SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Доходность казначейских векселей.

- 13 февраля 2017, 17:27

- |

Традиционно понедельник начинается без значительных событий. Данные по доходности казначейских векселей аналитиками ожидаются на уровне 0,54 для трехмесячных векселей:

И на уровне 0,6 для шестимесячных векселей:

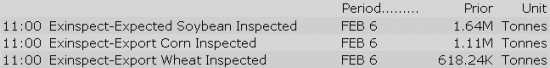

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Major European indices trade in the green with the UK's FTSE (+0.1%) struggling to keep pace with its peers. In Spain, caretaker Prime Minister Mariano Rajoy was re-elected to a fourth term as the head of the Popular Party. Separately, Greece has remained in the headlines with European Commission President Jean-Claude Juncker saying the third aid program to Greece is on shaky ground due to the magnitude of the problem. In addition, Mr. Juncker said he will not seek a second term in 2019.

---Equity Markets---

Treasuries Start Week in Red

Equity futures are in position to add to last week's gains this morning as the S&P 500 futures trade five points above fair value. This comes on the heels of the S&P 500's third consecutive weekly advance with the benchmark index rising 0.8% last week.

U.S. Treasuries are under selling pressure this morning and on track for their third consecutive loss. The benchmark 10-yr yield is up three basis points at 2.44%.

Crude oil is down 0.6% as some investors engage in profit taking ahead of OPEC's first report on production cut compliance. The energy component currently trades at $53.51/bbl.

Investors will not receive any economic data on Monday.

In U.S. corporate news:

Reviewing overnight developments:

FY17 guidance assumes no generic Copaxone competition — potential impact of 1-2 generic competitors to Copaxone 40 mg launching in Feb 17 in the U.S: Revenues decrease $1.0 — $1.3 billion (from 1.0-1.2 bln); EPS decrease $0.75 — $0.95 (up from $0.65-0.80).

Q1 will be the lowest of the four quarters; 40% of 2017 EPS will be generated in Q1-Q2; 60% in Q3-Q4; majority of U.S. Gx launches expected only in the second half of 2017

Copaxone accounted for 36% of profit in Q4

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metal producer stocks trading higher:

Other news:

Analyst comments:

Equity indices are on track to open the week higher as the S&P 500 futures trade six points above fair value.

Earnings news has been relatively quiet this morning, but will pick up later in the week with Express Scripts (ESRX 68.13, -0.28), PepsiCo (PEP 106.20, +0.10), AIG (AIG 65.70, +0.09), Cisco Systems (CSCO 31.59, +0.08), T-Mobile US (TMUS 61.15, -1.24), Kraft Heinz (KHC 90.20, 0.00), Duke Energy (DUK 78.10, 0.00), Marriott (MAR 86.45, 0.00), Pacific Gas & Electric (PCG 63.35, +0.46), Deere (DE 110.10, -0.14), CBS (CBS 64.40, 0.00), and DaVita HealthCare (DVA 64.87, +0.12) all scheduled to report.

The same can be said on the data front. Investors will not receive any economic data today, but January PPI (Briefing.com consensus 0.3%), January CPI (Briefing.com consensus 0.3%), January Retail Sales (Briefing.com consensus 0.1%), January Industrial Production (Briefing.com consensus 0.0%), and January Housing Starts (Briefing.com consensus 1220K) are scheduled to be released later in the week, among others.

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

European Debt Sees Mixed Session, Le Pen Odds Tick Up

The S&P 500 futures trade five points above fair value.

Equity indices in the Asia-Pacfic region began the week on a broadly higher note. The weekend meeting between President Donald Trump and Prime Minister Shinzo Abe featured a commitment to joint defense spending. Mr. Trump reiterated that the United States is determined to defend Japan after North Korea conducted a missile test on Sunday.

---Equity Markets---

Major European indices trade in the green with the UK's FTSE (+0.2%) struggling to keep pace with its peers. In Spain, caretaker Prime Minister Mariano Rajoy was re-elected to a fourth term as the head of the Popular Party. Separately, Greece has remained in the headlines with European Commission President Jean-Claude Juncker saying the third aid program to Greece is on shaky ground due to the magnitude of the problem. In addition, Mr. Juncker said he will not seek a second term in 2019.

---Equity Markets---

Filings:

Offerings:

Pricings:

The equity market is on track to open Monday's session in positive territory as the S&P 500 futures trade seven points (0.3%) above fair value.

Conversely, U.S. Treasuries trade in the red this morning to extend Friday's downtick. The benchmark 10-yr yield is three basis points higher at 2.44%.

Earnings news has been relatively quiet with only a handful of names reporting quarterly results this morning. Most notably, Teva Pharma (TEVA 33.49, +1.30) has jumped 4.1% after reporting better than expected top and bottom lines.

Elsewhere on the corporate front, Verizon (VZ 48.36, -0.62) has slid 1.3% in pre-market trade after announcing that it will begin offering an unlimited data plan. The move is a response to growing competition in the wireless space as smaller companies like T-Mobile US (TMUS 61.50, -0.89) and Sprint (S 8.66, -0.30) have gained ground on Verizon and fellow industry heavyweight AT&T (T 41.05, -0.33) with their unlimited offerings.

Investors will not receive any economic data on Monday. The first notable report of the week will be Tuesday's 8:30 am ET release of January CPI (Briefing.com consensus 0.3%).

Upcoming Fed/Treasury Events:

Other International Events of Interest

The major indices opened Monday's session in the green with the S&P 500 holding a gain of 0.3%.

The financial sector (+0.7%) is the early leader with JPMorgan Chase (JPM 88.08, +1.09), Bank of America (BAC 23.40, +0.31), and Goldman Sachs (GS 247.21, +4.58) up between 1.3% and 1.9%. Industrials (+0.7%) and materials (+0.5%) also outperform the benchmark index.

At the bottom of the leaderboard is the telecom services space (-1.2%) thanks to losses from sector heavyweights Verizon (VZ 48.53, -0.45) and AT&T (T 40.81, -0.56). The two names are down 1.1% and 1.4%, respectively.

The tech sector — XLK — trades modestly behind the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.39%. Within the SOX index, ON (+5.02%) outperforms, while NVDA (-2.19%) lags. Among other major indices, the SPY is trading 0.40% higher, while the QQQ +0.44% and the NASDAQ +0.17% trade modestly higher on the session. Among tech bellwethers, QCOM (+1.33%) is showing relative strength, while ADBE (-0.39%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.62… VIX: (11.30, +0.45, +4.2%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

- Zosano Pharma (ZSAN +71.67%) announces its lead product candidate, M207, achieved both co-primary endpoints of pain freedom and most bothersome symptom freedom at 2 hours in the recently completed ZOTRIP trial

- XOMA (XOMA +17.12%) agrees to sell 1,200,000 shares of its common stock and 5,003 shares of convertible preferred stock directly to Biotechnology Value Fund, L.P. and certain of its affiliates; BVF agreed to purchase the shares of common stock from the Co pursuant to a subscription agreement at a price of $4.03/share

- SAGE Therapeutics (SAGE +12.78%) announces 'encouraging' top-line results from its Phase 2 clinical trial of orally-administered SAGE-217 for the treatment of major depressive disorder; study 'demonstrates positive signal of activity and tolerability'

Decliners on news:- Signal Genetics (SGNL -19.31%) stockholders approved all of the merger-related proposals including the issuance of common stock, note conversion and reverse stock split

- XTL Biopharma (XTLB -9.59%) Expands Clinical Advisory Board to Support Phase II Study of HCDR1 in Sjogren's Syndrome

- Axovant Sciences (AXON -5.13%) announces preliminary results from the planned interim analysis of the first 11 patients to complete its Phase 2 study of nelotanserin in Lewy body dementia patients; Beneficial treatment effect observed on the pre-specified primary endpoint of Unified Parkinson's Disease Rating Scale Parts II + III

Gainers on earnings:- Teva Pharma (TEVA +4.01%) beats by $0.02, beats on revs; reaffirms FY17 EPS and rev guidance

Upgrades/Downgrades:Biggest point losers: HAIN 34.2(-4.33), NVDA 109.69(-3.93), CYNO 51.33(-3.73), CHTR 321.37(-3.19), UBNT 50.33(-3.1), KNL 24.06(-3), WEX 116.59(-2.7), EXPE 120.21(-2.44), TMUS 60.5(-1.89), FANG 103(-1.79), AVB 178.14(-1.73), ATVI 45.58(-1.65), LNCE 37.56(-1.63), CSOD 40.48(-1.6), OXY 67(-1.47), COLM 58.4(-1.43), CARA 13.57(-1.28), EVHC 67.19(-1.25), INCY 120.45(-1.25), APC 68.12(-1.22), EQT 63.14(-1.21), NBIX 43.27(-1.17), INOV 11.18(-1.08), EOG 100.41(-1.03), AEM 49.81(-1.02)

Rumor Activity was active to start out the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

Stocks that traded to 52 week lows: ANGI, AOBC, CIE, COSIQ, DCTH, DHX, DPRX, GBSN, GEVO, HAIN, ICLD, JRJC, NAO, NCMI, OHRP, RELY, RGSE, RWLK, SHIP, SPWH, SQQQ, STAF, TDW, TVIX, ULTRQ, VMEMQ, VNRSQ, VRA

