Блог им. JohnHard

Activision Blizzard Inc

- 27 марта 2019, 14:34

- |

Activision Blizzard Inc

Description:

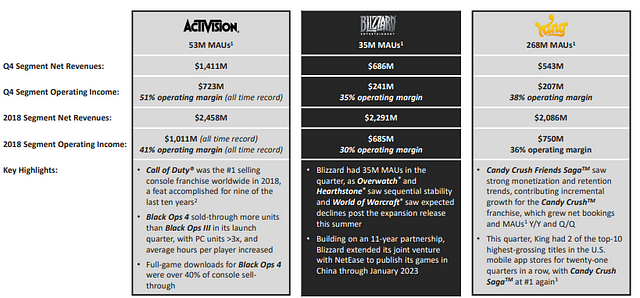

Activision Blizzard, Inc., a member of the Fortune 500 and S&P 500, is the world’s most successful standalone interactive entertainment company. We delight hundreds of millions of monthly active users around the world through franchises including Activision’s Call of Duty®, Spyro™, and Crash™, Blizzard Entertainment’s World of Warcraft®, Overwatch®, Hearthstone®, Diablo®, StarCraft®, and Heroes of the Storm®, and King’s Candy Crush™, Bubble Witch™, and Farm Heroes™. The company is one of the Fortune “100 Best Companies To Work For®.” Headquartered in Santa Monica, California, Activision Blizzard has operations throughout the world. More information about Activision Blizzard and its products can be found on the company’s website, www.activisionblizzard.com

FORM 8-K

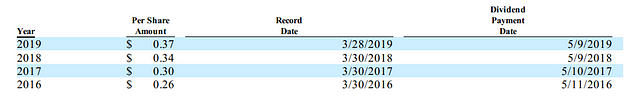

On February 12, 2019, the Company’s Board of Directors declared a cash dividend of $0.37 per share of the Company’s outstanding common stock, payable on May 9, 2019, to shareholders of record at the close of business on March 28, 2019.

On January 31, 2019, the Company’s Board of Directors authorized the Company to repurchase up to $1.5 billion of the Company’s common stock on terms and conditions to be determined by the Company from February 14, 2019 until the earlier of February 13, 2021 and a determination by the Board of Directors to discontinue the repurchase program.

In order to better capitalize on long-term growth opportunities, on February 12, 2019 Activision Blizzard, Inc.committed the Company to a Board-authorized restructuring plan under which the Company plans to refocus its resources on its largest opportunities and to remove unnecessary levels of complexity and duplication from certain parts of the business. More specifically, the Company intends to:

increase its investment in development for its largest, internally-owned franchises — across upfront releases, in-game content, mobile and geographic expansion;

reduce certain non-development and administrative-related costs across its business;

integrate its global and regional sales and “go-to-market,” partnerships, and sponsorships capabilities across the business.

Key risks:

on October 3, 2018 Michael Morhaime entered into an agreement with Activision Blizzard, Inc. pursuant to which he would provide strategic advice to the Company in an advisory capacity. Mr. Morhaime’s employment with the Company as a strategic advisor will conclude on April 7, 2019.

The Company expects to incur aggregate pre-tax restructuring charges of approximately $150 million in 2019, related to severance, including, in many cases, above legally required amounts (approximately 65% of the aggregate charge), facilities costs (approximately 20% of the aggregate charge), and asset writedowns and other costs (approximately 15% of the aggregate charge). The Company expects the majority of these charges to be incurred in the first quarter of 2019, with most of the balance expected to be incurred in the remainder of 2019. The total pre-tax charge associated with the restructuring will be almost entirely in cash and the outlays are expected to be incurred throughout 2019.

We made capital expenditures of $131 million in 2018, as compared to $155 million in 2017. In 2019, we anticipate total capital expenditures of approximately $125 million, primarily for leasehold improvements, computer hardware, and software purchases.

In 2019, we expect to have a lighter slate of full game releases than in 2018. We plan to release our latest Call of Duty game in the second half of 2019, along with Sekiro: Shadows Die Twice and Crash Team Racing Nitro-Fueled in the first half of 2019. In addition, we expect to deliver ongoing content for our various franchises, including continued in-game content for Call of Duty: Black Ops 4, expansion packs for Hearthstone, and in-game events for Overwatch. Overall, we expect lower revenues and earnings per share in 2019 as compared to 2018.

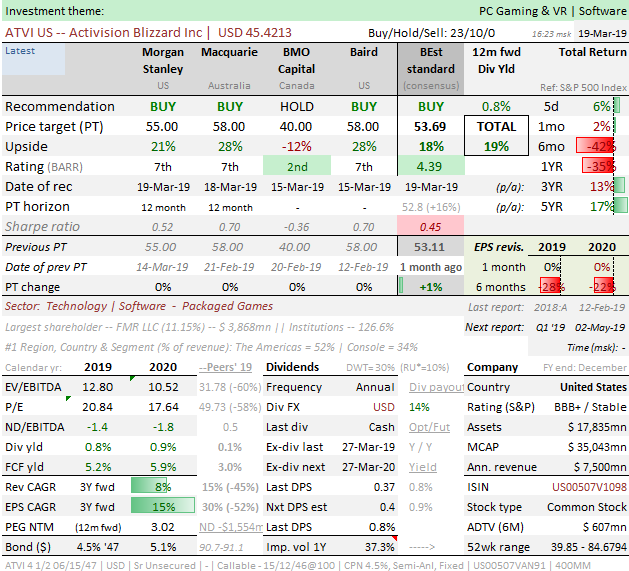

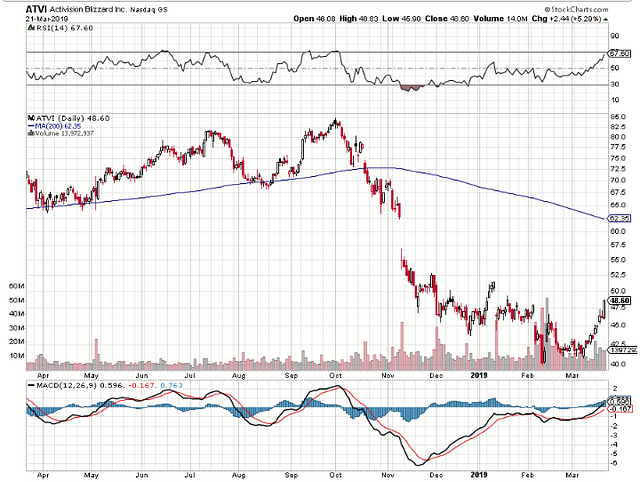

Price$46.20, Target price 57,10 -56,80, Upside 20–30%

Time range 3–6 month

теги блога Юрий Ломов

- Activision Blizzard

- analytics

- BCH

- bchusd

- bitcoin

- Br

- brent

- btc

- BTCUSD

- EOS

- EOSUSD

- ETF

- eth

- ethereum

- etherium

- ETHUSD

- eur

- EUR USD

- gaz

- Gold

- Inc

- IPO

- JD.com

- news

- or group (обувь россии)

- Ri

- RIM

- ripple

- Ripple Криптовалюта

- SB

- Sber

- si

- spacex

- SPCE

- STELLAR

- stock

- Virgin

- Virgin Galactic

- Vodafone

- XRP

- XRPUSD

- акции

- акции РФ

- АФК Система облигации

- биржа

- бюджет 2013

- бюджет 2016

- идея

- израиль

- ИПО

- КАНАДА

- Китай

- криптовалюта

- мир

- ММВБ

- мнение по рынку

- МосБиржа

- мысли

- мысли в слух

- Новости

- новости рынков

- новость

- облгации

- Облигации

- Обувь России

- опционы

- прогноз по акциям

- ртс

- руб доллар

- рубль

- рф

- санкии против России

- сбер

- сбербанк

- система

- ставка

- статистика

- США

- ТМК

- торговые роботы

- торговые сигналы

- трейдинг

- фьюерс ртс

- ЦБ

https://chrome.google.com/webstore/detail/google-translate/aapbdbdomjkkjkaonfhkkikfgjllcleb?hl=ru

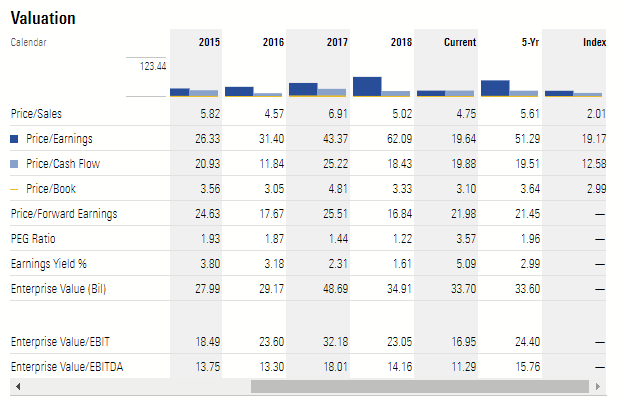

P/E = 62.

Danu naher luchshe brat' Danaher!