SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Shark_Traders

Аналитика на 23 мая

- 23 мая 2013, 16:44

- |

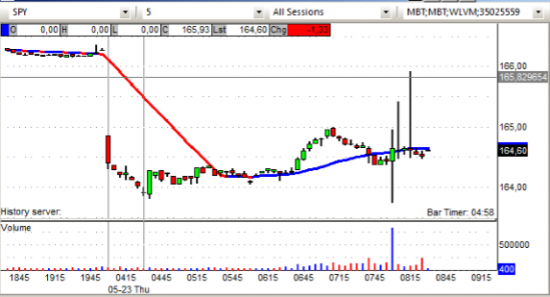

Спайдер снижается перед открытием торгов на NYSE.

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: PSUN +16.4%, HPQ +11.6%, OESX +7.9%, (thinly traded), VVTV +5.7%, HEI +3.5%, (light volume), WDAY +3.4%, ORIG +3.2%, PETM +2.5%, SNPS +2.3%, PLCE +1.6%, AINV +0.7%, LTD +0.3%.

M&A news: LPS +13.4% and FNF +0.5% (Fidelity National Financial and buyout firm Thomas H. Lee Partners are in discussions to purchase LPS for $33/share, according to reports).

Other news: CYNO +4.3% (CYNO to replace NCS in the S&P SmallCap 600), LPSN +3.5% (authorized the additional funding of a previously-announced stock repurchase program), DPZ +3.3% (DPZ to replace PXP in the S&P MidCap 400), LYB +1.4% (announces share repurchase program; increase to interim dividend).

Analyst comments: STX +0.8% (light volume, upgraded to Buy from Hold at Deutsche Bank)

Gapping down:

In reaction to disappointing earnings/guidance: DRYS -6.7%, RL -4.3%.

Financial related names showing weakness: NBG -5.3%, ING -2.4%, DB -2.2%, HBC -1.9%, BCS -1.8%, BAC -1.6%, SAN -1.4%

Japan related names lower after Nikkei plunged 7.3%: KYO -9.9%, NMR -7.1%, MTU -6.7%, SMFG -5.9%, NTT -4.2%, SNE -3.8%, MFG -3.3%, DCM -3.3%, HMC -3.2%, TM -3%, TSM -2.1%

Solar names pulling back in early trade: STP -11.8%, YGE -4.6%, SPWR -4.2%, FSLR -3.8%, RSOL -2.1%, TSL -1.8%, LDK -1.2%

Other news: CLNT -11.3% (modestly pulling back), APRI -9.1% (announces proposed public offering of common stock and warrants), SAAS -7% (disclosed Piper proposes to purchase Enterprise Network Holdings stake in SAAS), DDD -6.2% (continued weakness), NCS -5.5% (CYNO to replace NCS in the S&P SmallCap 600), BXMT -4% (announces upsizing and pricing of public offering Of Class A Common Stock), AMD -4% (still checking for anything specific), MCP -3.8% (Japan is planning on developing offshore rare earth resources, according to reports), TSLA -3.7% (confirms that it has repaid its $451 mln government loan as expected ), GRPN -3.6% (still checking), WAIR -2.5% (announces pricing of sale of 15 mln shares of common stock by the Carlyle Group (CG) at $16 per share), SDRL -2.5% (still checking), INFN -2% (proposed $100 mln offering of convertible senior notes due 2018), OAK -1.9% (prices 7 mln shares at $53.50 per share), LNKD -1.7% (LinkedIn has acquired social polling startup Maybe for $750 mln, according to reports), LG -1.5% (prices 8.7 mln shares of common stock at $44.50 per share), F -1.5% (plans shut down two manufacturing plans in Australia following higher costs, according to reports), BIDU -1.4% (Sohu.com's Sogou unit has attracted interest from Baidu (BIDU), Tencent and Qihoo 360 (QIHU), according to reports), JCP -1.2% (Announces Consummation of $2.25 Billion Term Loan and Initial Settlement of its Tender Offer and Consent Solicitation ), AVB -0.5% (announces secondary offering of 7.87 mln shares of common stock by affiliate of Lehman Brothers Holding), EQR -0.4% (prices offering of 15.068 mln of its common shares by Jupiter Enterprise, an indirect subsidiary of Lehman Brothers Holdings; price not disclosed).

Analyst comments: SANM -3.6% (downgraded to Sell from Hold at Deutsche Bank), ARMH -2.7% (downgraded to Neutral from Outperform at Exane BNP Paribas), DVN -1.8% (downgraded to Neutral from Overweight at JP Morgan), JNJ -1.7% (resumed with a Underperform at Credit Suisse), O -1.3% ( downgraded to Sell from Neutral at Goldman), FLEX -0.7% (downgraded to Hold from Buy at Deutsche Bank)

Отчетыкомпаний:

Сегодняпередоткрытием: AAP AINV ALKS BKE BONT CATO CMCO DLTR GMAN GME HRL KIRK PACT PDCO PERY PLCE QSII RL SIG SMRT TAOM TTC TWMC VOYA

Вчерапослезакрытия: BRS DRYS EGHT HEI HOTT HPQ LTD NED PETM PSUN SEAS SMTC SNPS SPTN VVTV WDAY WSTL

Торговые идеи NYSEи NASDAQ:

HPQ– шорт ниже 23.50

WDAY– лонг выше 69.00, ниже 68.00 смотрим акцию в шорт.

CLNT– шорт ниже 8.00

SDRL– лонг выше 39.50

BIDU – шорт ниже 93.00

Оригинал статьи:http://shark-traders.com/blog/analitika-na-23-maya/

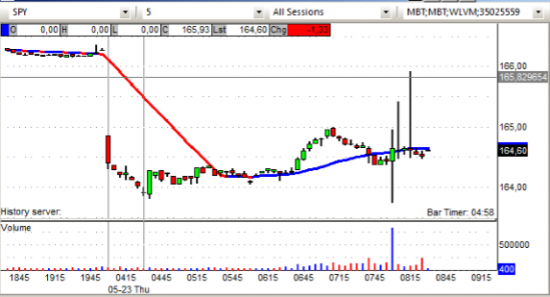

- Европейские индексы на отрицательной территории.

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: PSUN +16.4%, HPQ +11.6%, OESX +7.9%, (thinly traded), VVTV +5.7%, HEI +3.5%, (light volume), WDAY +3.4%, ORIG +3.2%, PETM +2.5%, SNPS +2.3%, PLCE +1.6%, AINV +0.7%, LTD +0.3%.

M&A news: LPS +13.4% and FNF +0.5% (Fidelity National Financial and buyout firm Thomas H. Lee Partners are in discussions to purchase LPS for $33/share, according to reports).

Other news: CYNO +4.3% (CYNO to replace NCS in the S&P SmallCap 600), LPSN +3.5% (authorized the additional funding of a previously-announced stock repurchase program), DPZ +3.3% (DPZ to replace PXP in the S&P MidCap 400), LYB +1.4% (announces share repurchase program; increase to interim dividend).

Analyst comments: STX +0.8% (light volume, upgraded to Buy from Hold at Deutsche Bank)

Gapping down:

In reaction to disappointing earnings/guidance: DRYS -6.7%, RL -4.3%.

Financial related names showing weakness: NBG -5.3%, ING -2.4%, DB -2.2%, HBC -1.9%, BCS -1.8%, BAC -1.6%, SAN -1.4%

Japan related names lower after Nikkei plunged 7.3%: KYO -9.9%, NMR -7.1%, MTU -6.7%, SMFG -5.9%, NTT -4.2%, SNE -3.8%, MFG -3.3%, DCM -3.3%, HMC -3.2%, TM -3%, TSM -2.1%

Solar names pulling back in early trade: STP -11.8%, YGE -4.6%, SPWR -4.2%, FSLR -3.8%, RSOL -2.1%, TSL -1.8%, LDK -1.2%

Other news: CLNT -11.3% (modestly pulling back), APRI -9.1% (announces proposed public offering of common stock and warrants), SAAS -7% (disclosed Piper proposes to purchase Enterprise Network Holdings stake in SAAS), DDD -6.2% (continued weakness), NCS -5.5% (CYNO to replace NCS in the S&P SmallCap 600), BXMT -4% (announces upsizing and pricing of public offering Of Class A Common Stock), AMD -4% (still checking for anything specific), MCP -3.8% (Japan is planning on developing offshore rare earth resources, according to reports), TSLA -3.7% (confirms that it has repaid its $451 mln government loan as expected ), GRPN -3.6% (still checking), WAIR -2.5% (announces pricing of sale of 15 mln shares of common stock by the Carlyle Group (CG) at $16 per share), SDRL -2.5% (still checking), INFN -2% (proposed $100 mln offering of convertible senior notes due 2018), OAK -1.9% (prices 7 mln shares at $53.50 per share), LNKD -1.7% (LinkedIn has acquired social polling startup Maybe for $750 mln, according to reports), LG -1.5% (prices 8.7 mln shares of common stock at $44.50 per share), F -1.5% (plans shut down two manufacturing plans in Australia following higher costs, according to reports), BIDU -1.4% (Sohu.com's Sogou unit has attracted interest from Baidu (BIDU), Tencent and Qihoo 360 (QIHU), according to reports), JCP -1.2% (Announces Consummation of $2.25 Billion Term Loan and Initial Settlement of its Tender Offer and Consent Solicitation ), AVB -0.5% (announces secondary offering of 7.87 mln shares of common stock by affiliate of Lehman Brothers Holding), EQR -0.4% (prices offering of 15.068 mln of its common shares by Jupiter Enterprise, an indirect subsidiary of Lehman Brothers Holdings; price not disclosed).

Analyst comments: SANM -3.6% (downgraded to Sell from Hold at Deutsche Bank), ARMH -2.7% (downgraded to Neutral from Outperform at Exane BNP Paribas), DVN -1.8% (downgraded to Neutral from Overweight at JP Morgan), JNJ -1.7% (resumed with a Underperform at Credit Suisse), O -1.3% ( downgraded to Sell from Neutral at Goldman), FLEX -0.7% (downgraded to Hold from Buy at Deutsche Bank)

Отчетыкомпаний:

Сегодняпередоткрытием: AAP AINV ALKS BKE BONT CATO CMCO DLTR GMAN GME HRL KIRK PACT PDCO PERY PLCE QSII RL SIG SMRT TAOM TTC TWMC VOYA

Вчерапослезакрытия: BRS DRYS EGHT HEI HOTT HPQ LTD NED PETM PSUN SEAS SMTC SNPS SPTN VVTV WDAY WSTL

Торговые идеи NYSEи NASDAQ:

HPQ– шорт ниже 23.50

WDAY– лонг выше 69.00, ниже 68.00 смотрим акцию в шорт.

CLNT– шорт ниже 8.00

SDRL– лонг выше 39.50

BIDU – шорт ниже 93.00

Оригинал статьи:http://shark-traders.com/blog/analitika-na-23-maya/

теги блога Shark Traders

- AMEX

- CME

- forex

- multicharts

- NASDAQ

- NYSE

- research

- spin off

- sterling

- stocks in play

- stocks inplay

- support

- алготрейдинг

- аналитика

- бинарные опционы

- брокеры

- вакансия

- дейтрейдинг

- котировки

- Московская биржа

- Московская биржа ММВБ-РТС

- отбор акций

- оффтоп

- программирование торговых роботов

- стратегия

- торговые алгоритмы

- торговые идеи

- Торговые роботы

- фьючерсы