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: VISN

ETFs that traded to 52 week highs: BKF, CROP, DBB, DIA, DVY, EEB, EFA, EPOL, EPP, EPU, EWA, EWC, EWJ, EWO, EWT, HYG, IAI, IGN, IGV, IOO, ITA, IWF, IWM, IYF, IYG, IYJ, IYM, JJC, KBE, KCE, KIE, KRE, MDY, MOO, OEF, PHO, QQQ, REMX, SKYY, SLX, SPY, UWM, UYG, UYM, VTI, VWO, XLF, XLI, XLK, XLY, XME

ETFs that traded to 52 week lows: NIB, SMN, VXX

Today's top 20 % gainers

- Healthcare: ZLTQ (55.63 +12.61%), SAGE (53.39 +12.59%), CRBP (7.75 +9.14%), MNKD (0.56 +8.3%), MYGN (16.9 +5.69%)

- Materials: CC (31.79 +13.01%), VALE (11.3 +8.03%), CLF (12.03 +7.89%), X (40.23 +6.99%)

- Industrials: CMRE (6.03 +8.06%)

- Information Technology: AAOI (35.49 +8.67%), ACIA (60.29 +7.62%), TRVG (13.28 +7.27%), SWIR (26.2 +7.16%), ON (15.03 +6.29%)

- Financials: FBC (28.26 +9.79%), SBCF (25.03 +8.78%)

- Energy: STNG (3.83 +6.98%)

- Telecommunication Services: GSAT (1.44 +6.71%), I (3.85 +6.65%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: ZLTQ (15.73 mln +12.61%), TEVA (11.75 mln +3.85%)

- Materials: CLF (34.73 mln +7.89%), VALE (33.41 mln +8.03%), AKS (17.48 mln +3.34%), X (12.38 mln +6.99%), FCX (12.13 mln +2.19%), MT (11.24 mln +4.74%),

- Industrials: GE (8.74 mln +0.61%)

- Consumer Discretionary: F (11.79 mln -0.08%)

- Information Technology: AMD (22.46 mln +0.81%), NVDA (14.36 mln -3.44%), TWTR (11.84 mln +0.74%), ON (9.65 mln +6.29%), AAPL (9.64 mln +0.92%), ATVI (9.53 mln -3.55%)

- Financials: BAC (45.66 mln +1.73%)

- Energy: CHK (8.75 mln -0.78%)

- Telecommunication Services: S (12.05 mln -1%), T (10.18 mln -1.08%)

Today's top relative volume (current volume to 1-month average daily volume)The Industrials sector (XLI) is trading 1% higher today, higher than the broader market (SPY +0.5%). In a quiet day for the Industrial Sector, Avis Budget (CAR +0.2%) and Travel (TVPT +0.1%) sign new, multi-year partnership agreement, and Deluxe (DLX +0.3%) will acquire 100% of the stock of RDM Corp of Canada for approx. $70 mln in cash.

Earnings/Guidance

Additional Industrials reporting earnings/guidance: EVI +18% DCIX +12.4%

News

Broker Research

Upgrades

Downgrades

Other

Notable earnings/guidance:

- Trading higher following earnings/guidance: QSR +2.1%

In the news:- comScore reported Q4 U.S. retail e-commerce spending from desktop computers and mobile devices +18% (AMZN +1.6%).

- Leaders: M 3.3% (outperforming amid ongoing M&A speculation despite CNBC's David Faber reporting a potential takeover of Macy's by Hudson's Bay seems unlikely), LRLCY 1.4% (Sunday Times UK reported on possible buyers for The Body Shop from Loreal), LEA 1.2% (announces increase in the Co's share repurchase authorization to $1 billion; increases quarterly dividend to $0.50/share from $0.30/share), SHO 0.4% (Sunstone Hotel announces the sale of Fairmont Newport beach for $125.0 mln; results in an estimated net book gain of approximately $44 mln and is estimated to increase 2017 taxable income by approximately $37 mln), SGMS 0.7% (appoints of Karin-Joyce Tjon as Chief Operating Officer and President effective February)

- Laggards: VRA -5.6% (CFO leaving) AOBC -4% and RGR -1% (reports that fishing and hunting chain Gander Mountain is mulling a possible bankruptcy filing), SHLD -3.9% (continued weakness; issues formal response to reports it and Kmart removed Trump products from their websites), KORS -0.6% (files to delay its 10-Q due to technical issue with its information technology reporting systems; does not expect previously reported ending cash balance of $368.8 million as of December 31, 2016 to change), DAN -0.3% (to purchase axle housing and driveline shaft manufacturing operations from U.S. Manufacturing Corporation for $100 mln in cash)

- Nearly unchanged: COH (Coach approved an amendment and restatement of the Company's Bylaws, effective as of February 8, 2017 to add proxy access)

