SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Shark_Traders

Аналитика на 10 апреля

- 10 апреля 2013, 16:55

- |

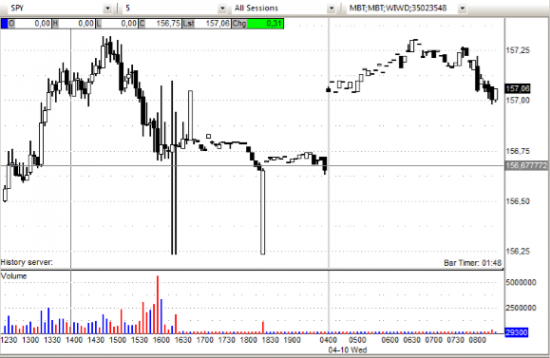

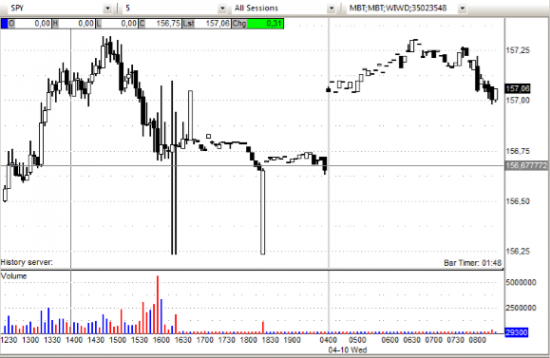

Спайдер торгуется на премаркете около уровня 157.00

SPY (внутридневной график) боковое движение на премаркете. Сопротивление 157.25 Поддержка: 157.00, 156.25

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: ADTN +10.7% (light volume), ACTS +9.8%, PSMT +3.5% (also reports March net warehouse club sales +11.5%; comparable net warehouse club sales +7.9%).

Financial related names showing strength: CS +3.4%, BBVA +3.4%, BCS +3.1%, RBS +3%, ING +2.7%, UBS +2.3%, SAN +2.2%, DB +2%.

Other news: BCRX +11.4% (light volume, Bloomberg discusses that China Bird Flu outbreak may came from two other viruses, according to reports ), MNKD +5.9% (continued strength), WOR +4.3% (acquires Palmer Mfg. & Tank business ), STP +3.2% (may sell some assets and bring in strategic investor, according to reports), YHOO +1.6% (Yahoo! and Apple (AAPL) are in discussions for deeper IoS partnership, according to reports), FB +1.5% (AllThingsD discusses FB's data targeting efforts, according to reports), SRPT +1.1% (following 5 point jump after GSK's data for drisapersen did not appear as strong as that of Sarepta's eteplirsen), JNPR +1.0% (Belgacom selects Juniper Networks 100GE Routing Solution).

Analyst comments: PSUN +6.7% (upgraded to Overweight from Neutral at Piper Jaffray), IBM +1.3% (upgraded to Buy from Neutral at UBS), AEO +1.1% (upgraded to Overweight from Neutral at Piper Jaffray, STWD +0.9% (upgraded to Buy from Neutral at BofA/Merrill ), CYS +0.5% (upgraded to Outperform from Mkt Perform at Keefe Bruyette), SI +0.3% (upgraded to Neutral from Underperform at Exane BNP Paribas)

Gapping down:

In reaction to disappointing earnings/guidance: HMA -12.6%, (downgraded to Hold from Buy at Deutsche Bank), TITN -11.5%, SEAC -9.7%, RLGY -7.6%, (also announced an underwritten public offering of 35 million shares of its common stock by certain funds affiliated with Apollo Global Management), GRA -5.3% (ticking lower), FDO -3.8%, JKS -2.6%, FAST -1.7% (light volume), DGIT -0.7%.

M&A news: LIFE -0.3% (Thermo Fisher has made an offer for LIFE for more than $65/share, according to reports).

Select HMA peers under pressure: THC -6.9% (downgraded to Hold from Buy at Deutsche Bank), CYH -3.9% (downgraded to Hold from Buy at Deutsche Bank), UHS -2.0%.

Select solar names modestly pulling back (JKS reported earnings and FSLR cautious analyst comments): FSLR -2.9% (modestly pulling back, multiple analysts are out this morning suggesting the upside move on yesterday's guidance is overdone), TSL -2.5%, SPWR -2.3%, YGE -1.8%, WFR -1.3%.

Select metals/mining related names showing early weakness: HL -1.5%, ABX -0.8%, BHP -0.7%, NEM -0.6%, GG -0.5%, GLD -0.5%, SLW -0.5% .

Other news: SGYP -11.2% (announces public offering of $90 mln of common stock), RSO -3.5% (announces follow-on offering of 16.25 mln shares of its common stock), HBIO -3% (announces postponement of the IPO for Harvard Apparatus Regenerative Technology, Inc.), INFI -2.4% (announced an underwritten public offering of its common stock by existing stockholders), SHPG -0.9% (still checking).

Отчеты компаний:

Вчера после закрытия: CCIH PSMT SEAC

Сегодня перед открытием: ATNY FAST FDO JKS KMX MSM STZ TITN

Торговые идеи NYSEи NASDAQ:

RLGY– плохой guidance на первый квартал 2013, дополнительное размещение 35млн акций среди акционеров. Смотрим акцию в лонг выше 42.00, либо на отбой от уровня 40.00. Шорт возможен на пробой минимума постмаркета 41.00.

ADTN– отчет чуть лучше ожиданий, но прибыль не растет. Выше 20.00 смотрим акцию в лонг, ниже – шорт. В 9-30 Conference Call.

HMA – так называемый Grow Stock, плохой гайденс на следующий квартал, покупаем от поддержки 11.00. Связанная компания: THC (госпитали).

FDO– отчет примерно на уровне ожиданий, но плохой гайденс на FY13. Смотрим акцию в шорт ниже уровней премаркета, лонг возможен выше уровня 58.00. Связанные тикеры: DLTR, DG

ARO– компания попала в список Sell Goldman Sachs, смотрим акцию в лонг от 12.00, если будет падение.

Оригинал статьи:http://shark-traders.com/blog/analitika-na-10-aprelya/

- Европейские индексы на положительной территории.

- Nikkei +0,73 %

SPY (внутридневной график) боковое движение на премаркете. Сопротивление 157.25 Поддержка: 157.00, 156.25

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: ADTN +10.7% (light volume), ACTS +9.8%, PSMT +3.5% (also reports March net warehouse club sales +11.5%; comparable net warehouse club sales +7.9%).

Financial related names showing strength: CS +3.4%, BBVA +3.4%, BCS +3.1%, RBS +3%, ING +2.7%, UBS +2.3%, SAN +2.2%, DB +2%.

Other news: BCRX +11.4% (light volume, Bloomberg discusses that China Bird Flu outbreak may came from two other viruses, according to reports ), MNKD +5.9% (continued strength), WOR +4.3% (acquires Palmer Mfg. & Tank business ), STP +3.2% (may sell some assets and bring in strategic investor, according to reports), YHOO +1.6% (Yahoo! and Apple (AAPL) are in discussions for deeper IoS partnership, according to reports), FB +1.5% (AllThingsD discusses FB's data targeting efforts, according to reports), SRPT +1.1% (following 5 point jump after GSK's data for drisapersen did not appear as strong as that of Sarepta's eteplirsen), JNPR +1.0% (Belgacom selects Juniper Networks 100GE Routing Solution).

Analyst comments: PSUN +6.7% (upgraded to Overweight from Neutral at Piper Jaffray), IBM +1.3% (upgraded to Buy from Neutral at UBS), AEO +1.1% (upgraded to Overweight from Neutral at Piper Jaffray, STWD +0.9% (upgraded to Buy from Neutral at BofA/Merrill ), CYS +0.5% (upgraded to Outperform from Mkt Perform at Keefe Bruyette), SI +0.3% (upgraded to Neutral from Underperform at Exane BNP Paribas)

Gapping down:

In reaction to disappointing earnings/guidance: HMA -12.6%, (downgraded to Hold from Buy at Deutsche Bank), TITN -11.5%, SEAC -9.7%, RLGY -7.6%, (also announced an underwritten public offering of 35 million shares of its common stock by certain funds affiliated with Apollo Global Management), GRA -5.3% (ticking lower), FDO -3.8%, JKS -2.6%, FAST -1.7% (light volume), DGIT -0.7%.

M&A news: LIFE -0.3% (Thermo Fisher has made an offer for LIFE for more than $65/share, according to reports).

Select HMA peers under pressure: THC -6.9% (downgraded to Hold from Buy at Deutsche Bank), CYH -3.9% (downgraded to Hold from Buy at Deutsche Bank), UHS -2.0%.

Select solar names modestly pulling back (JKS reported earnings and FSLR cautious analyst comments): FSLR -2.9% (modestly pulling back, multiple analysts are out this morning suggesting the upside move on yesterday's guidance is overdone), TSL -2.5%, SPWR -2.3%, YGE -1.8%, WFR -1.3%.

Select metals/mining related names showing early weakness: HL -1.5%, ABX -0.8%, BHP -0.7%, NEM -0.6%, GG -0.5%, GLD -0.5%, SLW -0.5% .

Other news: SGYP -11.2% (announces public offering of $90 mln of common stock), RSO -3.5% (announces follow-on offering of 16.25 mln shares of its common stock), HBIO -3% (announces postponement of the IPO for Harvard Apparatus Regenerative Technology, Inc.), INFI -2.4% (announced an underwritten public offering of its common stock by existing stockholders), SHPG -0.9% (still checking).

Отчеты компаний:

Вчера после закрытия: CCIH PSMT SEAC

Сегодня перед открытием: ATNY FAST FDO JKS KMX MSM STZ TITN

Торговые идеи NYSEи NASDAQ:

RLGY– плохой guidance на первый квартал 2013, дополнительное размещение 35млн акций среди акционеров. Смотрим акцию в лонг выше 42.00, либо на отбой от уровня 40.00. Шорт возможен на пробой минимума постмаркета 41.00.

ADTN– отчет чуть лучше ожиданий, но прибыль не растет. Выше 20.00 смотрим акцию в лонг, ниже – шорт. В 9-30 Conference Call.

HMA – так называемый Grow Stock, плохой гайденс на следующий квартал, покупаем от поддержки 11.00. Связанная компания: THC (госпитали).

FDO– отчет примерно на уровне ожиданий, но плохой гайденс на FY13. Смотрим акцию в шорт ниже уровней премаркета, лонг возможен выше уровня 58.00. Связанные тикеры: DLTR, DG

ARO– компания попала в список Sell Goldman Sachs, смотрим акцию в лонг от 12.00, если будет падение.

Оригинал статьи:http://shark-traders.com/blog/analitika-na-10-aprelya/

теги блога Shark Traders

- AMEX

- CME

- forex

- multicharts

- NASDAQ

- NYSE

- research

- spin off

- sterling

- stocks in play

- stocks inplay

- support

- алготрейдинг

- аналитика

- бинарные опционы

- брокеры

- вакансия

- дейтрейдинг

- котировки

- Московская биржа

- Московская биржа ММВБ-РТС

- отбор акций

- оффтоп

- программирование торговых роботов

- стратегия

- торговые алгоритмы

- торговые идеи

- Торговые роботы

- фьючерсы