SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Потребительское кредитование.

- 09 января 2017, 16:57

- |

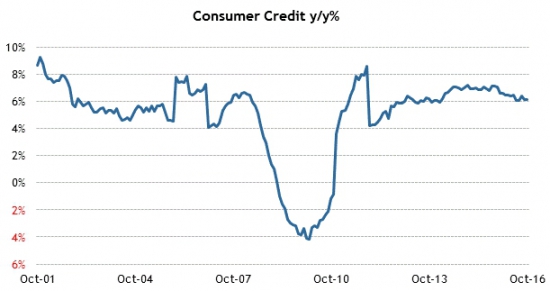

После бурной пятницы и прострела недели к новым вершинам, понедельник ожидается безветренный. Данные по потребительскому кредитованию беспокоят рынок только в моменты неопределенности. Общая картина показывает замедление роста с 2014-го года и плавное его сокращение:

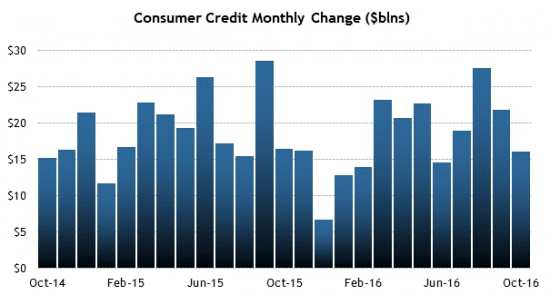

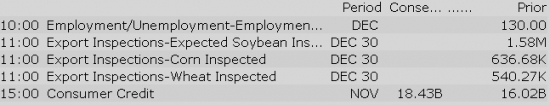

На помесячной диаграмме цикл приближается к своим нижним значениям, аналитики ожидают уверенное восстановление роста показателя к весне. Данные по ноябрю с учетом сезона и пересмотров сентябрьского показателя на 2,5 миллиарда в октябре, ожидаются на отметке 19.3 миллиарда:

Все новости:

Данные: Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Upgrades:

Downgrades:

Miscellaneous:

European Government Bonds Rally as Pound Drops on Hard Brexit Fear

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher: KGC +5.4%, VALE +4%, AUY +3.2%, GFI +2.8%, MUX +2.3%, GG +2.3%, AG +2.3%, GDX +2.2%, SLW +2%, ABX +1.9%, NEM +1.8%, AKS +1.1%

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select financial related names showing weakness:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher: KGC +5.4%, VALE +4%, AUY +3.2%, GFI +2.8%, MUX +2.3%, GG +2.3%, AG +2.3%, GDX +2.2%, SLW +2%, ABX +1.9%, NEM +1.8%, AKS +1.1%

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select financial related names showing weakness:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

The S&P 500 futures trade four points below fair value.

Equity indices in the Asia-Pacific region began the trading week on a mostly higher note while Japan's Nikkei was closed for Coming of Age Day. The closure has not prevented the yen from advancing 0.4% against the dollar to 116.51. Separately, China saw its sixth consecutive monthly decline in foreign reserves, which dropped to $3.01 trillion from $3.05 trillion.

---Equity Markets---

Major European indices trade in negative territory with Italy's MIB (-1.8%) leading the retreat amid weakness in bank stocks. Elsewhere, the UK's FTSE (+0.3%) outperforms amid a 1.1% dive in the pound (1.2157) against the dollar after British Prime Minister Theresa May reiterated her country will leave the single market.

---Equity Markets---

Filings:

разве эти экономические данные помогают?