Other notable trends:- Most retail names are in the red today

- Teen/fashion retailers: BKE -3%, TLYS -2.5%, EXPR -1.8%, FRAN -1.3%, AEO -1.3%, LB -1%, URBN -0.7%, GES -0.6%, ANF -0.4%

- Discount retailers. TUES -3.8%, CATO -2.2%, BIG -2.2%, FIVE -2.2%, SSI -1.1%, SMRT -0.8%, FRED -0.8%, ROST -0.7%, TJX -0.5%

Analyst related:Looking ahead:

The broader market makes fresh all-time highs after finishing last week on a high note, led higher now by the Dow Jones Industrial Average which gains about 122 points (+0.60%) to 20391, the Nasdaq Composite adds 29 (+0.50%) to 5762, and the S&P 500 is up about 10 (+0.43%) to 2326. Action has come on mixed average volume (NYSE 308 vs. avg. of 321; NASDAQ 794 mln vs. avg. of 780), with advancers outpacing decliners (NYSE 1750/1212, NASDAQ 1670/1095) and new highs outpacing new lows (NYSE 226/4, NASDAQ 261/18).

Relative Strength:

Steel-SLX +3.8%, Emrg. Mkts. M. East&Africa-GAF +3.2%, Rare Earth Metals-REMX +2.7%, Copper Miners-COPX +1.9%, Metals&Mining-XME +1.7%, Israel-EIS +1.6%, US Broker/Dealers-IAI +1.4%, Turkey-TUR +1.3%, Vietnam-VNM +1.3%, Banking-KBE +1.2%, Reg. Banking-KRE +1.2%, China Lg. Cap-FXI +0.9%, Italy-EWI +0.7%, France-EWQ +0.6%.

Relative Weakness:

US Nat Gas-UNG -2.8%, Sugar-SGG -2.6%, Short-Term Futures-VXX -2.3%, US Gasoline-UGA -2.3%, Cocoa-NIB -1.9%, Colombia-GXG -1.6%, US Oil-USO -1.4%, Gold Miners-GDX -1.3%, Greece-GREK -1.1%, Mexico-EWW -0.7%, Chinese Yuan-CYB -0.6%, Russia-RSX -0.6%, India-INP -0.5%, Australian Dollar-FXA -0.5%.

The major averages have ridden investors' bullish bias to fresh record highs in the first half of Monday's session. The benchmark S&P 500 has increased steadily since posting a modest gain at the opening bell, and now hovers 0.5% above its flat line at midday.

Monday's upbeat sentiment has stemmed from the continued optimism surrounding President Trump's upcoming tax-related announcement, which is expected in the coming weeks. The president has called the plan «phenomenal» but has yet to give any specific details. Still, investors have appeared to take comfort in in the announcement as a sign that the new administration is looking to make good on the pro-growth promises of Mr. Trump's presidential campaign.

Financials (+1.2%) have provided strong sector leadership again today, similar to last Thursday following the news of the president's tax-related announcement. Industrials (+0.9%) have also outperformed the broader market with sector heavyweight Caterpillar (CAT 98.62, +2.31) leading the advance.

The industrial sector has profited from a recent U.S. Department of Homeland Security report which showed the cost of President Trump's proposed barrier along the U.S./Mexico border to be greater than it was originally estimated. However, Mr. Trump promised to bring the costs back down once he steps up to the negotiation table.

The lightly-weighted telecom services sector (-1.1%) has set up camp at the opposite end of today's leaderboard. Shares of Verizon (VZ 48.54, -0.43) trade 0.9% lower after the company announced that it will begin offering an unlimited data plan. The move is a response to growing competition in the wireless space as smaller companies like T-Mobile US (TMUS 60.64, -1.75) and Sprint (S 8.85, -0.11) have gained ground on Verizon and fellow industry heavyweight AT&T (T 40.80, -0.57) with their unlimited offerings.

Energy (-0.3%) is the only other sector that resides in negative territory at midday. The space's loss has been spurred by a 1.9% decline in crude oil, which currently trades at $52.84/bbl.

In the Treasury market, longer-dated issues hold the majority of their earlier losses while shorter-dated issues have ticked back up to their flat lines in recent action. The benchmark 10-yr yield is two basis points higher at 2.43% while the 2-yr yield is unchanged at 1.20%.

Investors did not receive any economic data today.

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.94… VIX: (11.15, +0.30, +2.8%).

This Week is options expiration — Friday, February 17th is the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Events and conferences of interest for tomorrow, December 14th include:

Conference in progress:

Dollar Grinds Higher

Crude oil (USO, -1.4%) futures down today, ending a 3 day rally. Natural gas (UNG, -3%) continued Friday's losses.

Notable Gainers:

Notable Laggards:

Earnings/News