6a

⚡️ Today found a potential opportunity in the Australian dollar (6A)

- 29 октября 2023, 21:06

- |

Good evening, traders

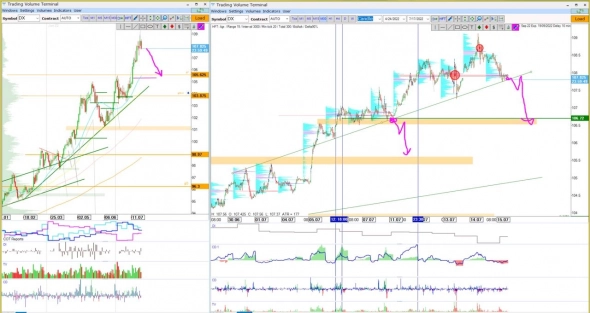

I returned from vacation and today found a potential opportunity in the Australian dollar (6A).

On Frіday the price rejected the strong level of resistance on the daily chart and big volumes went short according to delta and HFTs’ Bid imbalance. But a bit earlier we saw algorithmic purchases in the South direction which we can observe with the help of quantitative cumulative delta (CDQ), and they expected that the daily level of resistance would be broken. To my mind, after the last involvement of sellers, we can really see a breakout attempt of those levels. But for now, It is not allowed for the price to go lower than 0,63375 as that definitely will mean that current limit support is not strong enough to protect our stop-loss. If it is strong, the target I expect on 0,6407 price level.

In the last big tick chain which was absorbed by Marketmaker, we have a duration of 4 seconds 581 milliseconds and 86% preponderance of trades by market sellers. (Watch)

( Читать дальше )

- комментировать

- Комментарии ( 1 )

New imbalances in Oil markets 🛢

- 11 июня 2023, 18:55

- |

Today I made a video review on the British Pound (6B), Japanese Yen (6J), and Australian dollar (6A), and forecasts in Crude Oil (CL), Brent Oil (BR) , and Natural Gas (NG).

This 9 — minutes video is for you

Thank you very much for watching!

Have a good week.

Hot forecasts in Pound, Aussi, Oil, Coffee 🔥

- 01 мая 2023, 00:10

- |

Good evening, traders! 👋

Today I decided to make a video market forecast highlighting situations in British Pound (6B), Aussi (6A), Coffee (KC), Crude and Brent Oil (CL, BR).

Also measured possible continuations of scenarios that I executed in my previous Sunday forecast.

This 11-minute video is for you today

Thank you very much for watching.

Have a good week!

NEW buying opportunities in 6N, 6C, 6A and Corn

- 21 августа 2022, 18:03

- |

Good day, Traders, NEW video analysis is ready!

Today we will speak about Corn (ZC) and buying opportunities in the New Zealand dollar (6N), Canadian dollar (6C), and Australian dollar (6A).

Hope this information will be very helpful for you!

This time it’s a 10-minute video to watch

( Читать дальше )

DXY is tired to rise + video

- 18 июля 2022, 03:25

- |

Good evening, Traders!

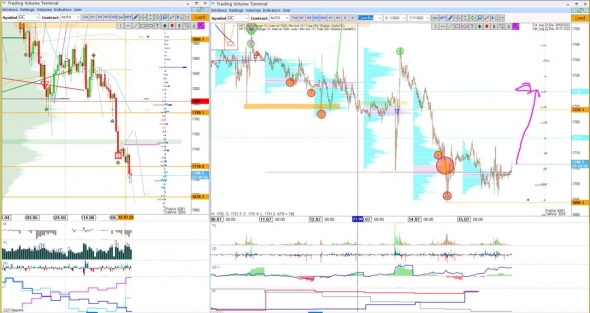

🔻 Let's start from the leader of markets — DXY. From the previous analysis, we have designated a key level 106.72 and the price did not brokedown this level even by 1 tick. It became a real growing point from the start of the week. On Friday the price closed on the uptrend line and after its breakdown, I expect to see correctional movement to this magnet. (See)

🔻 What about Gold (GC), I really expected that the price will go up from Tuesday's bottom, but the unbelievable record inflation in the USA created high volatility. Funds opened a record short position, and OI rose by 8% during the reported week. Now according to the big amount of ask HFTs here reversal is also rather possible. (See)

( Читать дальше )

СME Futures Analysis 03.07.2022 + video

- 03 июля 2022, 21:08

- |

Good evening, Traders!

Let's observe the market and prepare for the next week!

🔻 Gold (GC) showed entry points 3 times in a row that week, and honestly, I participated in each one. I expected this scenario before, you can see it in my previous reviews. Now I see that it is necessary to be patient and not react to local imbalances. Hier timeframes are in the game. Huge stop-losses were collected and there is enough fuel to go higher. It will be not a surprise if the price will go to 2000 from here. (See)

🔻 Silver (Si) is the same. The first magnet is volume level 20.8 and then we can go even higher. (See)

( Читать дальше )

⚡️ Дивергенция дельт + HFT объемы, примеры на разных активах

- 27 апреля 2021, 10:59

- |

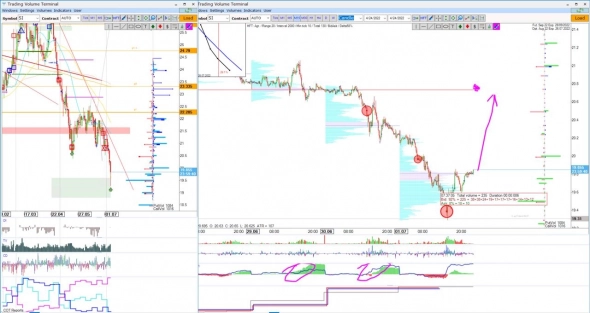

На каких активах товарного, валютного рынка, а также индексах, работает стратегия дивергенции кумулятивной дельты по объему КД и агрегированной дельты по количеству тиков (сделок) КДК?

Практически на всех, лучше дождаться своего рынка и своей ТВХ, которую видно невооруженным увеличительными приборами глазом.

( Читать дальше )

Вопрос знатокам рынка

- 14 августа 2020, 00:13

- |

ATM strike 0.7150

колл премия 70 пунктов. дельта 79

пут премия 80 пунктов. дельта 20

Куда пойдет фьючерс?

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- шорт

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал