SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Данные по недвижимости и запасам нефти.

- 22 марта 2017, 15:29

- |

Американский рынок недвижимости по активности на вторичном рынке выходит на десятилетние максимумы:

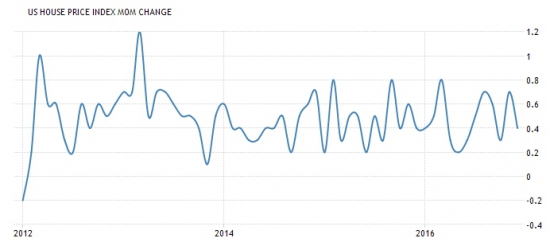

Рост цен на недвижимость находится в постоянном цикле. В данных этого месяца ожидают остановку показателя на отметке 0.4% и будущий рост:

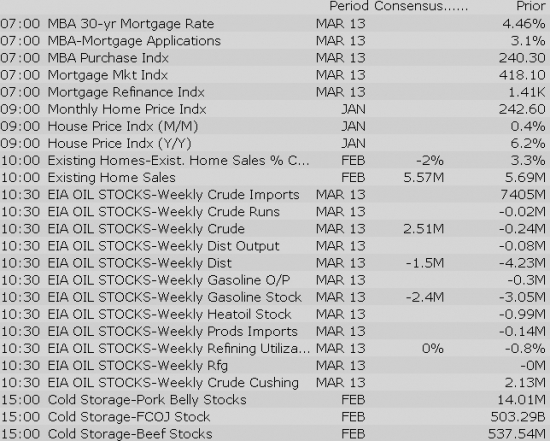

В данных по запасам нефти прогнозируется выход показателя из отрицательной зоны и накопление резервов до 1,2 млн:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market Updates

US Econ Data

Equity indices in the Asia-Pacific region ended the midweek session on a broadly lower note, taking a cue from Tuesday's slide on Wall Street. Japan's Nikkei (-2.1%) paced the decline as the yen extended yesterday's advance. Overnight yen strength has pressured the dollar/yen pair to a new low for the year in the 111.15 area. Elsewhere, an op-ed in the Chinese press discussed the possibility of an economic slowdown in the second half of the year. The op-ed argued that the Chinese government should step in to stabilize growth.

---Equity Markets---

---FX---

Gapping up:

Gapping down:

Major European indices trade lower across the board, but losses have been contained to no more than 1.0% so far. The Euro Stoxx 50 index is down 0.3%. ING Groep is the weakest component, falling 4.9% amid reports the company is being investigated by Dutch authorities for money laundering. Yesterday afternoon, French presidential candidate Emmanuel Macron said, in a tweet, «I refuse a multi-speed approach on European values: if you are part of the EU to access the single market, you have to respect our values.» This puts Mr. Macron on a collision course with German Chancellor Angela Merkel, who has spoken in favor of adopting a two-speed approach to European integration. Keep in mind that Ms. Merkel will stand for re-election later this year.

---Equity Markets---

In collaboration with Astellas Pharma (ALPMY), Cytokinetics is developing CK-2127107 as a potential treatment for people living with SMA and certain other debilitating diseases and conditions associated with skeletal muscle weakness and/or fatigue.

Treasuries Edge Higher as Investors Digest Tuesday's Stock Swoon

Equity futures point to a slightly lower open for Wednesday's session after the S&P 500 lost more than 1.0% for the first time since October on Tuesday. The S&P 500 futures trade one point below fair value.

Investors will keep their eyes on Washington today as reports indicate that there are currently 27 House Republicans that are ready to vote 'No' on the American Health Care Act on Thursday, which is more than the 22 needed to block the bill. Rather than losing on the floor of the House, GOP leaders may pull the legislation, which would serve as a blow to investors who have been hoping that the new administration would be able to shift its focus to tax reform soon.

Crude oil is under pressure this morning after the latest inventory report from the American Petroleum Institute (API) showed a build of 4.5 million barrels. The commodity will have a chance at redemption later this morning when the Energy Information Administration (EIA) releases its inventory report at 10:30 ET, but for now, WTI crude trades 1.4% lower at $47.57/bbl.

Treasuries have seen an uptick in buying interest this morning, putting U.S. sovereign debt on track for its fourth consecutive advance. The benchmark 10-yr yield trades one basis point lower at 2.41%.

On the data front, the weekly MBA Mortgage Applications Index, which was released earlier this morning, decreased 2.7% to follow last week's 3.1% uptick.

In addition, investors will receive January FHFA Housing Price Index at 9:00 ET and February Existing Home Sales (Briefing.com consensus 5.54 million) at 10:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

Upgrades:

Downgrades:

Miscellaneous:

Eurozone Yields Decline on Flight-to-Quality

Gapping up

In reaction to strong earnings/guidance:

Select metals/mining names showing strength:

Other news:

Analyst comments:

The S&P 500 futures trade one point above fair value.

WTI crude trades at its worst level in over three months, down 1.3% at $47.63/bbl, after last night's API reading showed a larger than expected build of 4.5 million barrels (consensus +2.8 million). Record high U.S. inventories have watered down the optimism surrounding OPEC's supply cut agreement as of late, forcing investors to fold on their bullish bets.

The commodity will have an opportunity to redeem itself at 10:30 ET this morning when the EIA releases its weekly crude oil inventory reading. However, if the energy component fails to do so, WTI crude will be in danger of posting its third consecutive loss while the energy sector will be poised to complete its fifth.

Currently, the energy sector sits unchallenged at the bottom of the 2017 leaderboard with a year-to-date loss of 8.5%. For reference, the S&P 500 is up 4.7% for the year.

Gapping down

In reaction to disappointing earnings/guidance:

Select financial related names showing weakness:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

Existing home sales have been solid, yet high prices and limited inventory have stood in the way of a more robust recovery in the housing market. Higher mortgage rates could now be another obstacle with which to contend. On Wednesday market participants will see how each of those factors worked to shape the pace of existing home sales in February.

According to the Briefing.com consensus estimate, existing home sales in February are expected to slip 2.6% month-over-month to a seasonally adjusted annual rate of 5.54 million. The January sales pace of 5.69 million was the strongest pace of sales since February 2007.

This is an important piece of economic data because:

The report will be released at 10:00 a.m. ET.

The S&P 500 futures trade in line with fair value.

Equity indices in the Asia-Pacific region ended the midweek session on a broadly lower note, taking a cue from Tuesday's slide on Wall Street. Japan's Nikkei (-2.1%) paced the decline as the yen extended yesterday's advance. Overnight yen strength has pressured the dollar/yen pair to a new low for the year in the 111.15 area. Elsewhere, an op-ed in the Chinese press discussed the possibility of an economic slowdown in the second half of the year. The op-ed argued that the Chinese government should step in to stabilize growth.

---Equity Markets---

Major European indices trade lower across the board, but losses have been contained to no more than 1.0% so far. The Euro Stoxx 50 index is down 0.2%. ING Groep is the weakest component, falling 4.9% amid reports the company is being investigated by Dutch authorities for money laundering. Yesterday afternoon, French presidential candidate Emmanuel Macron said, in a tweet, «I refuse a multi-speed approach on European values: if you are part of the EU to access the single market, you have to respect our values.» This puts Mr. Macron on a collision course with German Chancellor Angela Merkel, who has spoken in favor of adopting a two-speed approach to European integration. Keep in mind that Ms. Merkel will stand for re-election later this year.

---Equity Markets---

Shares of FDX are up approx 2.5% in pre-market trade.

Filings:

Offerings:

Pricings: