SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Чикаго, Даллас и Бонды.

- 24 апреля 2017, 15:27

- |

Значительные новости в понедельник выходят редко. Сегодня не исключение, на рынке увидим только немного статистической информации.

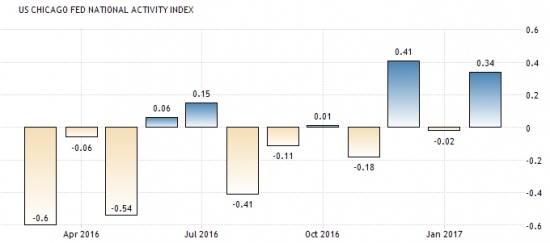

Чикагский индекс деловой активности демонстрирует падение, аналитики ожидают значение 0,15:

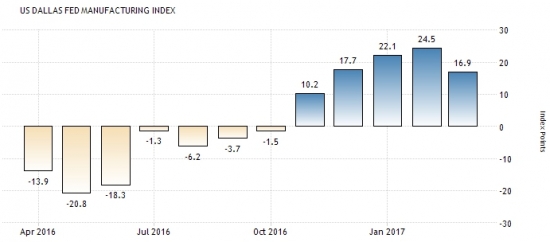

По деловой активности в Далласе также ожидается дальнейший спад:

Трехмесячные бонды выравниваются на отметке 0,8%:

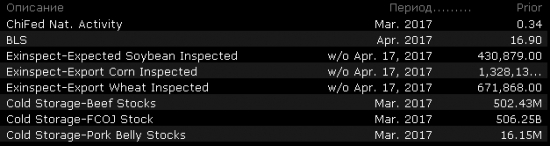

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market Updates:

US Econ Data

Upgrades:

Downgrades:

Miscellaneous:

Equity indices in the Asia-Pacific region began the trading week on a mostly higher note. Results from the French presidential election saw Emmanuel Macron receive 23.8% of the vote, meaning he is headed for a May 7 run-off against Marine Le Pen, who secured 21.5% of yesterday's vote. Elsewhere, People's Bank of China Governor Zhou Xiaochuan said that China's 2017 GDP target of 6.5% is within reach.

---Equity Markets---

---FX---

U.S. equity futures are higher by more than 1% this morning as global markets rally on the heels of the first round of France's Presidential election, which was won by centrist Emmanuel Macron.

Macron's victory in the first round of the French election has eased some market concern about the probability of more radical candidates being elected, and potential implications around France's membership in the EU. One of those more radical candidates, Marine Le Pen (far right), will oppose Macron in the runoff round, but polls are suggesting Macron has a 20 point lead. That final runoff round of the election will take place on May 7.

A presidential win for Macron would take the «Frexit» and EU disintegration idea off the table, so the more likely probability of that outcome is having a positive effect on risk assets globally.

The French results have had a positive effect on the euro, which is up 1.2% against the dollar (+0.0128 at $1.0852/euro). French equities are sharply higher, with France's CAC index +4.5%, and French bond yields have come down as concerns about the fate of the EU ease a bit.

The rest of Europe is gaining with France, with Germany's DAX +3.0% and the UK's FTSE is +1.9%. Japan's Nikkei is +1.4%.

Several related ETFs are moving, with French ETF (EWQ) and the German ETF (EWG) both gapping up in early trade. Other related ETFs include Vanguard FTSE Europe (VGK), iShares Europe (IEV), iShares MSCI Eurozone (EZU), SPDR Euro STOXX 50 ETF (FEZ) and the Currencyshares Euro trust (FXE).

Gapping up:

Gapping down:

BCR +20%, BDX -2%

Major European indices trade sharply higher in response to yesterday's vote in France, which has been deemed as favorable to the market. Centrist Emmanuel Macron (23.8%) received the most votes yesterday and will now take part in a run-off on May 7 against Marine Le Pen (21.5%). Investors have cheered yesterday's outcome, but it is worth noting that the strong support behind Ms. Le Pen suggests that parliamentary elections in June will result in National Front becoming the country's opposition party. The euro has jumped 1.2% against the dollar to 1.0860.

---Equity Markets---

Treasuries Plunge as Macron and Le Pen Advance to Second Round

Equity futures trade solidly higher this morning as investors cheer the results of yesterday's French vote. The S&P 500 futures trade 29 points, or 1.3%, above fair value.

Centrist candidate Emmanuel Macron and far-right candidate Marine Le Pen will face-off in the final round of the French presidential election on May 7 after receiving 23.8% and 21.5% of votes in the first round, respectively. Polls suggest that Macron currently has a 20 point lead on Le Pen, which has eased concerns surrounding Le Pen's anti-EU vision for France.

U.S. Treasuries are trading lower across the board this morning amid the risk-on sentiment; the benchmark 10-yr yield is higher by five basis points at 2.30%. Meanwhile, the U.S. Dollar Index (98.92, -0.74) is lower by 0.7% with the greenback losing 1.2% against the euro (1.0857).

After losing nearly 7.0% last week, crude oil is showing strength in early action, up 0.7% at $49.97/bbl. According to Reuters, a panel of OPEC and other allied producers spoke in favor of extending the original OPEC/non-OPEC production cut agreement by another six months.

Investors will not receive any notable economic data on Monday.

In U.S. corporate news:

Reviewing overnight developments:

French/German Spreads Narrow on French Election Relief

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial related names showing strength post French elections:

Select EU stocks trading higher with regional indices higher by 2-5%:

Select oil/gas related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select metals/mining stocks trading lower with Gold Futures -1.5% and Silver -0.6%:

Other news:

Analyst comments:

The S&P 500 futures trade 30 points, or 1.3%, above fair value as investors cheer yesterday's French vote.

Congress will return from its spring recess on Tuesday with just four days to prevent a government shutdown. Reports indicate that congressional Republicans may use the deadline to leverage funding for Mr. Trump's promised barrier along the U.S./Mexico border.

In addition to Capitol Hill, investors will be keeping an eye on the White House this week as President Trump has promised to unveil his tax reform plan, which he says will include a «massive» tax.Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial related names showing strength post French elections:

Select EU stocks trading higher with regional indices higher by 2-5%:

Select oil/gas related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select metals/mining stocks trading lower with Gold Futures -1.5% and Silver -0.6%:

Other news:

Analyst comments:

The S&P 500 futures trade 30 points, or 1.3%, above fair value.

Equity indices in the Asia-Pacific region began the trading week on a mostly higher note. Results from the French presidential election saw Emmanuel Macron receive 23.8% of the vote, meaning he is headed for a May 7 run-off against Marine Le Pen, who secured 21.5% of yesterday's vote. Elsewhere, People's Bank of China Governor Zhou Xiaochuan said that China's 2017 GDP target of 6.5% is within reach.

---Equity Markets---

Major European indices trade sharply higher in response to yesterday's vote in France, which has been deemed as favorable to the market. Centrist Emmanuel Macron (23.8%) received the most votes yesterday and will now take part in a run-off on May 7 against Marine Le Pen (21.5%). Investors have cheered yesterday's outcome, but it is worth noting that the strong support behind Ms. Le Pen suggests that parliamentary elections in June will result in National Front becoming the country's opposition party. The euro has jumped 1.2% against the dollar to 1.0855.

---Equity Markets---

Filings:

Offerings:

Pricings:

Total Machines (March 2017 vs February 2017)

Total Energy & Transportation (March 2017 vs February 2017)

Stocks are trading higher around the globe as investors breathe a sigh of relief following yesterday's French vote. The S&P 500 futures trade 27 points, or 1.1%, above fair value.

Centrist candidate Emmanuel Macron and far-right candidate Marine Le Pen will face-off in the final round of the French presidential election on May 7 after finishing in first and second place, respectively, in the first round. Current polling suggests that Mr. Macron has a 20 point lead on Ms. Le Pen, which has been construed as a positive for investors given Le Pen's anti-EU rhetoric. France's CAC currently trades higher by 4.4% while the euro (1.0863) has added 1.3% against the U.S. dollar.

Back in the U.S., earnings season is alive and well with another batch of companies reporting their quarterly results. Illinois Tool Works (ITW 139.00, +4.13) has jumped 3.1% in pre-market trade after beating top-line estimates and providing upbeat earnings guidance for 2017. Conversely, Kimberly-Clark (KMB 126.75, -3.21) has dropped 2.5% after reporting worse than expected earnings.

Crude oil held a solid gain earlier this morning, but the commodity has since given back all of the advance. WTI crude trades 0.2% lower at $49.53/bbl.

In the Treasury market, U.S. sovereign debt trades lower amid the risk-on sentiment, leaving the benchmark 10-yr yield five basis points higher at 2.30%.

Investors will not receive any economic data on Monday.

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

The S&P 500 opens the week with a solid gain of 1.0%.

Eight of eleven sectors trade in positive territory with the financial group (+2.2%) leading the advance. In general, cyclical sectors outperform their countercyclical peers as investors embrace the day's risk-on sentiment. Only the utilities, telecom services, and real estate sectors trade in the red, showing losses of no more than 0.3%.

In the bond market, Treasuries trade lower across the board, leaving the benchmark 10-yr yield (2.29%) higher by five basis points. For its part, gold is down 1.3% at $1,271.70/ozt.

The tech sector — XLK — trades in-line with the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +1.43%. Within the SOX index, ASML (+2.84%) outperforms, while MU (-1.19%) lags. Among other major indices, the SPY is trading 0.98% higher, while the QQQ +1.06% and the NASDAQ +1.30% trade modestly higher on the session. Among tech bellwethers, ORAN (+6.18%) is showing relative strength, while VZ (-0.45%) lags.

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.99… VIX: (11.92, -2.71, -18.5%).

May 19 is options expiration — the last day to trade May equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

The industrial sector (XLI +1.1%) is trading 0.2% higher than the broader market (SPY +0.9%). In a slow day for the sector (CAT +2.57%) reports retail data.

Earnings/Guidance

Notable Upcoming Industrial Earnings

News

Broker Research

Upgrades

Downgrades

Other

Stocks that traded to 52 week lows: ACHN, BONT, CBRIQ, CERU, CLW, COSIQ, COYN, DDR, DHX, DRYS, DXTR, DYN, EPRSQ, FENX, FI, FTEK, GMANQ, GWW, JRJC, MAT, MNKD, NWBO, OMED, OPHT, PSGLQ, RAD, RENN, RPRX, RWLK, SBH, SQQQ, SSH, TDW, TGLS, TTI, VRX, VTL

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: ACFC, ADRU, AIQ, ARTNA, ASRV, BANF, BBGI, BWFG, CABO, CHCT, CID, CPK, CWAY, CZWI, DAX, DXGE, EARN, EEA, EML, ESG, ESGD, EVBS, FAD, FBIZ, FBNK, FGM, FHY, FNY, FPXI, FSBW, FSZ, FT, GAM, GF, GGZ, GRID, IBUY, IDLB, IEUS, INTX, IPKW, IRL, ITEQ, JSMD, KF, LGI, MESO, MGU, MILN, MPCT, MSF, NBN, NEU, NTZ, OBCI, ONEQ, PCYO, PEBO, PFBI, PKBK, PNQI, PSCC, PSCH, PSCU, QCRH, QLC, QQXT, QYLD, RFDI, RFEU, RGT, RUSHB, SBCP, SONA, TLF, TPB, TTGT, USLB, UTL, VICR, VIDI, VONG, VTWG, WF, WOOD

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: ABIL, ARDM, BVSN, CASM, FTGC, ISIG, MTBC, PLXP

ETFs that traded to 52 week lows: FUD, VXZ

- C.R. Bard (BCR +20.21%) to be acquired by Becton Dickinson and Co (BDX) for $317.00 per share

- Akers Biosciences (AKER +8.06%) Aker Wellness app has been approved by the Apple App Store and is now available for download on iOS devices

- Hooper Holmes (HH +4.58%) announces a new service contract with Paradigm Health Plans

Decliners on news:- XOMA (XOMA -10.74%) received notice from Novo Nordisk (NVO) of its termination of an exclusive license agreement due to strategic and business reasons

- Eyegate Pharma (EYEG -7.65%) files for $11.5 mln common stock offering

- Akari Therapeutics (AKTX -6.59%) presents positive response with coversin in ongoing phase 2 pnh trial and in additional clinical targets; interim Phase 2 PNH data demonstrate positive response with Coversin

Upgrades/Downgrades:Today's top 20 % gainers

- Healthcare: BCR (304.45 +20.3%), BMRN (93.82 +6.05%), CYTK (15.08 +5.79%), ENDP (10.85 +5.44%)

- Materials: CENX (12.49 +5.13%)

- Industrials: PHG (34.35 +5.21%)

- Consumer Discretionary: SONC (26.58 +6.7%), HAS (101 +5.18%)

- Information Technology: IDCC (90.5 +5.97%)

- Financials: DB (18.32 +11.03%), BBVA (8.24 +8.28%), ING (16.33 +7.29%), SAN (6.5 +6.91%), BCS (11.18 +5.82%), UBS (16.45 +5.72%), EUFN (21.17 +5.38%), OPB (21.9 +5.29%)

- Telecommunication Services: ORAN (15.98 +6.25%), GSAT (1.86 +5.4%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: VRX (8.67 mln +1.41%)

- Materials: VALE (13.31 mln +2.02%), AKS (11.09 mln +3.2%), MT (9.29 mln +3.38%)

- Industrials: GE (17.69 mln +0.02%)

- Consumer Discretionary: F (10.33 mln +0.22%), SIRI (10.02 mln -0.1%)

- Information Technology: NOK (16.12 mln +2.87%), MU (15.91 mln -2.01%), AMD (14.05 mln +0.88%), MSFT (9.87 mln +1.4%)

- Financials: BAC (69.02 mln +3.9%), C (11.08 mln +3.19%), JPM (10.21 mln +3.43%), DB (9.52 mln +11.03%), RF (9.21 mln +2.75%), WFC (8.68 mln +1.79%)

- Energy: CHK (19.74 mln -3.17%), NE (9.76 mln -7.28%)

- Telecommunication Services: T (8.97 mln +0.34%)

Today's top relative volume (current volume to 1-month average daily volume)Notable earnings/guidance:

- Trading higher following earnings/guidance:

- HAS +5.8%

- ITW +4.6%

- CAT 2.4% (Caterpillar reports March 2017 retail data; total machines worldwide +1% vs -1% in February of 2017)

- EDU +0.2%

- Lower following guidance/update:

- SHLD -2.2% (Sears Holdings updates strategic restructuring program — evaluating bids for real estate properties in excess of $700 mln, names Rob Riecker CFO and reports Q1 update)… Dept store names are lower in sympathy (SHOS -1.77%, JWN -1.55%, M -1.32%, JCP -0.36%, DDS -0.09%)

In the news:- National Retail Federation's annual survey conducted by Prosper Insights & Analytics reported that consumers plan to spend more than ever on Mother's Day this year as they shower moms with everything from jewelry to special outings at favorite restaurants.

- WSJ reported that brick-and-mortar stores expected to close at record pace this year.

- Leaders:

- HTZ 2.6% (Hertz Global and Dollar Thrifty to pay C$1.25 million penalty for advertising unattainable prices and discounts)

- FRED 3.8% (Fred's announces cooperation agreement w/ shareholder Alden Global and 2 new Board appointments)

- PBS 0.5% (Moody's says the reinstatement of UHF discount is credit positive for US TV broadcasters — sees consolidation as imminent)

- Laggards:

- MAT -0.7% (continued weakness following earnings)

Other notable trends:- Restaurant/QSR names are mostly higher today: SONC +6.3% (upgraded to Overweight from Equal Weight at a boutique firm), SAUC +6%, DAVE +5.1%, WING +4%, RT +2.4%, LOCO +2%, CAKE +1.8%, NDLS +2.8%, RUTH +1.7%, FRGI 1.8% (announces new strategic plan including store closures; reports 1Q17 prelim comps decreased 6.7% and 4.5% at Pollo Tropical and Taco Cabana, respectively), QSR +1.6%, BWLD +1.6%, YUM +1.5%, WEN +1.4%, TXRH +1.2%, FOGO +1.3%, YUMC +1.2%, BJRI +1.2%, EAT +1%, DRI +0.9%, DNKN +0.8%

- Homebuilders are under pressure: CHCI -2%, PHM -1.5%, TOL -0.9%, LGIH -0.9%, LEN -0.9%, CAA -0.7%, DHI -0.6%, MHO -0.6%, KBH -0.3%, BZH -0.4%, MDC -0.4%, UCP -0.2%, ITB -0.2%, WLH -0.1%

Analyst related:Looking ahead:

Rumor Activity was slow to start the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

The broader market is higher at the moment, albeit well off highs of the day as the Nasdaq Composite gains about 67 points (+1.13%) to 5977, the Dow Jones Industrial Average adds about 207 (+1.00%) to 20753, while the S&P 500 is up 23 (+0.97%) to 2371. Action has come on mixed average volume (NYSE 340 vs. avg. of 305; NASDAQ 734 mln vs. avg. of 782), with advancers outpacing decliners (NYSE 2134/833, NASDAQ 2067/714) and new highs outpacing new lows (NYSE 230/15, NASDAQ 236/29).

Relative Strength:

Italy-EWI +5.8%, France-EWQ +5.3%, Spain-EWP +4.9%, Germany-EWG +4.4%, Austria-EWO +4.2%, Greece-GREK +4.2%, Sweden-EWD +3.9%, Infrastructure-GRID +2.8%, Reg. Banking-KRE +2.7%, Banking-KBE +2.5%, US Fincl. Svcs.-IYG +2.4%, Financials-XLF +2.2%, Global Wind Energy-FAN +2.1%, Steel-SLX +2.0%.

Relative Weakness:

Short-Term Futures-VXX -9.4%, Cocoa-NIB -2.3%, Jr. Gold Miners-GDXJ -2.0%, REIT-ICF -1.5%, Sugar-SGG -1.4%, US Real Estate-IYR -1.1%, Platinum-PPLT -1.1%, Egypt-EGPT -0.8%, Japanese Yen-FXY -0.7%, Thailand-THD -0.3%, British Pound-FXB -0.2%, Peru-EPU -0.1%, New Zealand-ENZL -0.1%, Canadian Dollar-FXC -0.1%.

McDonalds (MCD) is scheduled to report Q1 earnings before the open tomorrow. The company reported last quarter's earnings at 7:58 am ET (and a conference call is scheduled for 11:00 am ET)

are some other restaurant names that have been trending upwards during the last few months, as well.

