Америка сегодня. Рынки труда и недвижимости

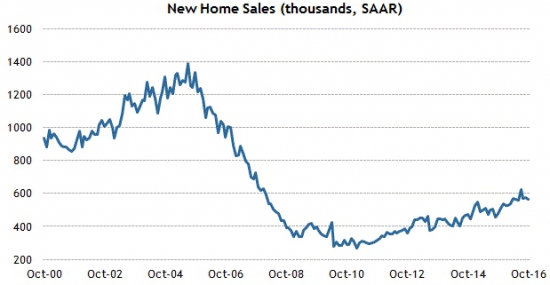

В годовом измерении рынок недвижимости США находится в восстанавливающемся тренде с 2010-го года:

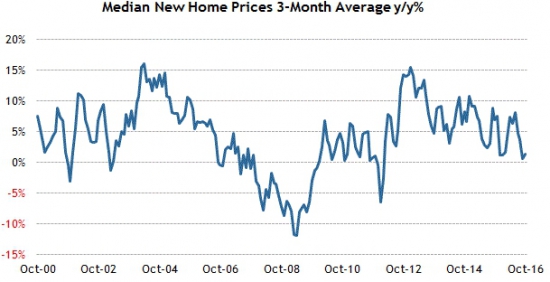

При этом последние два с половиной года наблюдается динамика в сокращении роста цен на новые дома. Произошла почти полная остановка этого показателя и он находится около нулевой психологической отметки:

Пробитие нулевой отметки будет сигнализировать, что конкуренция среди строителей значительно увеличена и они начинают бороться за покупателя серьёзно уступая в цене, это говорит о перенасыщении рынка и ближайшие месяцы возможен значительный спад и пессимизм. Аналитики по рынку недвижимости настроены разносторонне, показатели ожидаются в диапазоне 2% от предыдущих значений:

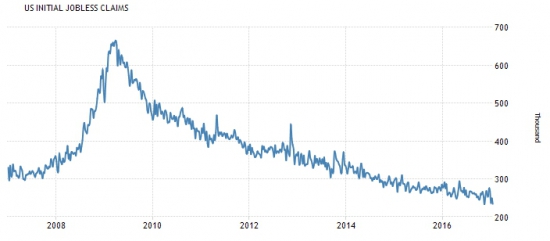

Еженедельный индикатор заявок на пособия демонстрирует оптимизм, его значения снова упали к 43-хлетним минимумам:

Новое значение ожидается на отметке 242 тысячи, аналитики осторожны в своих оценках, ожидаемое значение немного выше предыдущего:

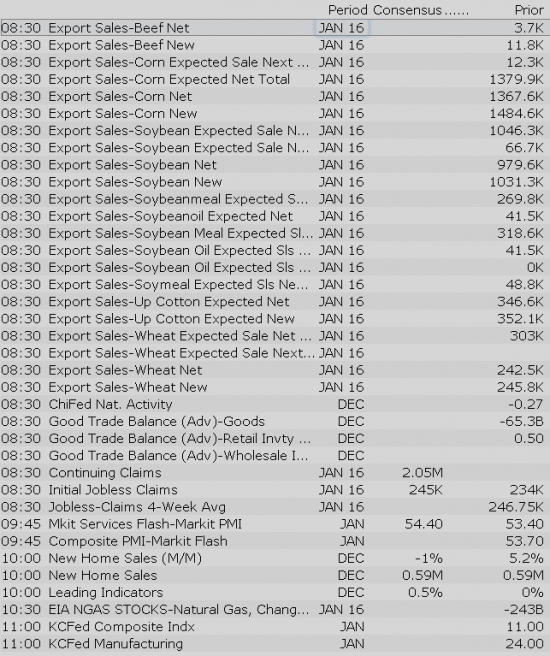

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

Equity indices in the Asia-Pacific region ended Thursday on a broadly higher note with Japan's Nikkei (+1.8%) leading the way. Etsuro Honda, who advises Japan's Prime Minister Shinzo Abe, said that it may make sense to compile an extra budget of JPY5 trillion. Mr. Honda also said the dollar/yen pair may climb above 120 this year.

---Equity Markets---

---FX---

AT&T shares are down ~0.3% pre-market in reaction to earnings.

Major European indices trade in the green, but gains have been limited for the most part. In Italy, the Constitutional Court amended a run-off rule in the country's electoral law for the lower house. The old rule called for a second vote in the event no party secures more than 40.0% of the vote. Seats will now be appointed proportionally to the percentage of vote received by each party. The ruling could lead to early elections.

---Equity Markets---

Gapping down: DRWI -19%, MAT -11.1%, ENTL -10.4%, QTM -8.6%, CMPR -8.3%, MCK -5.9%, VAR -5.9%, AGI -5.6%, HMY -5.2%, FFIV -5.2%, CSII -5.2%, POT -5.2%, EURN -4.9%, LVS -4.7%, EFII -4.6%, UN -4.4%, CTXS -4.1%, HIMX -3.9%, ABC -3.3%, WHR -3.3%, HAS -3.2%, KGC -3%, QCOM -3%, KNX -2.9%, GFI -2.6%, ABX -2.5%, AU -2.3%, SSRI -2.3%, GOLD -2.3%, SLW -2.2%, AUY -2.2%, BMY -2.2%, LRCX -2.1%, MUR -2.1%, GDX -1.9%, GDX -1.8%, LYTS -1.8%, NEM -1.7%, RTN -1.7%, LANC -1.6%, MPEL -1.5%, BHP -1.4%, RIO -1.2%, BBL -1.2%, CMO -1.2%, NUTR -1.2%, MGM -1.1%, SLV -1%

Upgrades:

Downgrades:

Miscellaneous:

Treasuries Slip as Bonds of Eurozone Periphery Fall Sharply

Upcoming IPOs:

The major averages finished at record highs on Wednesday, with the Dow officially taking out the 20,000 mark. The tone remains positive this morning, with gains in Europe and Asia following yesterday's U.S. strength. The S&P 500 futures are currently flat, trading one point below fair value.

Crude oil spent the overnight session in positive territory and is currently up 0.6% at $53.10/bbl. The gains have come despite a 0.3% uptick in the U.S. Dollar Index (100.21, +0.30), which currently hovers near its overnight high.

Conversely, U.S. Treasuries are down for the second day in a row, pushing further into negative territory for the week. The benchmark 10-yr yield is up three basis points at 2.54%.

Today's economic data will include Advance International Trade in Goods (Briefing.com consensus -$65.0 million) and Initial Claims (Briefing.com consensus 246,000) at 8:30 am ET, while Leading Indicators (Briefing.com consensus 0.5%) and New Home Sales (Briefing.com consensus 589,000) will cross the wires at 10:00 am ET.

In U.S. corporate news:

Reviewing overnight developments:

The S&P 500 futures trade two points (0.1%) below fair value.

The latest weekly initial jobless claims count totaled 259,000 while the Briefing.com consensus expected a reading of 246,000. Today's tally was above the revised prior week count of 237,000 (from 234,000). As for continuing claims, they rose to 2.100 million from the revised count of 2.059 million (from 2.046 million).

December International Trade in Goods decreased by $65.00 billion on the back of a unrevised $65.30 billion decline in November.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Eurozone Yields Jump

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select LVS peers showing weakness:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select LVS peers showing weakness:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Investors have displayed caution this morning after the major indices closed at record highs yesterday. The S&P 500 futures are relatively flat, trading one point below fair value.

Earnings have been this morning's central focus as many large-cap names have reported between yesterday's close and this morning's opening bell. The results have been generally negative with Celgene (CELG 113.48, -0.50), Caterpillar (CAT 97.14, -1.01), Bristol-Myers Squibb (BMY 48.52, -1.03), Ford Motor (F 12.74, -0.05), and Raytheon (RTN 140.36, -6.51) all trading lower in pre-market action.

Treasuries remain in negative territory, but have come up in recent action amid this morning's earnings reports. The benchmark 10-yr yield is two basis points higher at 2.53%.

On the data front, the latest weekly initial jobless claims count totaled 259,000 while the Briefing.com consensus expected a reading of 246,000. Today's tally was above the revised prior week count of 237,000 (from 234,000). Continuing claims rose to 2.100 million from the revised count of 2.059 million (from 2.046 million).

Separately, December International Trade in Goods decreased by $65.00 billion on the back of a unrevised $65.30 billion decline in November.

Today's remaining economic reports, December Leading Indicators (Briefing.com consensus 0.5%) and December New Home Sales (Briefing.com consensus 589,000), will both cross the wires at 10:00 am ET.

Markets are holding on to yesterday's gains. The biggest push for the most recent leg is coming from two sources: 1) Tech company earnings have generally been impressive allowing FANG to be a leader once again and 2) Asian economic data has shown that the region is performing well. Not a surprise given the tech influence in the region as both data points are supportive of each other.

There were a few items of interest on the macro front overnight. One macro play I am watching here is the euro which is giving up some of its recent gains. I have seen a few headlines from the Eurogroup meeting that have members down playing inflation readings in the region. I am not seeing any news from the Weidmann speech this morning that would dispute these claims. I still think the euro will be pressured higher on prices.

The first look at the United Kingdom GDP beat expectations as the country continues to outperform the post-Brexit expectations. We still need to see how business sentiment reacts as we get closer to an actual physical Brexit. But so far the country is showing signs of proving the gloom and doom Academics were wrong. Again, this is far too early to call a win. We need to see how the economy reacts when the actual Brexit nears and trade deals are re-done. But it is important if the UK shows success given the elections that are on tap for the EU this year.

China continues to tighten capital flow controls as it has ordered its banks to cut back on loans. This is in line with comments made in November that it expected to tighten credit conditions in 2017.

With regards to this comment, I am changing the process to reflect a chronological approach rather than a regional. The assumption here is that it will be a better reflection in terms of the ebb and flow of market action in the overnight session. I am looking for ways to make this data more actionable so if there is any thoughts, please feel free to write in to feedback.

Overnight Macro News:

Equity indices opened Thursday's session relatively flat as investors display caution after the major averages posted record highs on Wednesday. The Nasdaq shows relative strength with a 0.2% gain.

Cyclical sectors are the early leaders as all six post modest gains out of the gate. Conversely, on the non-cyclical side, four of the five sectors are lower, with real estate (+0.4%) showing relative strength.

U.S. Treasuries opened Thursday lower, increasing their losses for the week. The benchmark 10-yr yield is currently up two basis points at 2.53%.

The tech sector — XLK — trades behind the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -0.20%. Within the SOX index, TER (+3.97%) outperforms, while CAVM (-0.78%) lags. Among other major indices, the SPY is trading 0.01% higher, while the QQQ +0.15% and the NASDAQ +0.28% trade modestly higher on the session. Among tech bellwethers, FB (+0.58%) is showing relative strength, while AMX (-1.78%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Scheduled to report earnings after the bell:

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 1.08… VIX: (10.97, +0.16, +1.5%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Guidance:

Metrics:

Analyst Notes

Options Activity

Technical Perspective

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Gainers on news:

- Avinger (AVGR +32.39%) announces positive two-year clinical data from the pivotal VISION study of the company's Lumivascular technology

- MGC Diagnostics (MGCD +14.21%) declares a a special cash dividend of $0.70/share and initiates a strategic review of its businesses and assets

Decliners on news:- Entellus Medical (ENTL -14.75%) prices 3.53 mln shares of common stock at $17.00 per share

Gainers on earnings:- Biogen (BIIB +3.65%) beats by $0.08, misses on revs; guides FY17 EPS in-line, revs below consensus

- Quest Diagnostics (DGX +2.24%) beats by $0.04, reports revs in-line; guides FY17 EPS in-line, revs above consensus

- NeuroMetrix (NURO +0.71%) reports Q4 results; rev +36% y/y to $3.7 mln

Decliners on earnings:- McKesson (MCK -7.72%) misses by $0.04, reports revs in-line; guides FY17 EPS above consensus

- Varian Medical (VAR -6.19%) beats by $0.03, reports revs in-line; guides Q2 EPS below consensus

- Abiomed (ABMD -4.07%) beats by $0.04, reports revs in-line; guides FY17 revs in-line

Upgrades/Downgrades:Treasury Auction Preview

Rumor Activity was active today.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

Biggest point losers: WHR 175.43(-14.77), CMPR 86.1(-12.07), FFIV 134.13(-11.63), WRLD 49.2(-11.25), MCK 139.86(-11.24), BLK 380.86(-7.47), ADS 220.39(-6.87), CTXS 89.56(-6.18), CLB 118.47(-5.72), VAR 86.73(-5.69), HAS 81.37(-5.39), NOC 226.11(-4.73), MAT 26.84(-4.72), ETH 29(-4.7), TROW 69.9(-4.28), ABMD 110.55(-4.27), RTN 142.8(-4.07), HP 77.06(-4.05), DISH 58.22(-4.01), LVS 52.92(-3.73), ISRG 696.4(-3.6), AGU 106.5(-3.09), QCOM 53.85(-3.05), REGN 346.07(-2.87), CMCO 25.77(-2.86)

Stocks that traded to 52 week lows: BMY, CERS, DRYS, EYES, FCEL, GBSN, GEVO, HGG, ICLD, ITEK, MFIN, NK, PGLC, PSGLQ, RGSE, SQQQ, SSI, STKS, TRIL, TUES, VMEMQ, XON

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: EDUC, EVGN, NHA

ETFs that traded to 52 week highs: AMJ, DIA, EEB, EWJ, FDN, IAI, IGV, ITB, IWF, IYF, IYJ, IYM, JNK, KIE, KRE, MDY, OEF, QQQ, REMX, SKYY, SMH, SPY, UYG, UYM, VTI, XLB, XLI, XLK, XLY

ETFs that traded to 52 week lows: SMN

Today's top 20 % gainers

- Healthcare: AVXS (56.87 +8.28%), QSII (14.77 +7.19%), TSRO (149.25 +6.61%)

- Materials: SHW (306.94 +8.3%), PKX (58.67 +8.29%)

- Industrials: URI (128.33 +12.31%), LUV (52.62 +6.39%), EGLE (7.16 +6.18%), HRI (48.5 +6.17%)

- Consumer Discretionary: LBRDK (87.49 +9.1%), LBRDA (85.92 +8.87%), CHTR (333.75 +7.55%), RCL (94 +7.21%)

- Information Technology: MGI (13.02 +9.6%), EBAY (32.12 +6.25%), STM (12.93 +6.16%)

- Financials: TCBI (84.6 +6.95%)

- Energy: EMES (18.38 +7.36%), SM (34.34 +6.51%)

- Consumer Staples: SPB (132.71 +7.95%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: BMY (13.71 mln -2.56%)

- Materials: AKS (19.28 mln -2.85%), FCX (16.74 mln -2.79%), ABX (11.48 mln -1.44%), X (10.56 mln +3.27%)

- Industrials: JBLU (10.51 mln -2.2%)

- Consumer Discretionary: F (27.4 mln -2.85%), MAT (16.81 mln -15%), CMCSA (14.16 mln +2.33%)

- Information Technology: AMD (18.86 mln +1.78%), QCOM (18.44 mln -5.41%), EBAY (17.71 mln +6.25%), INTC (11.86 mln -0.93%), MSFT (10.66 mln +0.35%)

- Financials: BAC (38.78 mln +0.17%), WFC (10.21 mln +0.67%)

- Energy: CHK (14.76 mln +0.7%)

- Consumer Staples: RAD (17.18 mln +2.97%)

- Telecommunication Services: VZ (20.37 mln -0.87%), T (12 mln +0.28%)

Today's top relative volume (current volume to 1-month average daily volume)The broader market is split at the moment, with the Dow Jones Industrial Average the sole gainer, adding 40 points (+0.20%) to 20107, the S&P 500 is down less than a point (-0.03%) to 2297, and the Nasdaq Composite also sheds less than a point (-0.01%) to 5655. Action has come on mixed average volume (NYSE 330 vs. avg. of 337; NASDAQ 817 mln vs. avg. of 793), with decliners outpacing advancers (NYSE 1344/1628, NASDAQ 1060/1691) and new highs outpacing new lows (NYSE 238/5, NASDAQ 187/14).

Relative Strength:

US Nat Gas-UNG +3.7%, US Oil-USO +2.2%, US Gasoline-UGA +1.4%, Short-Term Futures-VXX +1.3%, Sugar-SGG +1.2%, US Diesel/Heating Oil-UHN +1.0%, Rare Earth Metals-REMX +1.0%, Egypt-EGPT +0.7%, Emrg. Mkts. M. East&Africa-GAF +0.7%, Japan-EWJ +0.4%, China Lg.-Cap-FXI +0.3%, Chinese Yuan-CYB +0.3%, Sweden-EWD +0.3%, Hong Kong-EWH +0.3%.

Relative Weakness:

Silver Miners-SIL -4.0%, Mexico-EWW -2.6%, Cocoa-NIB -2.6%, Gold Miners-GDX -2.5%, Jr. Gold Miners-GDXJ -2.4%, Copper Miners-COPX -2.3%, Copper-JJC -1.7%, Coffee-JO -1.7%, Italy-EWI -1.6%, Peru-EPU -1.4%, Philippines-EPHE -1.3%, Japanese Yen-FXY -1.2%, Latin Am. 40-ILF -1.2%, Spain-EWP -1.1%.

The Industrials sector (XLI) is trading -0.2% today, higher than the broader market (SPY -0.2%). In the Industrial sector big names like Caterpillar (CAT -1%) and Raytheon (RTN -3.6%) shares fall after earnings misses and General Dynamics receives a $116 mln US Air Force contract modification.

Earnings/Guidance

Additional Industrials reporting earnings/guidance: BHI -0.7% DOV -1.9% LLL +2.6% URI +12.4% JBLU -3.6% OSK -0.9% HXL -0.5% WCC -1.3% DLX -2.3% KNX -4.5% AIT -0.3% EURN -3.1% BGG -2.9% RGS -1.5% CMCO -5.6% CVTI +3.1% LYTS +7.7%

News

Broker Research

Upgrades

Downgrades

Other

The stock market has been hit with news on all fronts--corporate, economic, and political--but it has snubbed it all as the major averages have clung to their flat lines through the first half of today's session.

On the corporate front, the earnings season is alive and well with a cluster of large-cap names reporting between yesterday's close and this morning's open. The results were technically mixed, but leaned towards negative as investors reacted cautiously to reports from Celgene (CELG 112.80, -1.18), Bristol-Myers Squibb (BMY 47.31, -2.25), Qualcomm (QCOM 53.68, -3.21), Ford Motor (F 12.35, -0.43), and Raytheon (RTN 141.65, -5.22). Only one Dow component reported this morning, Caterpillar (CAT 98.31, +0.16), showing mixed results. The company is down 1.0% as disappointing revenue overshadowed better than expected earnings per share.

However, the reactions weren't all bad, and a handful of companies are up after reporting quarterly earnings, including Comcast (CMCSA 75.08, +1.62), Dow Chemical (DOW 61.00, +0.81), Biogen (BIIB 280.30, +7.06), and eBay (EBAY 31.63, +1.41). The four names all show gains between 1.5% and 5.3%.

On the political front, Mexican President Enrique Pena Nieto officially canceled his upcoming meeting with President Trump after the U.S. President tweeted «if Mexico is unwilling to pay for the badly needed wall, then it would be better to cancel the upcoming meeting», this morning. Only time will tell if Mr. Trump's relations with foreign leaders will be as friendly to the stock market as his domestically focused, pro-growth agenda has been.

Sector standings have lacked leadership thus far, with all spaces posting gains/losses between -0.4% and +0.4%. At the top of the leaderboard is consumer discretionary (+0.4%), riding on Comcast's upbeat earnings report, while telecom services (-0.4%) sit at the bottom despite AT&T (T 41.54, +0.13) reporting in-line earnings this morning.

Treasuries have returned to their flat lines after spending the morning session in negative territory. The 10-yr yield is near its overnight low, up one basis point at 2.53%.

Today's economic data included Initial Claims, International Trade in Goods, New Home Sales, and Leading Indicators:

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Most homebuilder names are higher following PulteGroup (PHM +5%) earnings: BZH +2.6%, KBH +1.4%, CAA +1.3%, MHO +1%, TMHC +0.9%, TPH +0.9%, MTH +0.8%, HOV +0.4%, ITB +0.5%, LGIH +0.4%

- Cruise lines are getting boost from RCL earnings. CCL +1.9%, CUK +2.1%, NCLH +2.5%

- Casino/gaming names are lower on the heels of disappointing Las Vegas Sands (LVS -7.5%) earnings report (BJK -0.8%): IGT -4% (downgraded to Hold from Buy at Jefferies), MPEL -2.4%, CNTY -1.8%, PENN -1.7%, WBAI -1.4%, ISLE -1.4%, MGM -0.9%, BYD -0.9%, UWN -0.8%, WYNN -0.6%, PNK -0.5%

- Hasbro (HAS -7%) under pressure following Mattel earnings; was also downgraded to Neutral at Monness Crespi & Hardt.

- Furniture/home goods retail names are lower following Ethan Allen (ETH -14%) earnings/guidance: PIR -4.1%, RH -4%, KIRK -3.5%, WSM -1.5%, TCS -1%

- Conn's (CONN -3.2%) is lower in sympathy with HHGregg (HGG -16%)

In the news:Looking ahead:

Treasury Auction Results

— The dollar index was +0.4% around the 100.46 level.

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.78… VIX: (10.99, +0.18, +1.7%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Alphabet (GOOG, GOOGL) is set to report Q4 results tonight after the close with a conference call to follow at 4:30pm ET. GOOGL (we will use the voting right Class A shares here) usually reports results right after the bell. Capital IQ consensus stands at EPS of $9.62 on Revenues of $25.14 bln. GOOGL does not guide and releases results on its web site.

Shares of GOOGL are trading near all time highs as we approach the Q4 results. The stock kicked off the start of the week by breaking above the previous high of $838 which was set two days ahead of its Q3 earnings report. The stock got as high as $861 in early trade before seeing some profit taking ahead of the report. Recall the stock saw a similar reaction ahead of its Q3 news. Shares did see a nice jump in immediate reaction, rallying from $814 to $839. But it would fail to hold gains and would eventually slide to the $743 area in the weeks to follow. But GOOGL held its 200-sma and has ran over 100 points over the past two months.

GOOGL has been at the forefront of the growth in digital advertising (along with FB). With digital advertising expected to supplant TV as the top advertising destination market participants will have high expectations for the company despite a difficult set of comparables for 2017. GOOGL has seen its growth pick up as it is finally benefiting from its YouTube acquisition. It still benefits from its Android-driven ad business in mobile which is flourishing. Investors would like to see Alphabet continue to dominate in these areas. But a stream of revenue from other areas, particularly cloud, could help bolster expectations of growth continuing.

Key Metrics/Topics

Q3 Recap