantic indicated they would remain attuned to economic headwinds. The Turkish lira continued to slump, and stock prices there fell out of bed after swap rates soared. USD/MXN rose as the Greenback firmed against a host of emerging market currencies. The Transports ended the session strong after LUV cut their Q1 capacity outlook in the midst of growing flight cancellations. Cable strengthened after various MPs said they would now support the PM May's Brexit deal after she said she would step down once the agreement passes.

Markets:

— Dow Jones -0.1%

— S&P500 -0.5%

— Nasdaq -0.6%

— Russell 2000 -0.4%

-After Market Movers-

-LULU Reports Q4 $1.85 v $1.74e, Rev $1.17B v $1.15Be; authorizes $500M stock repurchase program (3% of market cap); +8% afterhours

-VRNT Reports Q4 $1.08 v $1.01e, adj Rev $336.7M v $333Me; +8% afterhours

-PVH Reports Q4 $1.84 v $1.75e, Rev $$2.48B v $2.41Be; authorizes $750M increase and extension to stock buybacks (9% of market cap); +8% afterhours

-SNX Reports Q1 $2.84 v $2.75e, Rev $5.25B v $5.27Be; +3% afterhours

-FUL Reports Q1 $0.34 v $0.34e, Rev $673M v $699Me; -5% afterhours

We are talking about leaving tariffs on China for a long period of time to ensure China complies with the trade deal.

We are talking about leaving tariffs on China for a long period of time to ensure China complies with the trade deal.

— China trade deal is 'coming along nicely'; confirms US trade negotiators will travel to China this weekend(reminder: Trump said yesterday China trade talks are going «very well»)

— EU has been very tough on the US for many years, EU has been as tough on the US as China has been

— I have no idea when Mueller investigation's report will be released; doesn't mind if public sees Mueller report on Russia probe

— On auto tariffs, says there is no recommendation and its still up for review Полезно послушать опытного трейдера — twitter.com/i/status/1106915918414782464

Полезно послушать опытного трейдера — twitter.com/i/status/1106915918414782464 Market Internals update at 14:30ET

Market Internals update at 14:30ET

— NYSE volume 690M shares, 70% above its three-month average; advancers lead decliners by 2:1.

— NASDAQ volume 1.63B shares, 15% above its three-month average; advancers lead decliners by 2:1.

— VIX index -5% at 12.80 Market Internals update at 15:30ET

Market Internals update at 15:30ET

— NYSE volume 433M shares, 17% below its three-month average; decliners lead advancers by 1.2:1.

— NASDAQ volume 1.64B shares, 10% below its three-month average; decliners lead advancers by 1.4:1.

— VIX index -0.4% at 13.40

Ну не знаю

Нефть на хаях, Америка чувствует себя неплохо и S&P держится. Но, что смущает.

- Объемы растущей нефти падают (дивергенция)

- WIX – очень низкий, т.е. нет желающих покупать опционы S&P, что должно работать на корректировку в шорт

- Пром производство Европе совсем не ах...

читать дальше на смартлабе

cerenc, Что такое WIX? Объемы по нефти переходят в новый контракт

Бумага Боинга сколько имеет вес в СИПИ500, подскажите плиз? Может пикирование рынков начнется с нее, ибо дела там явно поплохели надолго

Бумага Боинга сколько имеет вес в СИПИ500, подскажите плиз? Может пикирование рынков начнется с нее, ибо дела там явно поплохели надолго

читать дальше на смартлабе

alex, Boing не имеет особого веса в СП500 а вот в ДДИА огромный Market Internals update at 15:30ET

Market Internals update at 15:30ET

— NYSE volume 457M shares, 12% below its three-month average; advancers lead decliners by 1.4:1.

— NASDAQ volume 1.68B shares, 7% below its three-month average; advancers lead decliners by 1.1:1.

— VIX index -3% at 13.90 Через 20 минут — BREXIT vote. Может двинуть рынок, а может нет.

Через 20 минут — BREXIT vote. Может двинуть рынок, а может нет.

Смотреть здесь — youtu.be/4uSudx85Mis

Market Internals update at 12:00ET

Market Internals update at 12:00ET

— NYSE volume 269M shares, 6% below its three-month average; advancers lead decliners by 3.3:1.

— NASDAQ volume 899M shares, 8% below its three-month average; advancers lead decliners by 2.8:1.

— VIX index -9% at 14.60 Биржа - CME вводит микро контракты на S&P500, Nasdaq, RUSSEL 2000 и DJIA.

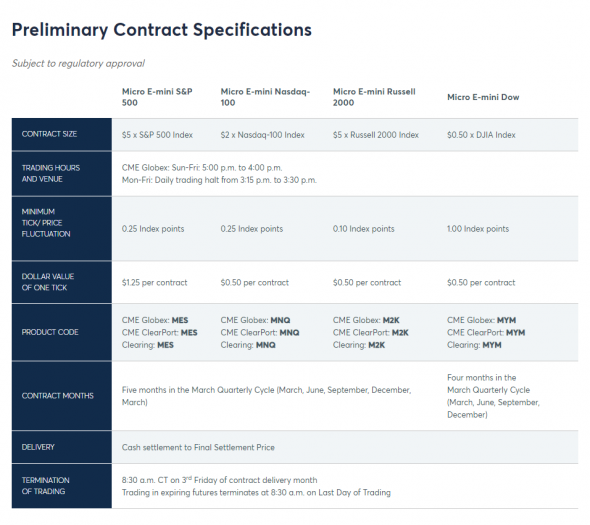

Биржа - CME вводит микро контракты на S&P500, Nasdaq, RUSSEL 2000 и DJIA.

CME вводит микро контракты на S&P500, Nastaq, RUSSEL 2000 и DJIA.

Подробнее читайте на сайте биржи: https://www.cmegroup.com/cme-group-futures-exchange/micro-futures.html

читать дальше на смартлабе

Market Close Summary: Stocks regain some losses

Market Close Summary: Stocks regain some losses

Today Summary:

US stocks ended the day off their lows, but saw a sharp drop from opening levels as the glow from the news of a potential trade deal between the US and China wore off. Most sectors ended in the red, with healthcare lagging and materials over performing. The Dollar firmed up, led by gains against the Euro, while rates weakened amid the market selloff as the 2/10-year spread narrowed slightly. Gold prices continued to retreat, falling nearly another 1%. WTI crude ended the session higher, helped by jawboning from Russia Energy Minister Novak.

Markets:

— Dow Jones -0.8%

— S&P500 -0.4%

— Nasdaq -0.2%

— Russell 2000 -0.9%

читать дальше на смартлабе (US) Treasury Sec Mnuchin: implements 'extraordinary measures' to pay US debts; urges Congress to increase debt limit as soon as possible!

(US) Treasury Sec Mnuchin: implements 'extraordinary measures' to pay US debts; urges Congress to increase debt limit as soon as possible!