SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Рынки труда и недвижимости.

- 16 февраля 2017, 15:50

- |

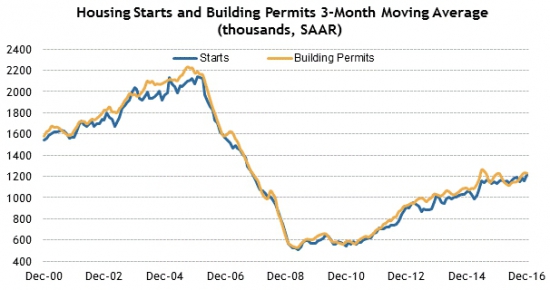

Рынок недвижимости Америки продолжает свою восходящую тенденцию:

Ожидается увеличение показателей и в объёме строительства новых домов и в количестве выданных разрешений на новое строительство за январь. Объём строительства ожидается на уровне 1220 тыс:

Разрешения на новое строительство ожидаются аналитиками на отметке 1230 тыс.:

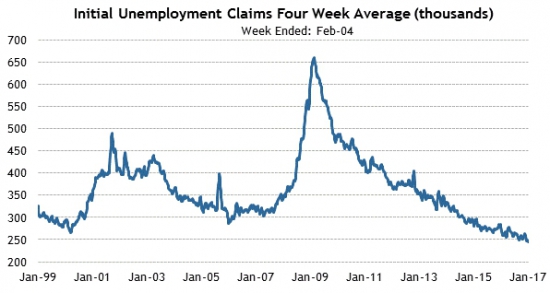

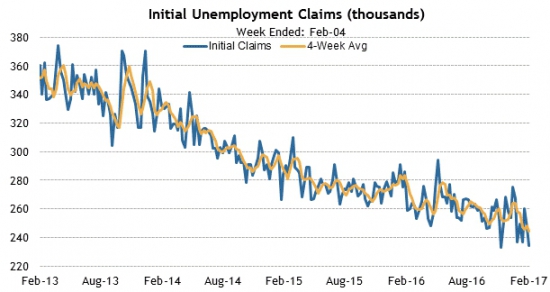

Плановое сокращение безработицы продолжает давать свои плоды и наблюдается продолжение этого многомесячного тренда:

Тем не менее, аналитики осторожны в своих оценках по поводу развития дальнейшей ситуации и ожидают данные выше уровня 240 тыс.:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market updates:

US Econ Data

Equity indices in the Asia-Pacific region ended Thursday on a mostly higher note while Japan's Nikkei (-0.5%) underperformed amid an uptick in the yen (113.69), which has added 0.4% against the dollar. Yesterday's TIC data showed that China increased its holdings of U.S. Treasuries for the first time in seven months. Elsewhere, employment data from Australia showed better than expected overall growth, but gains were entirely due to part time employment.

---Equity Markets---

---FX---

Gapping down: CFMS -38.6%, ACUR -28.4%, GNC -14.7%, MOH -14%, MOH -14%, BBW -12.6%, OMCL -10.8%, HAWK -9%, EVOK -8.8%, NGL -7.5%, CAR -6.5%, CRSP -6.3%, TRIP -5.9%, MZOR -5%, GDDY -4.4%, HIMX -4.4%, CF -3.6%, GRPN -3.4%, MMLP -2.9%, LSCC -2.8%, EQIX -2.8%, CNNX -2.7%, SPWR -2.5%, KHC -2.5%, AEM -2.4%, ATKR -2.2%, HOS -2.2%, TRU -2%, CNC -2%, FSLR -2%, VSLR -1.5%, CYS -1.5%, KGC -1.5%, HTZ -1.4%, SDRL -1.4%, NCI -1.1%, QTWO -1%, FRSH -0.9%, CBS -0.9%, CSV -0.9%, ANH -0.7%, SLF -0.7%, NICE -0.7%

Major European indices trade in the red, but losses have been contained for the time being. The latest policy minutes from the European Central Bank showed that policymakers do not see a convincing upward trend in inflation. Separately, Bundesbank President Jens Weidmann said it would be a mistake to roll back financial market regulations since bad loans triggered the last crisis. Elsewhere, European Commissioner Pierre Moscovici made upbeat comments about an expected bailout review agreement with Greece.

---Equity Markets---

Shares are trading ~1% lower pre-market

Treasuries Try to Stage Rally

Yesterday's bullish sentiment that pushed the major averages to record highs has faded this morning ahead of another wave of economic data. The S&P 500 futures currently trade one point below fair value.

