SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Данные по рынку труда

- 06 января 2017, 15:58

- |

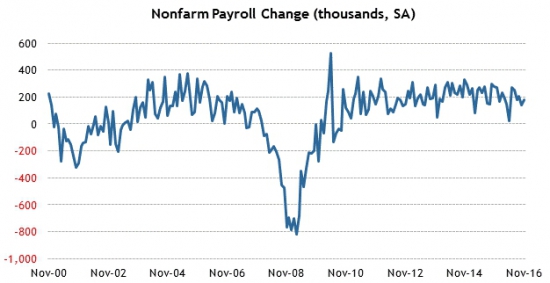

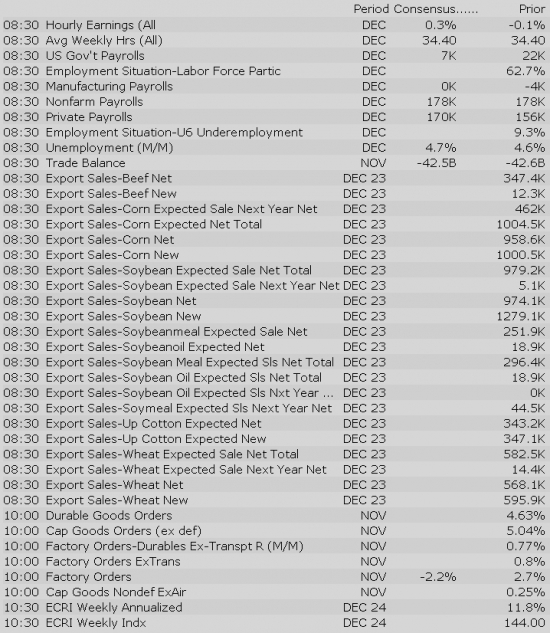

Сегодня основной новостной день недели. Блок новостей на открытии рынка ожидается ядерный. Основной показатель занятости в несельскохозяйственном секторе ожидают выше своего предыдущего значения 175 тысяч:

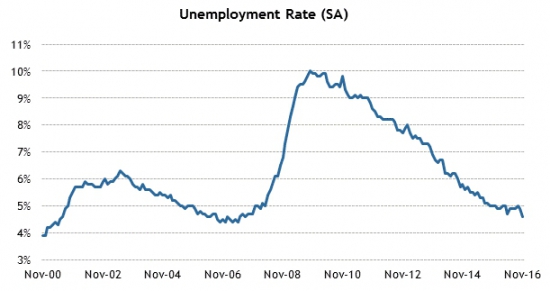

Уровень безработицы стремительно продолжает стремиться к своим 20-летним минимумам. Однако в данных за декабрь ожидают его небольшой рост на десятую долю до 4.7%:

Рост почасовой оплаты труда также ожидает рост после неожиданного падения в прошлом месяце ниже нулевой отметки. Сегодняшний показатель прогнозируют на уровне 0.3%:

Вялый индикатор средней продолжительности рабочей недели ожидается без особых изменений на уровне 34.4 часа:

Все новости:

Данные: Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market updates:

Markets in the Asia-Pacific region ended the week on a mixed note. Overnight dollar strength helped the greenback erase roughly a third of yesterday's decline against the yen (116.00). The dollar also climbed against the Chinese yuan (6.9186), retracing the bulk of yesterday's move lower. The People's Bank of China advisor Huang Yiping said that there is little fundamental reasoning behind the prolonged slide in the yuan.

---Equity Markets---

---FX---

The employment picture is one of the most important guides for the Federal Reserve in setting its monetary policy. That understanding is just one reason why the Employment Situation Report for December will be the market's focal point on Friday.

The report will be released at 08:30 a.m. ET.

Major European indices trade near their flat lines while Italy's MIB (-0.5%) underperforms. In France, a presidential poll conducted by Les Echos pointed to expectations of a tight three-way race between Emmanuel Macron, Francois Fillon, and Marine Le Pen. French citizens will head to the polls to vote for their next president on Sunday, April 23.

---Equity Markets---

Stocks with favorable mention: AAPL, AMZN, ARNC, ASIX, BOX, ECA, FB, HALO, SLB, STZ, VOD

Stocks with unfavorable mention: KSS, LB, M, SLCA, TGT, WMT