Following Federal Reserve Chairman Jerome Powell's description yesterday of the U.S. economic outlook as «remarkably positive,» market watchers are on the lookout for more Fedspeak. Speeches from seven Fed officials are on the radar today, just one week after the central bank hiked rates and signaled upcoming gradual increases. Powell will again take the podium, participating in discussion before The Atlantic Festival in Washington D.C. at 4:00 p.m. ET.

/ESZ8 Value: YVAH 2932 YPOC 2928 YVAL 2924

/ES Plan: Yesterday market closed balanced and overnight looks more bullish, moving above yesterday's range, so we've these options:

A) If market remains above YHOD 2936 with bullish internals, try to buy towards ONH 2939.75 GBT 2944 and ATH 2947.

B) If market starts to move below 2936 with bearish internals, sell towards YVAH 2932 GAP 2928.75 and ONL 2925.75.

Tips: We'll open out of previous day range. Trend days usually start outside of range of prior session. It's not uncommon to happen via a gap and it happens immediatly. Most common error is fading a trend day.

Today's Economic Calendar:

09:45 PMI Services Index

10:00 ISM Non-Manufacturing Index

10:30 EIA Petroleum Inventories

12:00 PM Fed's Harker speech

01:00 PM Fed's Brainard speech

02:15 PM Fed's Mester speech

04:00 PM Jerome Powell speech

08:00 PM Fed's Kaplan speech

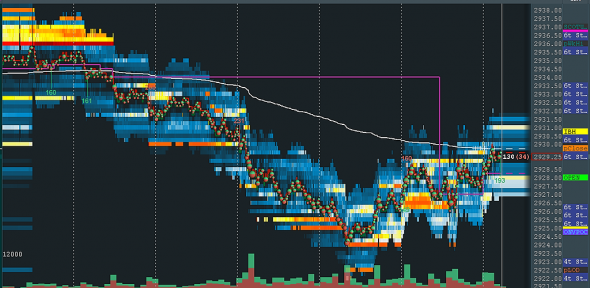

This area (39s) looks like another long opportunity IMO, for either adds or new initiation

This area (39s) looks like another long opportunity IMO, for either adds or new initiation

Following Federal Reserve Chairman Jerome Powell's description yesterday of the U.S. economic outlook as «remarkably positive,» market watchers are on the lookout for more Fedspeak. Speeches from seven Fed officials are on the radar today, just one week after the central bank hiked rates and signaled upcoming gradual increases. Powell will again take the podium, participating in discussion before The Atlantic Festival in Washington D.C. at 4:00 p.m. ET.

Following Federal Reserve Chairman Jerome Powell's description yesterday of the U.S. economic outlook as «remarkably positive,» market watchers are on the lookout for more Fedspeak. Speeches from seven Fed officials are on the radar today, just one week after the central bank hiked rates and signaled upcoming gradual increases. Powell will again take the podium, participating in discussion before The Atlantic Festival in Washington D.C. at 4:00 p.m. ET. This morning's Trader Bite at 16:00MSK — *9:00 AM* Eastern US:

This morning's Trader Bite at 16:00MSK — *9:00 AM* Eastern US: GAP trading rules are in play this morning; the current trade location offers above-average risk and opportunity. Failure to trade to and through all-time highs could trigger liquidation. New highs could spark upside enthusiasm.

GAP trading rules are in play this morning; the current trade location offers above-average risk and opportunity. Failure to trade to and through all-time highs could trigger liquidation. New highs could spark upside enthusiasm. Lots of Fed speakers on the docket today, beginning with Chicago Fed President Charles Evans who is speaking at an event right now in London, and ending with Fed Chairman Jerome Powell at 4pm EST

Lots of Fed speakers on the docket today, beginning with Chicago Fed President Charles Evans who is speaking at an event right now in London, and ending with Fed Chairman Jerome Powell at 4pm EST

Если вы не понимаете сокращения в тексте и на графиках описание здесь — yadi.sk/i/PeVQg6FWwQxbaw

Если вы не понимаете сокращения в тексте и на графиках описание здесь — yadi.sk/i/PeVQg6FWwQxbaw

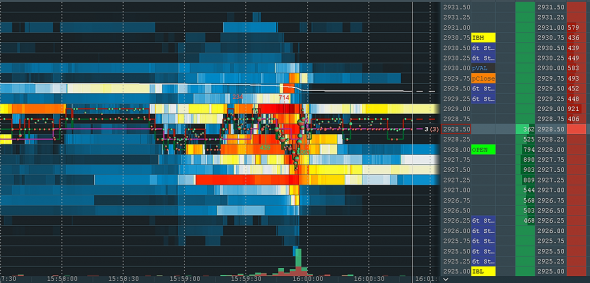

Large rotation down from 2936 to 2924 with a pullback to mid on ES so far. This area would be of interest to me but is crowded and at the end of the day. Given that it is a setup (had it not be for end of day), I would have looked for 2929.50 short for scale at 2927 and risk at 2931.50 and target of 2925.50

Large rotation down from 2936 to 2924 with a pullback to mid on ES so far. This area would be of interest to me but is crowded and at the end of the day. Given that it is a setup (had it not be for end of day), I would have looked for 2929.50 short for scale at 2927 and risk at 2931.50 and target of 2925.50