SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. madeyourtrade

Разбор серебра от Peter Brandt.

- 05 июня 2013, 19:33

- |

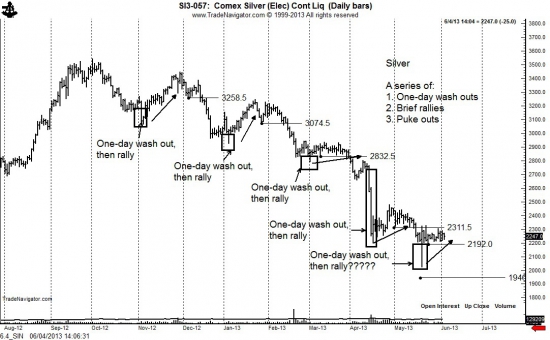

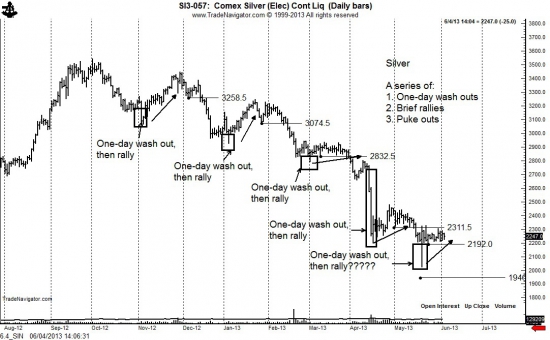

If the cyclic pattern continues, the next down wave in Silver is just around the corner

The entire basis for technical analysis is that price behavior tends to repeat itself in an analog manner. This is exactly what has happened in Silver since November 2012.

The pattern takes the form of three simple stages:

The present Gold/Silver ratio is about where is should be. Gold is about 25% over valued relative to its historic relationship to fiat currency. A 25% decline in Silver would be to 16.85, well below my long-standing chart target of 18.75.

The harsh reality for Silver bulls is that Silver is a commodity and subject to booms and busts. There is nothing special about Silver — it is simply a rock mined form the earth. Contrary to what the Silver bulls claim, industrial Silver use is not sky rocketing., but has been flat for years. The biggest growth in consumption has come from investors. But, what would happen if the market went through a period of disinvestment? This has happened in the past.

Silver needs to rally and close above 23.40 in order offset the present negative technical bias.

The entire basis for technical analysis is that price behavior tends to repeat itself in an analog manner. This is exactly what has happened in Silver since November 2012.

The pattern takes the form of three simple stages:

- A one-day spike decline (three days in the case of April) that lacks follow through

- A brief three to four week rally

- Another sharp decline

The present Gold/Silver ratio is about where is should be. Gold is about 25% over valued relative to its historic relationship to fiat currency. A 25% decline in Silver would be to 16.85, well below my long-standing chart target of 18.75.

The harsh reality for Silver bulls is that Silver is a commodity and subject to booms and busts. There is nothing special about Silver — it is simply a rock mined form the earth. Contrary to what the Silver bulls claim, industrial Silver use is not sky rocketing., but has been flat for years. The biggest growth in consumption has come from investors. But, what would happen if the market went through a period of disinvestment? This has happened in the past.

Silver needs to rally and close above 23.40 in order offset the present negative technical bias.

теги блога Kir

- agro

- aptk

- AQUA

- br

- brent

- CIAN

- fees

- FIVE

- gd

- gold

- IMOEX

- LSRG

- MGNT

- PIKK

- poly

- Ri

- rih

- rosn

- si

- sv

- TCSG

- VKCO

- акции

- алроса

- аптеки

- аптеки 36 и 6

- аэрофлот

- брент

- Василий Олейник

- ВКонтакте

- внешняя свеча

- внутренняя свеча

- восходящий канал

- восходящий клин

- восходящий треугольник

- втб

- газпром

- герчик

- ГМК НорНикель

- доллар

- доллар рубль

- золото

- инарктика

- Индекс МБ

- итоги дня

- ловушки

- ложный пробой

- лср

- лукойл

- магнит

- ммвб

- ммк

- мосбиржа

- мтс

- неудавшийся размах

- нефть

- нисходящий канал

- нисходящий клин

- нлмк

- новичку

- опрос

- оффтоп

- пик

- Полиметалл

- пятерочка

- распадская

- Ри

- ромб

- роснефть

- россети

- ртс

- рубль

- русагро

- РусГидро

- сбербанк

- сделки

- северсталь

- серебро

- си

- симметричный треугольник

- смартлаб

- та

- тактика торговли

- татнефть

- теханализ

- техническая картина

- технический анализ

- тинькофф

- торговые сигналы

- трейдинг

- треугольник

- форекс

- ФСК ЕЭС

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- циан

- юмор

- яндекс