SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Данные по оптовым запасам и новым рабочим местам.

- 10 января 2017, 16:34

- |

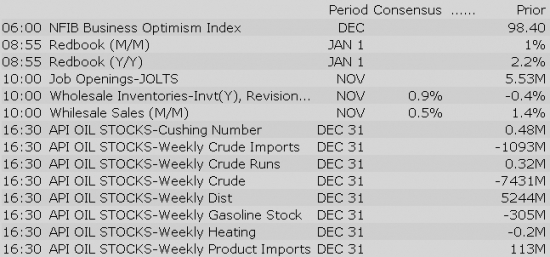

Показатель запасов на складах ожидается на уровне 0.9%. Это самый высокий процент за весь предыдущий год на смешанной динамике:

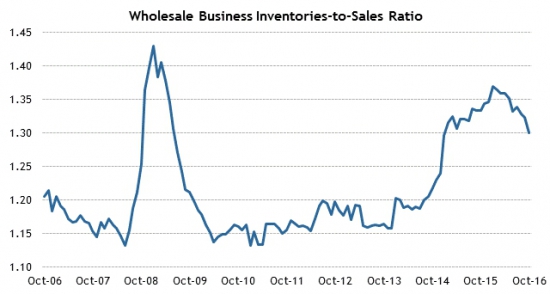

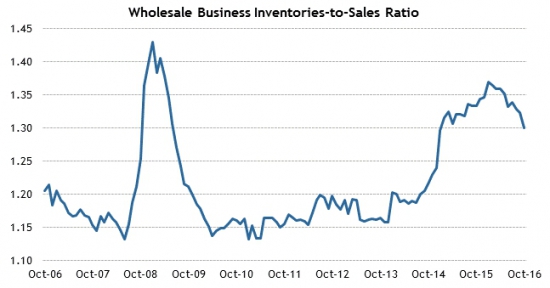

Основные всплески идут по металлургической отрасли и здравоохранению. При этом, показатель запасов-к-продажам имеет выраженный разворот на графике и продолжает падение:

Количество новых рабочих мест находится на отметке 5,534 миллиона. Средний показатель с 2000-го года находится на уровне 3,9 млн. Поэтому, несмотря на ожидаемое аналитиками сокращение количества новых рабочих мест, показатель внушает оптимизм:

Все новости:

Данные: Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Gapping down: HGG -23.7%, AKER -22.6%, WMB -8.8%, FRSH -7.1%, WPZ -6.4%, WDFC -5.8%, BOOT -5.4%, ATW -5.2%, CIO -4.3%, CRAY -4.2%, HALO -4.1%, DB -2.4%, SCVL -2.3%, ABMD -2.2%, ZLTQ -2.1%, DM -1.5%, FLDM -1%, ICLR -0.5%

Treasuries Flatline Despite Surging Small Business Optimism

Equity futures are flat ahead of Tuesday's open with the S&P 500 futures trading one point above fair value. Global markets are mixed with Asia closing on a mostly lower note while European indices hold modest gains.

Crude oil spent most of the overnight session near its flat line and remains at the same level this morning. The commodity is modestly higher, up 0.3% at $52.11/bbl.

After an upbeat start to the week, U.S. Treasuries are under modest selling pressure early this morning. The 10-yr yield is higher by two basis points at 2.39%.

Today's economic data will be limited to November Job Openings (JOLTS) and November Wholesale Inventories (Briefing.com consensus 0.9%). Both reports will be released at 10:00 am ET.

In U.S. corporate news of note:

Reviewing overnight developments:

Upgrades:

Downgrades:

Miscellaneous:

European Yields Dip