SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. diamante

Research 09/08/2012

- 09 августа 2012, 16:02

- |

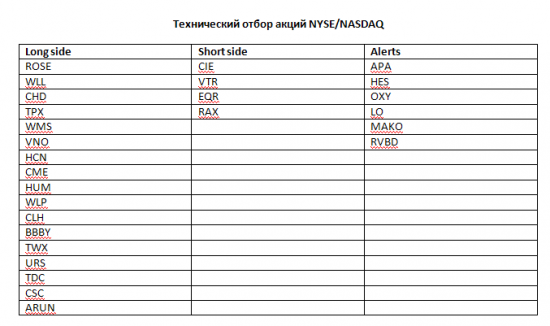

Отбор акций для торговли NYSE, NASDAQ

Последние пару дней индексы почти не двигаются, любой рост скорее всего будет ограничен. Многие быки готовы зафиксировать прибыль на этих уровнях. Сегодня публикуются данные по первичным заявкам на пособие по безработице, это может сдвинуть рынок. Причем снижение выглядит наиболее вероятным вариантом, при выходе данных хуже ожиданий. Моя логика такова: негатив на рынке вызывает снижение индекса ниже 1395 пунктов, инвесторы начинают паниковать и судорожно разгружать лонговые позиции. В результате мы увидим минираспродажу. Но это всего лишь один из возможных сценариев. Данные лучше ожиданий, очевидно, поднимут рынок, но рост будет вялотекущим. На лист сегодня попали 5 новостных бумаг и достаточно большое количество акций, отобранных по технике. Очень неплохо для лонгов внутри дня выглядит нефтяной сектор. Вчера он показал наибольший рост на фоне укрепления фьючерсов на нефть. Так же интересными выглядят акции некоторых компаний, которые отчитывались 3-4 сессии назад. Наболее перспективными будут сделки в акциях, имеющих низкую корреляцию с индесом.

Индекс волатильности, между прочим, находиться у глобальной линии поддержки. Поэтому есть большая доля вероятности начала снижения. Снизу график ETFна индекс.

Оригинал тут: http://www.shark-trading-group.com/

Новостные акции

CLRотчет лучше ожиданий

Significantaccomplishmentsinthesecondquarterincluded:

Achievedrecordproductionof94,852 barrels of oil equivalent per day (Boepd), a 76 percent increase over production of 53,984 Boepd for the second quarter of 2011. Production reached 100,000 Boepd in June 2012. Earned $421.9 million of EBITDAX, 48 percent higher than the second quarter of 2011, and increased net income compared to the second quarter last year. Accelerated the value of high rate-of-return projects in the Bakken play of North Dakota and Montana and the Anadarko Woodford play of Oklahoma through increased drilling efficiencies and capital spending. Continued to simultaneously de-risk and extend the proven inventory in the Bakken play while accelerating its transition to multi-well pad drilling to more efficiently develop this inventory.

Record Production and Proved Reserves

Continental's production was 94,852 Boepd in the second quarter of 2012, an increase of 76 percent over the second quarter of 2011 and 11 percent over the first quarter of 2012. The Company increased 2012 full-year production growth guidance to a range of 57 percent to 59 percent, while reducing its operated rig count to 29 rigs today from 44 in late 2011. «Our operating results have been exceptionally strong. We are significantly ahead of plan to achieve our five-year goal of tripling production from 2009 to 2014,» said Harold Hamm, Chairman and Chief Executive Officer. «We have demonstrated increasing efficiencies by delivering higher production with fewer rigs, and we expect to hit our five-year target during the first half of 2013, which is 18-to-24 months earlier than our original plan. This speaks to the quality of our assets and tremendous team performance by the people at Continental.»

Seattle Genetics Inc.'s (SGEN) second-quarter loss narrowed as the biotechnology company's revenue surged on sales of its lymphoma drug Adcetris, but revenue growth still fell short of analyst expectations. Shares slid 6.6% to $22.30 after hours Wednesday. Through the close, the stock had climbed 25% over the past three months. Adcetris was approved in the U.S. last year to treat Hodgkin's lymphoma and anaplastic large-cell lymphoma after other treatments fail. Seattle Genetics sells Adcetris in the U.S. and Canada while Takeda Pharmaceutical Co. (TKPYY, 4502.TO) markets it elsewhere.Chief Executive and President Clay B. Siegall said Seattle Genetics remains focused on making Adcetris available to patients through its continued commercial initiatives for patients in the labeled indications and through clinical development of the drug in earlier lines of therapy and other CD30-positive malignancies.Seattle Genetics reported a loss of $17.2 million, or 15 cents a share, compared with a year-earlier loss of $51.5 million, or 45 cents a share. Analysts polled by Thomson Reuters had projected a per-share loss of 15 cents.

Kronos Worldwide (KRO): Q2 EPS of $0.56 beats by $0.12. Revenue of $545M (+1.5% Y/Y) misses by $50M. (PR) высокий shoart float, скорее всего рост.

CTB Second quarter net sales of over $1 billion, an increase of 15 percent

— Record quarterly operating profit of $95 million, or 9.0 percent of net sales

— Operating profit records for both North American and International segments

— Net Income of $0.82 per share attributable to Cooper Tire & Rubber Company

Findlay, Ohio, August 9, 2012 — Cooper Tire & Rubber Company CTB +1.91% today reported net sales of $1.06 billion, an increase of $140 million, or 15 percent, compared with the second quarter of 2011. Operating profit was $95 million for the quarter, an increase of $71 million from the prior year same quarter. Net income attributable to Cooper Tire & Rubber Company was $52 million, or $0.82 per share on a diluted basis, for the quarter ended June 30, 2012, compared with $12 million, or $0.18, for the second quarter of 2011.

ViroPharma Inc. (VPHM) posted second-quarter net loss of $4.2 million or $0.06 per share versus profit of $22.8 million or $0.28 per share last year.

Adjusted net income per share plunged to $0.09 from $0.43 in the same quarter last year. On average, 13 analysts polled by Thomson Reuters expected the company to report earnings of $0.12 per share. Analysts' estimates typically exclude special items.

Net product sales fell to $94.64 million from $128.81 million in the prior-year quarter. Analysts expected revenues of $104.39 million.

The decrease was the result of the impact of generic oral vancomycin entries into the market. Regarding Cinryze, the channel remained below normal levels from the end of the first quarter and as a result, the revenue reported is more reflective of demand.

теги блога day0markets.ru

- Basic Materials

- Binance

- BOVESPA

- charts

- CME

- data feed

- Earning season

- earnings

- earnings season

- ECN

- ETF

- EWZ

- Excel

- FDA

- floored

- FOMC

- Forex

- halt

- HFT

- Hotkeys

- imbalance

- Imbalance trading

- IQFeed

- machine learning

- multicharts

- NASDAQ

- NASDQ

- nflx

- NYSE

- python

- S&P500

- S&P500 фьючерс

- Sec fillings

- short float

- SPY

- stocks in play

- stocks inplay

- STX

- takion

- thinkorswim

- trading floor

- Triple Witching Day

- UVXY

- VPS

- VRTX

- WDC

- азия

- акции

- алгоритмы

- алготрейдинг

- аналитика

- Бразилия

- брокеры

- бэктестинг

- видео

- волатильность

- выборы

- Гербалайф

- Греция

- дауншифтинг трейдера

- дивиденды в США

- заграница

- имбэлансы

- Индонезия

- инсайдеры

- история котировок

- итоги года

- корпоративные новости

- корреляция

- котировки NYSE

- криптовалюта

- лось

- ММВБ

- мысли в слух

- опционы

- отбор акций

- оффтоп

- паттерны

- Повышение ставки в США

- премаркет

- проп трейдинг

- ребалансировка индекса

- рейтинги

- риск менеджмент

- сезон отчетов

- сервер для робота

- серфинг

- статистика для трейдера

- сырье

- такион

- тинькофф

- торговая платформа

- торговые роботы

- трейдинг

- фильм инсайдеры

- фреймворк

- фьючерс на биткоин

- фьючерсы

- эффективность рынка

- юмор