20 мая 2013, 16:52

Аналитика на 20 мая

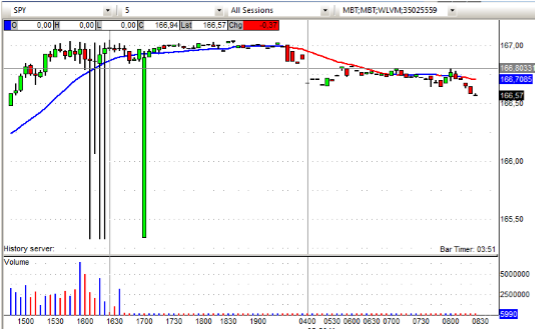

Спайдер незначительно снижается открытием торгов на NYSE.

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: QIHU +6.8%, JASO +5.5%, CPB +1.0 (ticking higher) .

M&A news: AQ +110.6% (Accenture announces acquisition of Acuity Group for $13.00 per outstanding ADS ), MEAD +97.6% (to be acquired by Jinghua Optics & Electronics for $3.45 per share), WBSN +30% (halted, Websense confirms it will be acquired by Vista Equity Partners for $24.75 per share in cash in transaction valued at approximately $1 billion), PACT +29.3% (announces receipt of 'going private' proposal at $7.50 per ADS), WCRX +3.1% and ACT +2.5% (Warner Chilcott to be acquired by Actavis in a stock-for-stock transaction valued at ~ $8.5 bln; WCRX shareholders will receive 0.160 shares of New ACT for each WCRX share, which equates to $20.08 per share).

Select solar stocks trading higher: RSOL +12.5% (continues strength), SCTY +5.3%, LDK +5.3%, SPWR +2.5%.

Other news: PXP +5.4% (to declare special $3.00/share dividend), DANG +5.1% (still checking), SNE +3.2% (story suggests potential upside break-up scenario), YHOO +2.9% (confirms acquisition of social networking site Tumblr), IQNT +2.4% (announces intention to declare special cash dividend of $1.25 per share and to initiate a quarterly dividend of $0.0625 per share of its common stock), GE +2.2% (GE Capital Board Plans to Pay $6.5 billion of Dividends to its Parent GE in 2013), MTOR +2.1% ( announces extension of the early tender date with respect to its cash tender offer and consent solicitation for any and all of its 8-1/8% notes due 2015), FCX +0.7% ( Announces Intention to Declare $1.00 per Share Supplemental Dividend on Closing of Plains Exploration & Production (PXP) Acquisition and Reiterates Capital Allocation Plan for Oil & Gas Business), BIDU +0.3% (may consider IPO for its video site, according to reports, CSCO +0.2% (positive Barrons mention).

Analyst comments: TMUS +2.6% (upgraded to Buy from Hold at Deutsche Bank), ABT +2.2% (upgraded to Buy from Neutral at Goldman), JCP +1.8% (upgraded to Buy from Hold at Maxim), P +1.5% (upgraded to Equal Weight from Underweight at Barclays), PCLN +0.8% (upgraded to Buy from Hold at Deutsche Bank)

Gapping down:

In reaction to disappointing earnings/guidance: QLGC -1.9% (QLogic President and CEO resigns to pursue other opportunitites; co reaffirms Q1 guidance).

Select financial related names showing weakness: NBG -12.6%, SNV -2.1% (downgraded to Sell from Neutral at Goldman), HIG -2.1%, PUK -1.5%, SAN -1.1%, MTU -1.0%, LYG -1.0%, BCS -0.8%.

Metals/mining stocks trading lower: GFI -5.3%, AU -4.8%, SLV -2%, HMY -1.6%, GDX -1.3%, SLW -1.2%, GOLD -1.1% (enters into a $200 mln unsecured revolving credit facility with HSBC and three other banks, maturing in May 2016), NEM -0.8%, RIO -0.7%, GLD -0.3%.

Other news: XNPT -28.9% (reports top-line results of Phase 3 trial of arbaclofen placarbil for spasticity in multiple sclerosis patients; trial was unsuccessful in demonstrating that AP provided statistically significant improvement relative

Торговые идеи NYSEи NASDAQ:

QIHU– лонг выше 45.00

PXP– шорт ниже 48.00

Оригинал статьи:http://shark-traders.com/blog/analitika-na-20-maya/

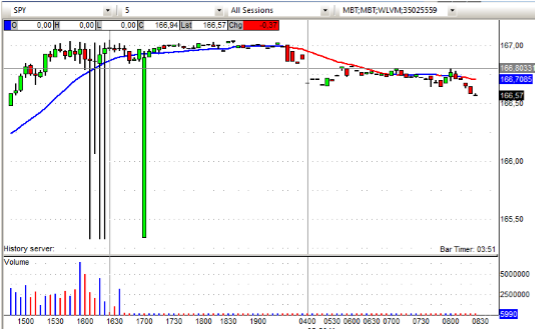

- Европейские индексы изменяются разнонаправленно.

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: QIHU +6.8%, JASO +5.5%, CPB +1.0 (ticking higher) .

M&A news: AQ +110.6% (Accenture announces acquisition of Acuity Group for $13.00 per outstanding ADS ), MEAD +97.6% (to be acquired by Jinghua Optics & Electronics for $3.45 per share), WBSN +30% (halted, Websense confirms it will be acquired by Vista Equity Partners for $24.75 per share in cash in transaction valued at approximately $1 billion), PACT +29.3% (announces receipt of 'going private' proposal at $7.50 per ADS), WCRX +3.1% and ACT +2.5% (Warner Chilcott to be acquired by Actavis in a stock-for-stock transaction valued at ~ $8.5 bln; WCRX shareholders will receive 0.160 shares of New ACT for each WCRX share, which equates to $20.08 per share).

Select solar stocks trading higher: RSOL +12.5% (continues strength), SCTY +5.3%, LDK +5.3%, SPWR +2.5%.

Other news: PXP +5.4% (to declare special $3.00/share dividend), DANG +5.1% (still checking), SNE +3.2% (story suggests potential upside break-up scenario), YHOO +2.9% (confirms acquisition of social networking site Tumblr), IQNT +2.4% (announces intention to declare special cash dividend of $1.25 per share and to initiate a quarterly dividend of $0.0625 per share of its common stock), GE +2.2% (GE Capital Board Plans to Pay $6.5 billion of Dividends to its Parent GE in 2013), MTOR +2.1% ( announces extension of the early tender date with respect to its cash tender offer and consent solicitation for any and all of its 8-1/8% notes due 2015), FCX +0.7% ( Announces Intention to Declare $1.00 per Share Supplemental Dividend on Closing of Plains Exploration & Production (PXP) Acquisition and Reiterates Capital Allocation Plan for Oil & Gas Business), BIDU +0.3% (may consider IPO for its video site, according to reports, CSCO +0.2% (positive Barrons mention).

Analyst comments: TMUS +2.6% (upgraded to Buy from Hold at Deutsche Bank), ABT +2.2% (upgraded to Buy from Neutral at Goldman), JCP +1.8% (upgraded to Buy from Hold at Maxim), P +1.5% (upgraded to Equal Weight from Underweight at Barclays), PCLN +0.8% (upgraded to Buy from Hold at Deutsche Bank)

Gapping down:

In reaction to disappointing earnings/guidance: QLGC -1.9% (QLogic President and CEO resigns to pursue other opportunitites; co reaffirms Q1 guidance).

Select financial related names showing weakness: NBG -12.6%, SNV -2.1% (downgraded to Sell from Neutral at Goldman), HIG -2.1%, PUK -1.5%, SAN -1.1%, MTU -1.0%, LYG -1.0%, BCS -0.8%.

Metals/mining stocks trading lower: GFI -5.3%, AU -4.8%, SLV -2%, HMY -1.6%, GDX -1.3%, SLW -1.2%, GOLD -1.1% (enters into a $200 mln unsecured revolving credit facility with HSBC and three other banks, maturing in May 2016), NEM -0.8%, RIO -0.7%, GLD -0.3%.

Other news: XNPT -28.9% (reports top-line results of Phase 3 trial of arbaclofen placarbil for spasticity in multiple sclerosis patients; trial was unsuccessful in demonstrating that AP provided statistically significant improvement relative

Торговые идеи NYSEи NASDAQ:

QIHU– лонг выше 45.00

PXP– шорт ниже 48.00

Оригинал статьи:http://shark-traders.com/blog/analitika-na-20-maya/

1 Комментарий

Читайте на SMART-LAB:

Как отыграть решение по ключевой ставке с помощью опционов

В ближайшую пятницу пройдет заседание Банка России по ключевой ставке. В случае продолжения смягчения монетарных условий рынок акций может отреагировать ростом на фоне сдержанного консенсуса....

10:12

Рост продаж более чем в 5 раз и сокращение чистого долга на 2,1 млрд рублей – операционные результаты ПАО «АПРИ» за январь 2026 года

Рост продаж более чем в 5 раз и сокращение чистого долга на 2,1 млрд рублей – операционные результаты ПАО «АПРИ» за январь 2026 года

Объём продаж в январе 2026 года вырос в 5,4 раза...

09:59

Вторичный рынок золота в России растет

РБК опубликовал материал о том, как рекордные цены на золото запустили рост внутреннего вторичного оборота драгметалла в России. 📊 По информации Федеральной пробирной палаты, объём...

10:01

РУСАГРО: выкупить акции и спасти Мошковича - могут ли акции вырасти на 100% от текущих ценах, подробный разбор

Начинаем покрытие компании РУСАГРО этим постом, надеюсь удастся под микроскопом разглядеть инвестиционную привлекательность или хотя бы сделать пост полезным/интересным. Пост будет длинным,...

09.02.2026