U.S. Treasuries have reversed their bearish trends this morning after posting their fifth consecutive loss on Wednesday. The benchmark 10-yr yield is down two basis points at 2.47%.

Crude oil has climbed 0.5% to recoup yesterday's modest loss. The energy component trades at $53.35/bbl as OPEC supply cuts have provided support against yesterday's Energy Information Administration (EIA) inventory report, which showed a build of 9.5 million barrels.

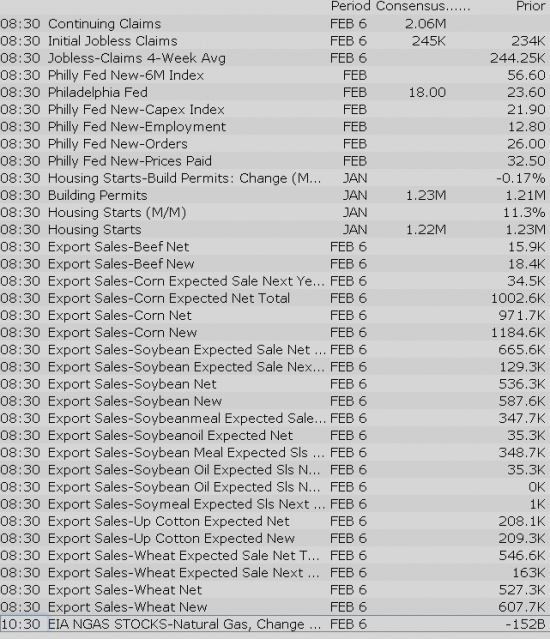

On the data front, Thursday will see January Housing Starts (Briefing.com consensus 1.22 million), Initial Claims (Briefing.com consensus 245K), and the Philadelphia Fed Index for February (Briefing.com consensus 17.5). All three reports will cross the wires at 8:30 am ET.

In U.S. corporate news:

Reviewing overnight developments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

The S&P 500 futures trade two points below fair value.

Housing starts decreased to a seasonally adjusted annualized rate of 1.246 million units in January, down from a revised 1.279 million units in December (from 1.226 million). The Briefing.com consensus expected starts to decrease to 1.220 million units. Building permits increased to a seasonally adjusted 1.285 million in January from a revised 1.228 million (from 1.210 million) for December. The Briefing.com consensus expected a reading of 1.230 million.

The latest weekly initial jobless claims count totaled 239,000 while the Briefing.com consensus expected a reading of 245,000. Today's tally was above the unrevised prior week count of 234,000. As for continuing claims, they declined to 2.076 million from the revised count of 2.079 million (from 2.078 million).

The Philadelphia Fed Survey for February rose to 43.3 from an unrevised 23.6 in January while economists polled by Briefing.com had expected a reading of 17.5.

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

European Debt Rallies as ECB Releases Minutes

The S&P 500 futures trade two points below fair value.

Equity indices in the Asia-Pacific region ended Thursday on a mostly higher note while Japan's Nikkei (-0.5%) underperformed amid an uptick in the yen (113.71), which has added 0.4% against the dollar. Yesterday's TIC data showed that China increased its holdings of U.S. Treasuries for the first time in seven months. Elsewhere, employment data from Australia showed better than expected overall growth, but gains were entirely due to part time employment.

---Equity Markets---

Major European indices trade in the red, but losses have been contained for the time being. The latest policy minutes from the European Central Bank showed that policymakers do not see a convincing upward trend in inflation. Separately, Bundesbank President Jens Weidmann said it would be a mistake to roll back financial market regulations since bad loans triggered the last crisis. Elsewhere, European Commissioner Pierre Moscovici made upbeat comments about an expected bailout review agreement with Greece.

---Equity Markets---

Filings:

Offerings:

Pricings:

Economic Data Summary:

Upcoming Economic Data:

Other International Events of Interest

Investors have paused for a breather this morning after pushing the major averages to record highs yesterday. The S&P 500 futures trade in line with fair value, indicating a flat open on Wall Street.

Traders received another dose of economic data this morning with January Housing Starts, Initial Claims, and the Philadelphia Fed Index for February crossing the wires at 8:30 am ET.

Housing starts decreased to a seasonally adjusted annualized rate of 1.246 million units in January, down from a revised 1.279 million units in December (from 1.226 million). The Briefing.com consensus expected starts to decrease to 1.220 million units. Building permits increased to a seasonally adjusted 1.285 million in January from a revised 1.228 million (from 1.210 million) for December. The Briefing.com consensus expected a reading of 1.230 million.

The latest weekly initial jobless claims count totaled 239,000 while the Briefing.com consensus expected a reading of 245,000. Today's tally was above the unrevised prior week count of 234,000. As for continuing claims, they declined to 2.076 million from the revised count of 2.079 million (from 2.078 million).

The Philadelphia Fed Survey for February rose to 43.3 from an unrevised 23.6 in January while economists polled by Briefing.com had expected a reading of 17.5.

Treasuries have squandered the majority of their gains in the wake of the hotter than expected readings. The benchmark 10-yr yield is lower by one basis point at 2.49%.

On the earnings front, Cisco Systems (CSCO 32.14, -0.68), Kraft Heinz (KHC 88.69, -2.41), Charter Communications (CHTR 322.25, -2.93), and Duke Energy (DUK 76.07, -0.71) reported their quarterly results between yesterday's close and today's open, among others.

The reactions were generally negative. CSCO, KHC, and CHTR have slipped despite beating bottom line estimates (Kraft Heinz also reported better than expected revenues). Conversely, DUK has dropped in reaction to worse than expected earnings.

Investors will not receive any more economic data on Thursday.

The major averages opened Thursday's session with slim gains. The S&P 500 is currently higher by 0.1%.

Nearly half of the sectors trade in the green with technology (+0.3%) showing relative strength. Conversely, financials (-0.1%) have slipped in early action as almost all banks trade below their flat lines.

The Treasury market still holds a modest gain after falling from its overnight high in the wake of this morning's batch of economic data. The benchmark 10-yr yield is one basis point lower at 2.49%.

Natural gas inventory data for the week ending Feb 10, is due out this morning:

The tech sector — XLK — trades ahead of the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -0.02%. Within the SOX index, CRUS (+1.09%) outperforms, while LRCX (-1.07%) lags. Among other major indices, the SPY is trading 0.11% lower, while the QQQ +0.02% and the NASDAQ +0.03% trade modestly higher on the session. Among tech bellwethers, ORAN (+1.21%) is showing relative strength, while CHA (-1.63%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Shares are down 21% following this morning's report

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Casino/gaming names are lower following MGM results: BYD -2.8%, WBAI -1.9%, WYNN -1.6%, LVS -1.2%, PENN -1%, BJK -1%, IKGH -0.7%, MPEL -0.6%, CNTY -0.5%, IGT -0.4%, ISLE -0.2%

- Avon (AVP -16%) is weighing on cosmetic names: COTY -3.2%, EL -0.6%, REV -1.4%, ULTA -0.2%

- Strayer Education (STRA -10%) is leading for profit education names lower. CECO -1.3%, APEI -1.2%, BPI -1%, DV -0.5%, LOPE -0.5%, EDU -0.4%, CPLA -0.3%

In the news:Looking ahead:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.58… VIX: (12.28, +0.31, +2.6%).

Tomorrow is options expiration — Tomorrow, February 17th is the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

- Neuralstem (CUR +16.35%) Announces Last Subject Enrolled in Phase 2 Trial with NSI-189 for Major Depressive Disorder

- Akers Biosciences (AKER +12.5%) announces the USPTO allowed a patent covering the co's cartridge for the optical scanning device used in BreathScan Lync technology

- Medigus (MDGS +11.06%) announces that the China FDA has approved the commencement of the first multi-center MUSE Clinical Study in China

Decliners on news:- Acura Pharma (ACUR -22.84%) to be delisted from the Nasdaq; will begin to trade under the same ticker on the OTCQB on February 23

- Evoke Pharma (EVOK -10.29%) prices 2,413,793 share offering at $2.90/share

Gainers on earnings:- Shire plc (SHPG +2.29%) beats by $0.14, beats on revs; guides FY17; XIIDRA captures 19% market share

- Laboratory Corp (LH +2.3%) reports EPS in-line, beats on revs; guides FY17 EPS in-line, revs in-line

Decliners on earnings:- ConforMIS (CFMS -33.33%) misses by $0.06, beats on revs; guides Q1 revs below consensus; guides FY17 revs below consensus

- CryoLife (CRY -18.41%) beats by $0.01, misses on revs; guides FY17 EPS in-line, revs in-line

- Moline Healthcare (MOH -18.55%) misses earnings and revenue estimates; guides FY17

Upgrades/Downgrades:Biggest point losers: REGN 370.68(-13.32), MOH 49.23(-10.66), EQIX 370.97(-9.79), ASPS 24.82(-5.97), CAR 35.09(-5.58), CHTR 320.5(-4.69), TSLA 275.35(-4.41), TRIP 48.53(-4.17), SYNT 19.19(-4.14), KHC 86.99(-4.1), PXD 193.66(-4.06), TSRO 180.99(-3.62), PANW 151.75(-3.6), CRY 16(-3.55), HAWK 33.85(-3.5), ICPT 129.42(-3.43), ILMN 159.98(-3.31), IBB 291.82(-3.14), RDUS 45.03(-3.03), WST 83.97(-2.99), FANG 108.93(-2.91), BLUE 76.35(-2.9), XIV 64.32(-2.84), DXCM 80.5(-2.76), ZTS 52.45(-2.71)

Stocks that traded to 52 week lows: ALQA, ANGI, AOBC, AXSM, BBW, BIS, BWINB, CERS, COSIQ, COYN, DRRX, DRWI, GBSN, GEC, GEVO, GNC, GTS, ICLD, KONA, MAV, MBRX, NAO, OHRP, PMF, RGSE, SAEX, SHIP, SPWH, SQQQ, ULTRQ, VMEMQ, WMIH

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: AAPC, AC, ACFC, ACTX, ADRE, AIQ, BANF, BBP, BCBP, BICK, BOCH, CART, CATH, CDL, CFA, CFCB, CFO, CHFN, CLBH, CRAI, CVCO, DDF, ELEC, ENFC, ESGE, FAD, FBMS, FBZ, FDT, FEMS, FHY, FONE, FORK, FRBA, FSZ, FTCS, GRP.UT, GRVY, IPKW, ITEQ, JKI, JMP, JSMD, KMM, KRMA, LFGR, LGI, LOR, LVHD, MGIC, MMAC, MPB, NTIC, ONEQ, OSB, PBBI, PEBO, PNQI, PTNR, QCLN, QQXT, RFDI, RFEU, RGT, SBBX, SCKT, SKIS, SWZ, VONG, VTHR, VTWG, WBKC, WOOD, Y

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: CCUR, GSIH, GTXI, NHA, NMRX, PESI, ZBIO

ETFs that traded to 52 week highs: AFK, AMJ, BKF, CUT, DIA, DVY, ECH, EEB, EEM, EFA, EPOL, EPP, EWA, EWC, EWO, EWZ, HYG, IGN, IGV, IHI, ILF, IOO, ITA, IWF, IWM, IYM, KCE, KIE, MDY, OEF, PPA, QQQ, REMX, SKYY, SMH, SPY, UYM, VTI, VWO, XBI, XLK

ETFs that traded to 52 week lows: SMN

Today's top 20 % gainers

- Healthcare: CSLT (3.58 +13.49%), PGNX (10.23 +6.34%), BCRX (6.54 +6.09%)

- Materials: ABX (20.62 +6.73%), VEDL (15.55 +6%)

- Industrials: SRCL (84.13 +8.71%)

- Consumer Discretionary: LILAK (25.14 +15.16%), LILA (25.59 +14.78%), DENN (13.82 +12.36%), KATE (21.99 +11.77%), CHH (63 +8.9%)

- Information Technology: TIVO (21.45 +12.3%), NTES (293.77 +12.19%), EIGI (9.3 +10.06%), SNPS (72.25 +9.05%), QTWO (35.85 +8.97%), RUBI (8.91 +8.07%), SSNC (35.12 +7.04%)

- Energy: CVI (22.94 +6.55%)

- Consumer Staples: ANDE (40.85 +5.97%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: VRX (20.95 mln -2.91%), PFE (18.64 mln +0.51%), NVAX (15.59 mln -5.56%)

- Materials: VALE (17.54 mln -0.18%), ABX (16.16 mln +6.73%), CLF (14.36 mln -1.69%), FCX (12.9 mln -1.98%)

- Consumer Discretionary: MGM (28.08 mln -6.79%), GRPN (14 mln +0.86%), SIRI (13.8 mln +1.23%), GNC (11.85 mln -10.82%)

- Information Technology: CSCO (24.88 mln +3.03%), AMD (24.05 mln -2.29%), MU (12.46 mln +0.15%)

- Financials: BAC (46.25 mln -0.57%), FIG (18.86 mln -0.13%)

- Energy: ECA (15.71 mln -1.33%), CHK (14.64 mln -2.37%), MRO (13.19 mln -0.4%)

- Consumer Staples: AVP (15.63 mln -18.09%)

Today's top relative volume (current volume to 1-month average daily volume)