SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Заказы на товары длительного пользования и индекс незавершенных продаж.

- 27 февраля 2017, 17:06

- |

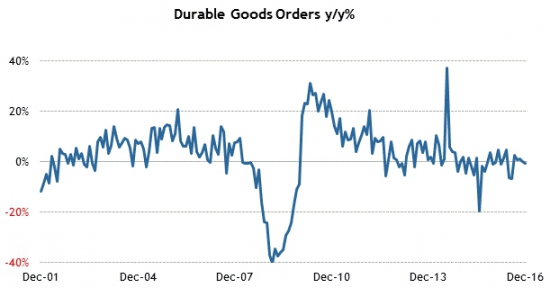

В заказах на товары длительного пользования ожидается новый восходящий цикл:

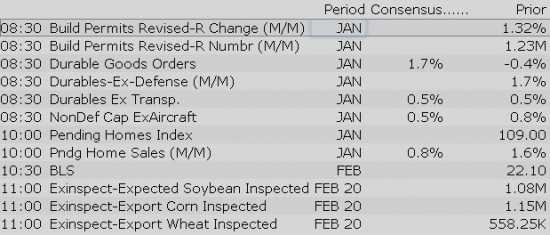

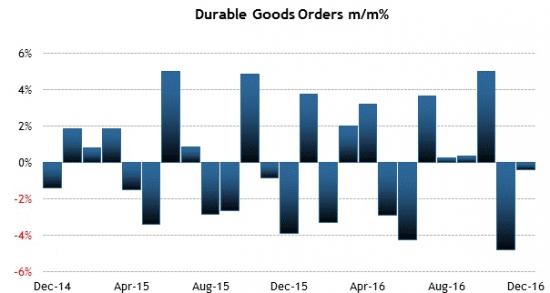

Рост в заказах за последний месяц аналитиками оценивается на отметке 2%:

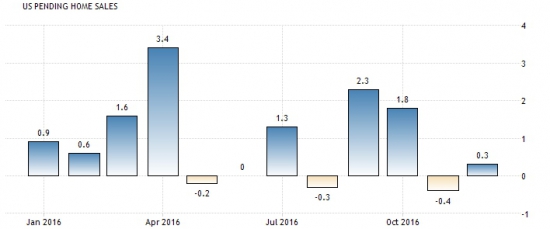

Также продолжение роста происходит и в данных по рынку недвижимости. Новый показатель незавершенных продаж оценивается отдельными аналитическими агентствами на уровне 0.8%:Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

The FDA has also set a Prescription Drug User Fee Act (PDUFA) date of October 12, 2017. The PDUFA date is the target date set by the FDA to communicate its decision on the New Drug Application.

Equity indices in the Asia-Pacific region began the week on a lower note, but no major index lost more than 1.0%. Japan's Nikkei (-0.9%) ended among the laggards while the yen has slipped 0.1% against the dollar to 112.28. Elsewhere, China Securities Regulatory Commission Chairman Liu Shiyu said that China is ready for a larger supply of IPOs, thanks to a stronger than expected recovery from a swoon in 2015.

---Equity Markets---

---FX---

Major European indices trade in mixed fashion with Italy's MIB (+0.9%) showing relative strength. Italy's Democratic Party has scheduled a primary vote for April 30, which is seen as a precursor to a general election being called later in the year. Elsewhere, Fitch affirmed Greece's sovereign rating at ‘CCC' while Moody's affirmed Germany's ‘AAA' rating with a ‘Stable' outlook. On a separate note, the British pound is down 0.4% against the dollar at 1.2412 amid reports Scotland may conduct another independence referendum once the UK triggers article 50.

---Equity Markets---

Treasuries Dip Ahead of Durable Goods Report

Stocks with favorable mention: ADSK, BURL, CBG, CSCO, DLTR, DPZ, ED, LYV, MRVL, PANW, SKT, TGT, VRX

Stocks with unfavorable mention: BBY, GNC, KR, SUN, VSI

Upgrades:

Downgrades:

Miscellaneous:

Equity futures point to a slightly lower open this morning as investors look to extend the Dow's streak of record closes to twelve on Monday. The S&P 500 futures trade two points below fair value.

The Treasury market holds a modest loss on Monday morning after finishing Friday near its three-month high. The benchmark 10-yr yield is currently two basis points higher at 2.33%.

Crude oil shows a solid gain in early action with WTI crude trading 0.7% higher at $54.36/bbl.

On the data front, investors will receive January Durable Orders (Briefing.com consensus 1.8%) and January Pending Home Sales (Briefing.com consensus 0.9%). The two reports will cross the wires at 8:30 am ET and 10:00 am ET, respectively.

In U.S. corporate news:

Reviewing overnight developments:

Gapping up: LJPC +51.1%, GOGO +5.3%, PTEN +3.4%, FIT +2.6%, LPX +2.5%, TEO +2.4%, MU +2.0%, VSTO +2.0%.

Gapping down: NVFY -11.5%, DRYS -10.3%, KEM -9.1%, SPKE -7.0%, PERI -5.2%, JKS -3.8%, URBN -3.3%, TSLA -2.1%, SNN -1.7%, SNCR -1.6%.

Eurozone Periphery Yields Decline

Under the agreement, SK Telecom and Nokia will conduct joint R&D activities to achieve interworking between SK Telecom's Quantum Key Distribution Systemand Nokia's next-generation optical transport system by the second half of this year.

Earnings: GOGO +5.3%, LUK +3.0%.

General news:

Analyst actions:

The AN/ALR-69A(V) — the world's first all-digital radar warning receiver — enhances aircrew survivability, providing «sensors forward» situational awareness at lower costs than competing systems through simple software modifications.

The S&P 500 futures trade three points below fair value.

Just in, January durable goods orders rose 1.8%, which is in line with the Briefing.com consensus. The prior month's reading was revised to -0.8% (from -0.4%). Excluding transportation, durable orders declined 0.2% (Briefing.com consensus +0.5%) to follow the prior month's revised gain of 0.9% (from 0.5%).

Earnings related: BCRX -16.2%, SSTK -11.4%, JKS -2.2%

General news:

Analyst actions:

The S&P 500 futures trade two points below fair value.

Equity indices in the Asia-Pacific region began the week on a lower note, but no major index lost more than 1.0%. Japan's Nikkei (-0.9%) ended among the laggards while the yen has slipped 0.3% against the dollar to 112.47. Elsewhere, China Securities Regulatory Commission Chairman Liu Shiyu said that China is ready for a larger supply of IPOs, thanks to a stronger than expected recovery from a swoon in 2015.

---Equity Markets---

Major European indices trade in mixed fashion with Italy's MIB (+1.0%) showing relative strength. Italy's Democratic Party has scheduled a primary vote for April 30, which is seen as a precursor to a general election being called later in the year. Elsewhere, Fitch affirmed Greece's sovereign rating at ‘CCC' while Moody's affirmed Germany's ‘AAA' rating with a ‘Stable' outlook. On a separate note, the British pound is down 0.4% against the dollar at 1.2412 amid reports Scotland may conduct another independence referendum once the UK triggers article 50.

---Equity Markets---

Gapping up:

Earnings: GOGO +5.3%, LUK +3.0%.

General news:

Analyst actions:

Gapping Down:

Earnings related: BCRX -16.2%, SSTK -11.4%, JKS -2.2%

General news:

Analyst actions:

Filings:

Offerings:

Pricings:

GOGO +11% premarket.

Equity futures point to a slightly lower open on Monday as investors contemplate profit-taking against a go at another record close. The S&P 500 futures trade two points below fair value.

The Treasury market is under pressure this morning after finishing Friday's session near its three-month high. The benchmark 10-yr yield is higher by two basis points at 2.33%.

Conversely, crude oil has shaken off Friday's poor performance to hold a solid gain of 0.9% ahead of today's opening bell. WTI crude currently trades at $54.48/bbl.

Corporate news has been relatively light this morning. Warren Buffett did create some pre-market movement after acknowledging that Berkshire Hathaway (BRK.b 171.10, +0.88) has more than doubled its stake in Apple (AAPL 137.14, +0.49) since the end of 2016. Shares of AAPL have added 0.4% in pre-market action.

On the data front, January durable goods orders rose 1.8%, which was in line with the Briefing.com consensus. The prior month's reading was revised to -0.8% (from -0.4%). Excluding transportation, durable orders declined 0.2% (Briefing.com consensus +0.5%) to follow the prior month's revised gain of 0.9% (from 0.5%).

