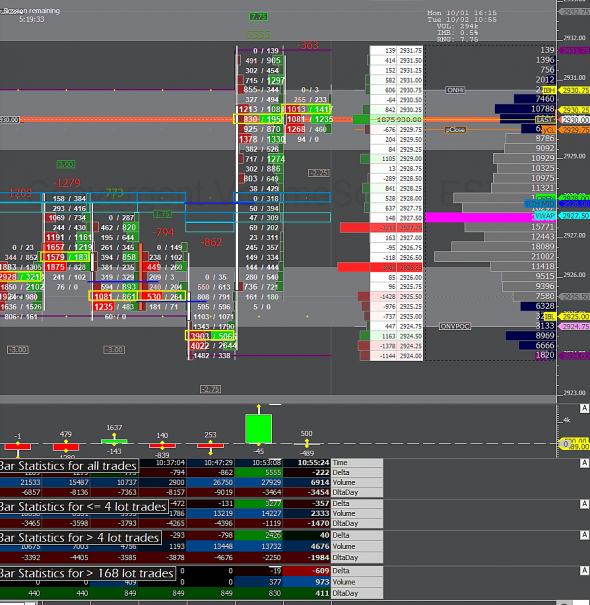

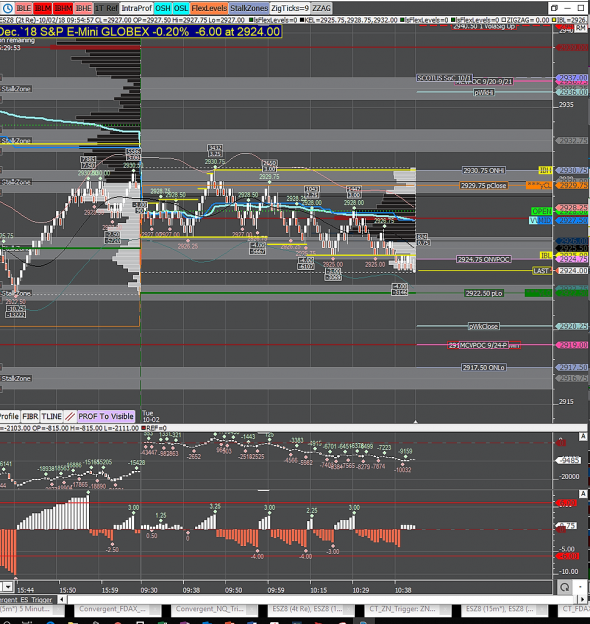

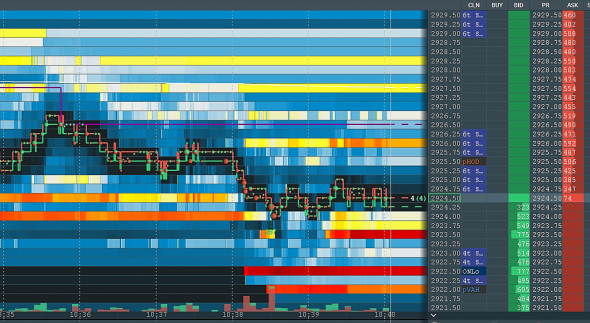

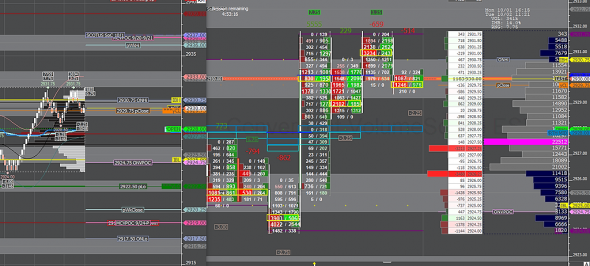

Very tight opening range with OS of 1.75pts and current range 5pts with little-to-no conviction on either side across any of the major indices except small-caps (continuation lower). Volume is running about 15% below normal. Mixed performance in underlying sectors with defensive utilities leading the mix, some of the big tech/communication names diverging quite a bit (AAPL, GOOG, INTC, Semis in general in the green, and AMZN/FB/MSFT dragging). Overall delta in ES is being modestly sold by size, while smalls are basically balanced. TICK/Breadth also largely neutral. Add it all up and it looks rotational-to-slight down bias at the moment IMO.

CME Group Averaged 17.5 Million Contracts Per Day in September 2018, Up 3% from September 2017

CME Group Averaged 17.5 Million Contracts Per Day in September 2018, Up 3% from September 2017

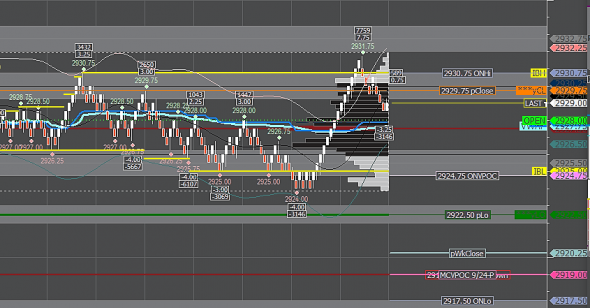

Key levels to watch at the moment are the 22s yLo area and the 32s ONH/CLVN on the upside. Looking for initial reversion from those points. Any sustained break likely gives better directional positioning for continuation.

Key levels to watch at the moment are the 22s yLo area and the 32s ONH/CLVN on the upside. Looking for initial reversion from those points. Any sustained break likely gives better directional positioning for continuation. Very tight opening range with OS of 1.75pts and current range 5pts with little-to-no conviction on either side across any of the major indices except small-caps (continuation lower). Volume is running about 15% below normal. Mixed performance in underlying sectors with defensive utilities leading the mix, some of the big tech/communication names diverging quite a bit (AAPL, GOOG, INTC, Semis in general in the green, and AMZN/FB/MSFT dragging). Overall delta in ES is being modestly sold by size, while smalls are basically balanced. TICK/Breadth also largely neutral. Add it all up and it looks rotational-to-slight down bias at the moment IMO.

Very tight opening range with OS of 1.75pts and current range 5pts with little-to-no conviction on either side across any of the major indices except small-caps (continuation lower). Volume is running about 15% below normal. Mixed performance in underlying sectors with defensive utilities leading the mix, some of the big tech/communication names diverging quite a bit (AAPL, GOOG, INTC, Semis in general in the green, and AMZN/FB/MSFT dragging). Overall delta in ES is being modestly sold by size, while smalls are basically balanced. TICK/Breadth also largely neutral. Add it all up and it looks rotational-to-slight down bias at the moment IMO.