SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Индексы цен производителей.

- 14 марта 2017, 15:44

- |

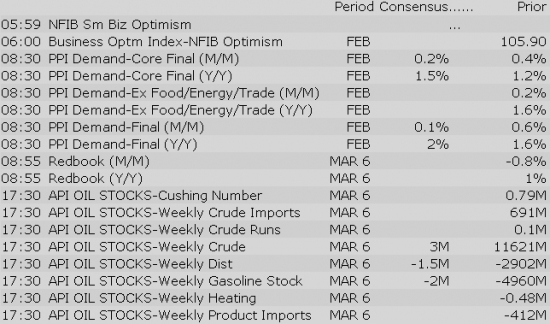

Сегодня уже вышли данные по индексу бизнес-оптимизма, который остаётся на своих максимальных отметках:

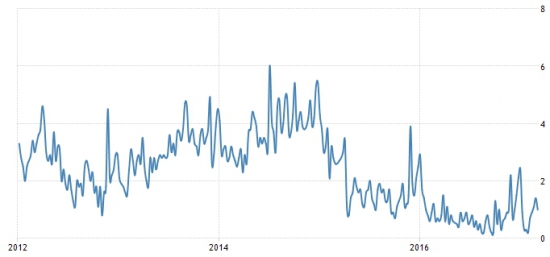

Индекс цен производителей также показывает галопирующую динамику и прогнозируется на максимальных отметках:

Единственным индексом, который показывает отрицательную динамику является Redbook, новое значение ожидается ниже единицы:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Downgrades:

Misc

Market Updates:

US Econ Data

Equity indices in the Asia-Pacific region ended Tuesday on a mixed note, but all in all, trading ranges were very narrow. In China, the country's National Bureau of Statistics noted that fundamentals of the Chinese economy are improving and that the business environment is in better shape than one year ago. Staying in China, press reports suggest the country will deploy anti-radar equipment to counter US deployment of THAAD missiles in South Korea.

---Equity Markets---

---FX---

As mentioned at 7:06, Euronet Worldwide (EEFT) has made competing proposal to acquire MGI for $15.20/share. On January 26, MGI had agreed to be acquired by Alibaba's (BABA) Ant Financial for $13.25/share in cash or approx. $880 mln. Today's offer by Euronet Worldwide is for $15.20/share in cash or more than $1 bln

Euronet will hold a conference call this morning, Tuesday, March 14, 2017 at 8:00 a.m. ET to discuss the proposal.

Major European indices trade in mixed fashion with Spain's IBEX (-0.5%) showing relative weakness. Bank of England deputy governor for banking and markets Charlotte Hogg resigned after not disclosing her brother's employment at Barclays. Staying in the UK, the British parliament has approved the Brexit bill, which is now set to receive Royal Assent—a final step before article 50 can be triggered. Elsewhere, inflation data from Germany showed the hottest year-over-year growth since late 2012.

---Equity Markets---

VRX -12.5% premarket.

Gapping down: ANTH -31.5%, ADPT -22.4%, AUPH -16.5%, CBIO -16.4%, VRX -12.9%, TLYS -12.5%, LNTH -11%, PPHM -8.9%, RYI -8.4%, KNDI -8%, PETX -7.9%, APRI -6.4%, AMPH -5.2%, DOC -4.5%, RBS -4%, CORT -3.6%, BLCM -3.5%, GBT -3.2%, LYG -2.9%, PSO -2.2%, TPVG -2%, ON -1.7%, HMY -1.7%, BCS -1.7%, DB -1.6%, AU -1.2%, RIO -1.2%, HSBC -1%, GFI -1%, MT -0.9%, SAN -0.9%, TWTR -0.9%, COUP -0.9%, AUY -0.8%, BHP -0.8%

Treasuries Edge Higher Ahead of PPI

Stocks with favorable mention: ABBV, ABT, BETR, FL, GOOGL, INTC, NXPI, PLCE, SWKS, ULTA, USCR

Stocks with unfavorable mention: IONS, JILL, SONC, XOM

Equity futures point to a slightly lower open on Tuesday morning as the Federal Open Market Committee meeting gets underway in Washington. The S&P 500 futures trade four points below fair value.

The FOMC meeting will occur over the course of two days with the Fed's rate decision on Wednesday afternoon serving as the climax. It's pretty much a given that the U.S. central bank will increase the Fed funds target range by a quarter point, leaving investors more interested in the Fed's updated rate projections for 2017 and beyond.

On the political front, yesterday evening, the Congressional Budget Office released its research on House Republicans' proposed replacement of the Affordable Care Act. Without going into the specifics, the report has stirred up some controversy, leaving investors worried that health care reform might take longer than previously anticipated, and thereby pushing back the timeline for tax reformation.

Crude oil trades in the red this morning, poised to extend its streak of five consecutive losses. The weekly inventory report from the American Petroleum Institute will cross the wires tonight at 4:30 pm ET with the EIA release scheduled for tomorrow morning. Currently, WTI crude trades 0.5% lower at $48.11/bbl.

In the Treasury market, U.S. sovereign debt trades just above its unchanged mark with the benchmark 10-yr yield one basis point lower at 2.62%.

Tuesday's lone economic report, February PPI (Briefing.com consensus 0.1%), will cross the wires at 8:30 am ET.

In U.S. corporate news:

Reviewing overnight developments:

Upgrades:

Downgrades:

Miscellaneous:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness:

Select metals/mining stocks trading lower:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

The S&P 500 futures trade nine points (0.4%) below fair value.

Just in, February producer prices increased 0.3%, which is above the Briefing.com consensus of 0.1%. Core producer prices increased 0.3% while the Briefing.com consensus expected an increase of 0.2%.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness:

Select metals/mining stocks trading lower:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

Eurozone Economic Sentiment Jumps Sharply

The S&P 500 futures trade seven points (0.3%) below fair value.

Equity indices in the Asia-Pacific region ended Tuesday on a mixed note, but all in all, trading ranges were very narrow. In China, the country's National Bureau of Statistics noted that fundamentals of the Chinese economy are improving and that the business environment is in better shape than one year ago. Staying in China, press reports suggest the country will deploy anti-radar equipment to counter US deployment of THAAD missiles in South Korea.

---Equity Markets---

Major European indices trade in negative territory with Spain's IBEX (-0.7%) showing relative weakness. Bank of England deputy governor for banking and markets Charlotte Hogg resigned after not disclosing her brother's employment at Barclays. Staying in the UK, the British parliament has approved the Brexit bill, which is now set to receive Royal Assent—a final step before article 50 can be triggered. Elsewhere, inflation data from Germany showed the hottest year-over-year growth since late 2012.

---Equity Markets---