Today's last economic report, January Pending Home Sales (Briefing.com consensus 0.9%), will cross the wires at 10:00 am ET.

The S&P 500 opened Monday's session below its flat line, showing a loss of 0.2%.

Financials (+0.2%) show relative strength while countercyclical spaces like consumer staples (-0.5%) and utilities (-0.5%) show relative weakness.

The top-weighted technology sector (-0.3%) performs just behind the broader market. The group's top component by weight, Apple (AAPL 136.39, -0.27), trades lower by 0.2% despite the company showing a modest gain in pre-market trade earlier this morning.

Key Points From Last Quarter

Metric Guidance:

Analyst Notes:

Options Activity

Technical Perspective

PCLN shares have slightly outperformed the Nasdaq YTD with PCLN increasing by 11% vs 8% gain in the index. PCLN tends to have 4-6% reactions to earnings. On a positive report, look for resistance near the $1650-1655 area, while support sits near the $1600-1605 vicinity.The tech sector — XLK — trades modestly behind the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.37%. Within the SOX index, AMD (+3.58%) outperforms, while CRUS (-1.07%) lags. Among other major indices, the SPY is trading 0.01% lower, while the QQQ -0.16% and the NASDAQ -0.17% trade modestly lower on the session. Among tech bellwethers, JD (+1.09%) is showing relative strength, while TMUS (-2.14%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 1.12… VIX: (13.43, -0.34, -2.0%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Rumor Activity was active to start out the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

Notable earnings/guidance:

- Trading higher following earnings/guidance: BID +14.4%

In the news:- Leaders: KATE 2.2% KORS 0.6% COH 1.7% (Michael Kors and Coach move into second round of bidding for Kate Spade, according to Reuters), CAT 1.7% (President Trump at Governor's meeting reiterates he will make statements regarding infrastructure plan during Tuesday's address to Congress),

- Laggards: KHC -1.5% (Warren Buffet on CNBC says KHC is not planning hostile takeover of Unilever; there is no «backup deal»; prices in the space would make other deals less attractive), RAD -0.2% (pulling back after initially seeing early strength on CTFN article discussing speculation that the company's pending merger with Walgreens could soon be approved by the FTC)

- Nearly unchanged: PAG flat (files mixed securities shelf offering)

Other notable trends:- Homebuilding / contruction names are seeing notable strength following pending home sales data and ahead of Trump's Tuesday speech (infrastructure topic among items to be discussed). LGIH +2.6%, CAA +2.3%, MTH +2.2%, HOV +1.9%, LEN +1.9%, BZH +1.8%, PHM +1.6%, TMHC +1.5%, DHI +1.5%, MHO +1.4%, KBH +1.3%, ITB +1.3%, TOL +1.2%, XHB +1%, WLH +0.7%, MDC +0.7%

Analyst related:Looking ahead:

Gainers on news:

- HTG Molecular Diagnostics (HTGM +165.88%) announced that its new direct-target sequencing chemistry will be available in the company's VERI/O laboratory as a service offering beginning in the first quarter of 2017

- La Jolla Pharm (LJPC +74.34%) announces positive top-line results from athos-3 phase 3 study of LJPC-501; 'primary efficacy endpoint analysis highly statistically significant'

- ViewRay (VRAY +21.43%) receives FDA 510K approval for the Viewray Linac System

Decliners on news:- Bio Blast Pharma (ORPN -6.22%) files for $10 mln ordinary share offering

- EDAP TMS SA (EDAP -4.53%) announced the first prostate ablation treatments performed at the University of Minnesota using its Ablatherm Robotic HIFU

- CEL-SCI Corp (CVM -1.37%) announces that the NYSE has accepted its plan to bring itself into compliance with the Exchange's continued listing standards

Decliners on earnings:- Ritter Pharma (RTTR -7.27%) reports Q4 results

- Horizan Pharma (HZNP -3.9%) beats by $0.13, reports revs in-line; guides Q1 revs in-line; guides Q2 (Jun) revs below consensus; guides FY17 revs in-line

- Halyard Health (HYH -3.09%) beats by $0.06, beats on revs; guides FY17 EPS in-line

Upgrades/Downgrades: