SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. margintrader

Berny Madoff must read

- 05 апреля 2012, 23:03

- |

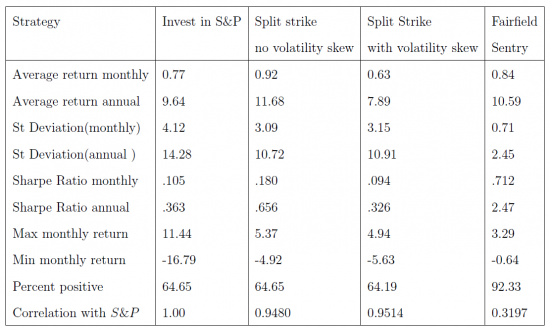

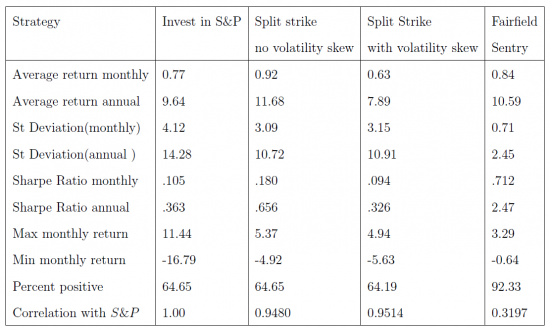

Статья 2009 года, в которой дается попытка воспроизвести стратегию. Там же приведены исторические результаты Fairfield Sentry Fund.

«It is now known that the very impressive investment returns generated by Bernie

Madoff were based on a sophisticated Ponzi scheme. Madoff claimed to use a split

strike conversion strategy. This strategy consists of a long equity position plus a long

put and a short call. In this paper we examine Madoff's returns and compare his

investment performance with what could have been obtained using the split strike

conversion strategy based on the historical data. We also analyze the split strike

strategy in general and derive expressions for the expected return standard deviation

and Sharpe ratio of this strategy.»

tinyurl.com/86qd5vy

А вот статья 2001 года (т.е. до того как Понзи пришел конец).

«Mention Bernard L. Madoff Investment Securities to anyone working on Wall Street at any time over the

last 40 years and you’re likely to get a look of immediate recognition.

After all, Madoff Securities, with its 600 major brokerage clients, is ranked as one of the top three

market makers in Nasdaq stocks, cites itself as probably the largest source of order flow for New York

Stock Exchange-listed securities, and remains a huge player in the trading of preferred, convertible and

other specialized securities instruments.

Beyond that, Madoff operates one of the most successful “third markets” for trading equities after

regular exchange hours, and is an active market maker in the European and Asian equity markets. And

with a group of partners, it is leading an effort and developing the technology for a new electronic auction

market trading system called Primex.

But it’s a safe bet that relatively few Wall Street professionals are aware that Madoff Securities could

be categorized as perhaps the best risk-adjusted hedge fund portfolio manager for the last dozen years. Its

$6–7 billion in assets under management, provided primarily by three feeder funds, currently would put it

in the number one or two spot in the Zurich (formerly MAR) database of more than 1,100 hedge funds,

and would place it at or near the top of any well-known database in existence defined by assets.»

tinyurl.com/6umxgjt

«It is now known that the very impressive investment returns generated by Bernie

Madoff were based on a sophisticated Ponzi scheme. Madoff claimed to use a split

strike conversion strategy. This strategy consists of a long equity position plus a long

put and a short call. In this paper we examine Madoff's returns and compare his

investment performance with what could have been obtained using the split strike

conversion strategy based on the historical data. We also analyze the split strike

strategy in general and derive expressions for the expected return standard deviation

and Sharpe ratio of this strategy.»

tinyurl.com/86qd5vy

А вот статья 2001 года (т.е. до того как Понзи пришел конец).

«Mention Bernard L. Madoff Investment Securities to anyone working on Wall Street at any time over the

last 40 years and you’re likely to get a look of immediate recognition.

After all, Madoff Securities, with its 600 major brokerage clients, is ranked as one of the top three

market makers in Nasdaq stocks, cites itself as probably the largest source of order flow for New York

Stock Exchange-listed securities, and remains a huge player in the trading of preferred, convertible and

other specialized securities instruments.

Beyond that, Madoff operates one of the most successful “third markets” for trading equities after

regular exchange hours, and is an active market maker in the European and Asian equity markets. And

with a group of partners, it is leading an effort and developing the technology for a new electronic auction

market trading system called Primex.

But it’s a safe bet that relatively few Wall Street professionals are aware that Madoff Securities could

be categorized as perhaps the best risk-adjusted hedge fund portfolio manager for the last dozen years. Its

$6–7 billion in assets under management, provided primarily by three feeder funds, currently would put it

in the number one or two spot in the Zurich (formerly MAR) database of more than 1,100 hedge funds,

and would place it at or near the top of any well-known database in existence defined by assets.»

tinyurl.com/6umxgjt

2 комментария

Владимир вы работали в Норд капитал в 2010?

- 05 апреля 2012, 23:25

С ними да, до сих пор работаю.

- 06 апреля 2012, 00:00

теги блога cutlоsses

- aapl

- BATS

- CME

- ETF

- fed

- forts

- FX

- GMCR

- insider123

- IPO

- IT Invest

- MF Global

- Ray Dalio

- topsteptrader

- United Traders

- xelius

- авто

- альтернативные инвестиции

- батл

- биография

- бред

- венчурные инвестиции

- виза

- газпром

- грааль

- гуру

- диалог

- диплом

- евро

- задачка

- золото

- инвестиции

- индекс оптимизма

- индекс ртс

- индикаторы

- истории

- итоги месяца

- йога

- кино

- криминал

- майтрейд

- маразм

- ммм

- мысли

- настроение

- непонятки

- общее

- ОИ

- опрос

- отдых от трейдинга

- офис

- оффтоп

- оффтопик

- паттерн

- пиф

- политика

- понты

- поэзия

- приколы

- прогнозы

- профессионалы

- психология

- результат

- Ри

- рф

- семинары

- серебро

- система

- смартлаб

- совесть

- стейт

- стихи

- стратегии

- стриптиз

- теория вероятностей

- тест

- тимофей мартынов

- торговые системы

- точки входа

- тренд

- тренды

- фейл

- фейсбук

- фейспалм

- форекс

- фортс

- фэйл

- хамелеон

- цветные революции

- черный лебедь

- Шаман

- шарлатанство

- шарлатаны

- шарп

- Швейцарский франк

- эквити

- экономика

- эпл

- юмор

- 2011