Comps Trends From Last Quarter

Analyst Actions:

Peers: YUM, WEN, BKW, CMG, SHAK, RRGB

Biggest point losers: TVIX 33.27(-7.94), CMG 472.62(-6.47), BDX 179.29(-6), PSA 223.62(-4.75), LII 167.88(-4.55), GWW 190.76(-4.39), SPG 168.96(-3.02), VIIX 26.29(-2.8), CYOU 28.07(-2.47), YIN 15.89(-2.3), SOHU 38.59(-2.24), VNO 99.63(-1.97), REG 65.51(-1.96), MZOR 33.8(-1.88), HCN 71.91(-1.77), AVB 185(-1.72), VTR 64.14(-1.64), AKTX 18.9(-1.6), GOLD 89.04(-1.57), EXR 78.97(-1.5), COUP 28.92(-1.49), DFT 49.72(-1.48), O 60.35(-1.4), RLJ 22.2(-1.4), ULTA 278.13(-1.37)

The following are 11 stocks that may be susceptible to a short squeeze tomorrow. These cos are reporting earnings after the bell today or before the market opens tomorrow. Look for cos w/ a low float and high short interest.

The bulls moved the stock market swiftly higher out of the gate on Monday morning, fueled by the positive sentiment surrounding yesterday's French vote. However, the looming possibility of a government shutdown in the U.S. has kept gains in check thus far, leaving the S&P 500 (+1.0%) near its opening level at midday.

Centrist candidate Emmanuel Macron and far-right candidate Marine Le Pen will face-off in the final round of the French presidential election on May 7 after finishing in first and second place, respectively, in the first round. Current polls give Mr. Macron a 20 point lead over Ms. Le Pen, which has been construed as a positive for investors given Ms. Le Pen's anti-EU rhetoric.

France's CAC (+4.1%) finished its trading day at its best level in nine years with markets around the globe--Germany's DAX (+3.4%), UK's FTSE (+2.1%), Japan's Nikkei (+1.4%), Hong Kong's Hang Seng (+0.4%), and India's Sensex (+1.0%)--reflecting the positive sentiment. The euro is up 1.2% against the U.S. dollar.

However, outside of the jolt at the start of Monday's session, U.S. equities have been relatively quiet as investors shift their focus from Paris to Washington. Congress will return from its spring recess on Tuesday, giving legislators just four days to pass a new spending bill and prevent a government shutdown. Reports indicate that President Trump will try to use the deadline to leverage funding for his promised barrier along the U.S./Mexico border, which may complicate what was expected to be a fairly routine passage.

Furthermore, if Congress can't pass a continuing resolution to keep the government running, investors will no doubt lose confidence in the new administration's ability to tackle more controversial issues such as tax reform, which has been a major catalyst in the stock market's post election rally. This concern is most clearly seen in the Treasury market, which has reclaimed much of its earlier loss, pushing the benchmark 10-yr yield (2.27%) back below the important 2.30% mark. Buyers' willingness to purchase U.S. sovereign debt in an otherwise risk-on day is certainly something to be watched in the afternoon session.

Sector standings have been fairly consistent throughout today's session with the financial group (+2.2%) leading the stock market higher from the jump. Nine of eleven sectors trade in positive territory with cyclical spaces generally outperforming their countercyclical peers. The lightly-weighted real estate (-1.3%) and telecom services (-0.1%) groups are the only sectors to trade in negative territory.

Investors did not receive any economic data in today's session.

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 1.00… VIX: (11.13, -3.50, -23.9%).

May 19 is options expiration — the last day to trade May equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Events and conferences of interest for tomorrow, April 25th include:

Dollar Slides as Euro Touches 5-Month High

The Energy Sector (XLE, +0.9%) trades higher in-line w/ broader market (SPY, +0.9%) which is trading higher following the French election over the weekend. Crude oil (USO, -0.4%) futures trading lower for the 4th straight session following Friday's rig count data and extending last weeks losses on lack of confirmation that OPEC will extend output cuts until the end of 2017. Russian officials also made comments indicating it would lift output if the OPEC doesn't extend output cuts. Lastly, natural gas (UNG, -1.4%) futures are trading down for the 3rd straight session.

Upcoming data reminders:

Earnings

Notable Gainers:

Notable Laggards: