SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. wannatradelikePTJ |Copper and copper stocks

- 27 ноября 2015, 01:19

- |

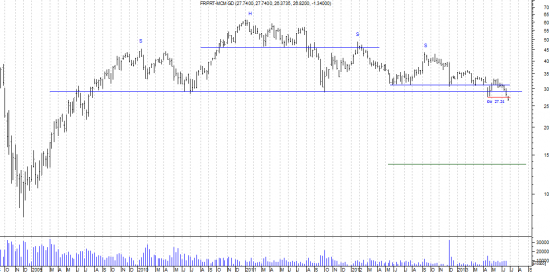

Here , two years ago, I offered a bearish view on copper and copper producers. Free Port Mc Moran appeared to be a perfect candidate for a short sale. Indeed, copper stoks crushed for real next year and has been falling down up untill recently. Prices could fall even lower, but current juncture is a good moment to cover shorts and walk away with huge profit. It looks like no bulls in copper pits nowdays.

- комментировать

- Комментарии ( 4 )

Блог им. wannatradelikePTJ |Copper update

- 25 июня 2013, 11:55

- |

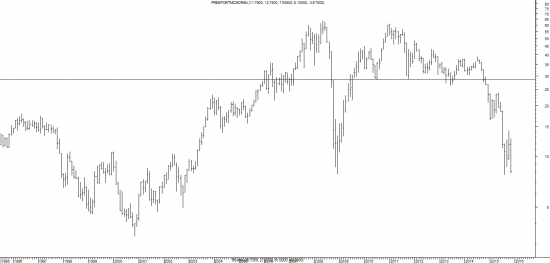

Three month ago, (see my post on 20th March) I wrote on pattern-perspectives of the copper prices, and assumed the probable target below 3.00. Yesterday market reached the stipulated target. I think much more downside is possible in coming weeks/month.

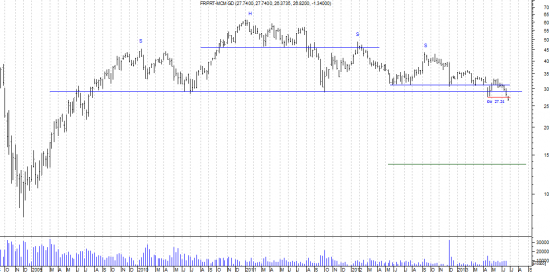

Copper producers reflect the inherent weakness of the commodity, and there is a breakout of a massive topping pattern confirmed yesterday in FreeportMcMoran shares.

( Читать дальше )

Copper producers reflect the inherent weakness of the commodity, and there is a breakout of a massive topping pattern confirmed yesterday in FreeportMcMoran shares.

( Читать дальше )

Блог им. wannatradelikePTJ |copper

- 28 марта 2013, 09:22

- |

Copper (HG) needs a daily close 9th November low of 340.30 (continuation contract chart) in order to reconfirm bearish case (with targets well below 300). Exchange stocks (inventories) at LME are at elevated levels. That's bearish backdrop, ceteris paribus.

Блог им. wannatradelikePTJ |Copper

- 20 марта 2013, 00:49

- |

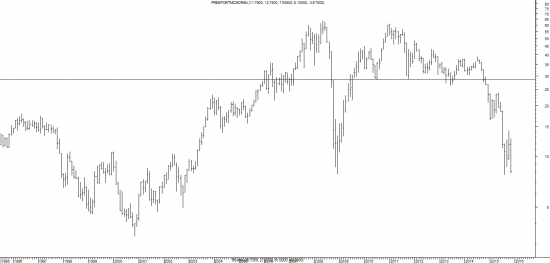

PhD in Macroeconomics is foretelling some nasty things to come soon:) Copper weekly demonstrates a good example of classic chart patterns (while I don't use classic chart pattern — set-ups, it still represents impotant information for general market perspective. Smart-money are probably selling copper into this now. Providing there will be no daily closing above 355 (on continuation chart) — price will likely slide down to some lofty targets below 300.

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- шорт

- экономика

- юмор

- яндекс